PNC Bank 2014 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

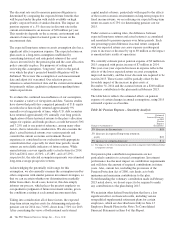

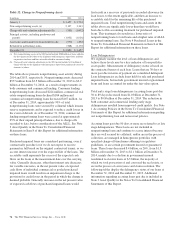

Table 32: Change in Nonperforming Assets

In millions 2014 2013

January 1 $ 3,457 $ 3,794

New nonperforming assets (a) 2,127 3,343

Charge-offs and valuation adjustments (b) (585) (1,002)

Principal activity, including paydowns and

payoffs (1,001) (1,016)

Asset sales and transfers to loans held for sale (570) (492)

Returned to performing status (548) (1,170)

December 31 $ 2,880 $ 3,457

(a) New nonperforming assets in the 2013 period include $560 million of loans added in

the first quarter of 2013 due to the alignment with interagency supervisory guidance

on practices for loans and lines of credit related to consumer lending.

(b) Charge-offs and valuation adjustments in the 2013 period include $134 million of

charge-offs due to the alignment with interagency supervisory guidance discussed in

footnote (a) above.

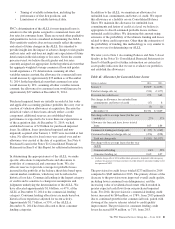

The table above presents nonperforming asset activity during

2014 and 2013, respectively. Nonperforming assets decreased

$577 million from $3.5 billion at December 31, 2013 to $2.9

billion at December 31, 2014, as a result of improvements in

both consumer and commercial lending. Consumer lending

nonperforming loans decreased $224 million, commercial real

estate nonperforming loans declined $184 million and

commercial nonperforming loans decreased $167 million. As

of December 31, 2014, approximately 90% of total

nonperforming loans were secured by collateral which lessens

reserve requirements and is expected to reduce credit losses in

the event of default. As of December 31, 2014, commercial

lending nonperforming loans were carried at approximately

65% of their unpaid principal balance, due to charge-offs

recorded to date, before consideration of the ALLL. See Note

3 Asset Quality in the Notes To Consolidated Financial

Statements in Item 8 of this Report for additional information

on these loans.

Purchased impaired loans are considered performing, even if

contractually past due (or if we do not expect to receive

payment in full based on the original contractual terms), as we

accrete interest income over the expected life of the loans. The

accretable yield represents the excess of the expected cash

flows on the loans at the measurement date over the carrying

value. Generally decreases, other than interest rate decreases

for variable rate notes, in the net present value of expected

cash flows of individual commercial or pooled purchased

impaired loans would result in an impairment charge to the

provision for credit losses in the period in which the change is

deemed probable. Generally increases in the net present value

of expected cash flows of purchased impaired loans would

first result in a recovery of previously recorded allowance for

loan losses, to the extent applicable, and then an increase to

accretable yield for the remaining life of the purchased

impaired loans. Total nonperforming loans and assets in the

tables above are significantly lower than they would have

been due to this accounting treatment for purchased impaired

loans. This treatment also results in a lower ratio of

nonperforming loans to total loans and a higher ratio of ALLL

to nonperforming loans. See Note 4 Purchased Loans in the

Notes To Consolidated Financial Statements in Item 8 of this

Report for additional information on these loans.

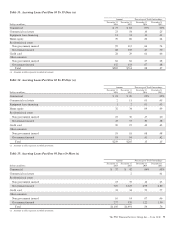

Loan Delinquencies

We regularly monitor the level of loan delinquencies and

believe these levels may be a key indicator of loan portfolio

asset quality. Measurement of delinquency status is based on

the contractual terms of each loan. Loans that are 30 days or

more past due in terms of payment are considered delinquent.

Loan delinquencies exclude loans held for sale and purchased

impaired loans, but include government insured or guaranteed

loans and loans accounted for under the fair value option.

Total early stage loan delinquencies (accruing loans past due

30 to 89 days) decreased from $1.0 billion at December 31,

2013 to $0.8 billion at December 31, 2014. The reduction in

both consumer and commercial lending early stage

delinquencies resulted from improved credit quality. See Note

1 Accounting Policies in the Notes To Consolidated Financial

Statements of this Report for additional information regarding

our nonperforming loan and nonaccrual policies.

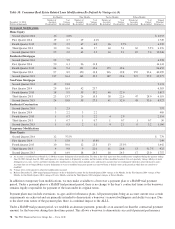

Accruing loans past due 90 days or more are referred to as late

stage delinquencies. These loans are not included in

nonperforming loans and continue to accrue interest because

they are well secured by collateral, and/or are in the process of

collection, are managed in homogenous portfolios with

specified charge-off timeframes adhering to regulatory

guidelines, or are certain government insured or guaranteed

loans. These loans decreased $.4 billion, or 26%, from $1.5

billion at December 31, 2013 to $1.1 billion at December 31,

2014, mainly due to a decline in government insured

residential real estate loans of $.3 billion, the majority of

which we took possession of and conveyed the real estate, or

are in the process of conveyance and claim resolution. The

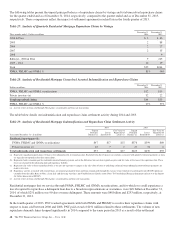

following tables display the delinquency status of our loans at

December 31, 2014 and December 31, 2013. Additional

information regarding accruing loans past due is included in

Note 3 Asset Quality in the Notes To Consolidated Financial

Statements of this Report.

74 The PNC Financial Services Group, Inc. – Form 10-K