PNC Bank 2014 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In determining a reporting unit’s fair value and comparing it

to its carrying value, we generally utilize the highest of these

three amounts (the “targeted equity”) in our discounted cash

flow methodology. Under this methodology, if necessary, we

will infuse capital to achieve the targeted equity amount. As of

October 1, 2014 (annual impairment testing date), unallocated

excess capital (difference between shareholders’ equity minus

total economic capital assigned and increased by the

incremental targeted equity capital infusion) represented

capital reserved for potential future capital needs.

The results of our annual 2014 impairment test indicated that

the estimated fair values of our reporting units exceeded their

carrying values by at least 10% and are not considered to be at

risk of not passing Step 1. By definition, assumptions utilized

in estimating the fair value of a reporting unit are judgmental

and inherently uncertain, but absent a significant change in

economic conditions of a reporting unit, we would not expect

the fair values of these reporting units to decrease below their

respective carrying values. Similarly, there were no

impairment charges related to goodwill in 2013.

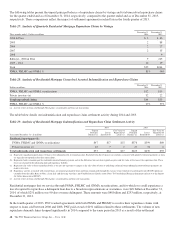

During 2012, our residential mortgage banking business,

similar to other residential mortgage banking businesses,

experienced higher operating costs and increased uncertainties

such as elevated indemnification and repurchase liabilities and

foreclosure related issues. As a result of our annual

impairment test, we determined that the carrying amount of

goodwill relating to the Residential Mortgage Banking

reporting unit was impaired. We recorded an impairment

charge of $45 million within noninterest expense which

reduced the carrying value of goodwill attributed to

Residential Mortgage Banking to zero.

See Note 8 Goodwill and Other Intangible Assets in the Notes

To Consolidated Financial Statements in Item 8 of this Report

for additional information.

Lease Residuals

We provide financing for various types of equipment,

including aircraft, energy and power systems, and vehicles

through a variety of lease arrangements. Direct financing

leases are carried at the sum of lease payments and the

estimated residual value of the leased property, less unearned

income. Residual values are subject to judgments as to the

value of the underlying equipment that can be affected by

changes in economic and market conditions and the financial

viability of the residual guarantors. Residual values are

derived from historical remarketing experience, secondary

market contacts, and industry publications. To the extent not

guaranteed or assumed by a third-party, we bear the risk of

ownership of the leased assets. This includes the risk that the

actual value of the leased assets at the end of the lease term

will be less than the estimated residual value, which could

result in an impairment charge and reduce earnings in the

future. Residual values are reviewed for impairment at least

annually.

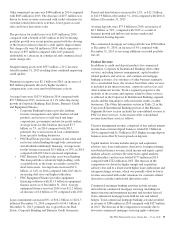

Revenue Recognition

We earn net interest and noninterest income from various

sources, including:

• Lending,

• Securities portfolio,

• Asset management,

• Customer deposits,

• Loan sales and servicing,

• Brokerage services,

• Sale of loans and securities,

• Certain private equity activities, and

• Securities, derivatives and foreign exchange

activities.

We also earn fees and commissions from issuing loan

commitments, standby letters of credit and financial

guarantees, selling various insurance products, providing

treasury management services, providing merger and

acquisition advisory and related services, and participating in

certain capital markets transactions. Revenue earned on

interest-earning assets, including the accretion of discounts

recognized on acquired or purchased loans recorded at fair

value, is recognized based on the constant effective yield of

the financial instrument or based on other applicable

accounting guidance.

The timing and amount of revenue that we recognize in any

period is dependent on estimates, judgments, assumptions, and

interpretation of contractual terms. Changes in these factors

can have a significant impact on revenue recognized in any

period due to changes in products, market conditions or

industry norms.

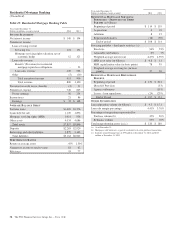

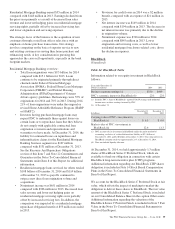

Residential And Commercial Mortgage Servicing Rights

We elect to measure our residential mortgage servicing rights

(MSRs) at fair value. This election was made to be consistent

with our risk management strategy to hedge changes in the

fair value of these assets as described below. The fair value of

residential MSRs is estimated by using a cash flow valuation

model which calculates the present value of estimated future

net servicing cash flows, taking into consideration actual and

expected mortgage loan prepayment rates, discount rates,

servicing costs, and other economic factors which are

determined based on current market conditions.

As of January 1, 2014, PNC made an irrevocable election to

subsequently measure all classes of commercial MSRs at fair

value in order to eliminate any potential measurement

mismatch between our economic hedges and the commercial

MSRs. The impact of this election was not material. The fair

value of commercial MSRs is estimated by using a discounted

cash flow model incorporating inputs for assumptions as to

constant prepayment rates, discount rates and other factors

determined based on current market conditions and

The PNC Financial Services Group, Inc. – Form 10-K 63