PNC Bank 2014 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Credit Risk Management

Credit risk represents the possibility that a customer,

counterparty or issuer may not perform in accordance with

contractual terms. Credit risk is inherent in the financial

services business and results from extending credit to

customers, purchasing securities, and entering into financial

derivative transactions and certain guarantee contracts. Credit

risk is one of our most significant risks. Our processes for

managing credit risk are embedded in PNC’s risk culture and

in our decision-making processes using a systematic approach

whereby credit risks and related exposures are identified and

assessed, managed through specific policies and processes,

measured and evaluated against our risk appetite and credit

concentration limits, and reported, along with specific

mitigation activities, to management and the Board through

our governance structure.

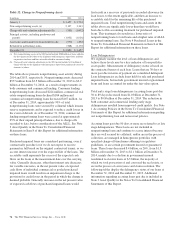

Asset Quality Overview

Asset quality trends in 2014 improved from 2013.

• Nonperforming assets at December 31, 2014

decreased $577 million compared with December 31,

2013 as a result of improvements in both consumer

and commercial nonperforming loans. Consumer

lending nonperforming loans decreased $224 million,

commercial real estate nonperforming loans declined

$184 million and commercial nonperforming loans

decreased $167 million. Nonperforming assets were

0.83% of total assets at December 31, 2014 compared

with 1.08% at December 31, 2013.

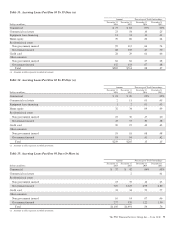

• Overall loan delinquencies of $1.9 billion decreased

$.5 billion, or 22%, from year-end 2013 levels. The

reduction was due in large part to a reduction in

accruing government insured residential real estate

loans past due 90 days or more of $.3 billion, the

majority of which we took possession of and

conveyed the real estate, or are in the process of

conveyance and claim resolution.

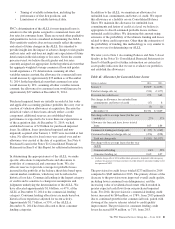

• Net charge-offs were $.5 billion in 2014, down 51%

from net charge-offs in 2013 of $1.1 billion, due

primarily to improved overall credit quality. Net

charge-offs for 2013 included $134 million of

charge-offs due to the impact of alignment with

interagency supervisory guidance on practices for

loans and lines of credit related to consumer lending

in the first quarter of 2013.

• Provision for credit losses in 2014 decreased to $273

million compared with $643 million in 2013. The

smaller provision is attributed to improved overall

credit quality, including lower consumer loan

delinquencies, and the increasing value of residential

real estate which resulted in greater expected cash

flows from our purchased impaired loans.

• The level of ALLL decreased to $3.3 billion at

December 31, 2014 from $3.6 billion at

December 31, 2013.

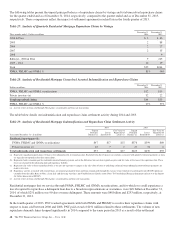

Nonperforming Assets and Loan Delinquencies

Nonperforming Assets, including OREO and Foreclosed Assets

Nonperforming assets include nonperforming loans and leases

for which ultimate collectability of the full amount of

contractual principal and interest is not probable and include

nonperforming troubled debt restructurings (TDRs), OREO

and foreclosed assets. Loans held for sale, certain government

insured or guaranteed loans, purchased impaired loans and

loans accounted for under the fair value option are excluded

from nonperforming loans. Additional information regarding

our nonperforming loans and nonaccrual policies is included

in Note 1 Accounting Policies in the Notes To Consolidated

Financial Statements in Item 8 of this Report. The major

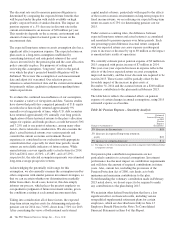

categories of nonperforming assets are presented in Table 30.

In the first quarter of 2013, we completed our alignment of

certain nonaccrual and charge-off policies consistent with

interagency supervisory guidance on practices for loans and

lines of credit related to consumer lending. This alignment

primarily related to (i) subordinate consumer loans (home

equity loans and lines of credit and residential mortgages)

where the first-lien loan was 90 days or more past due,

(ii) government guaranteed loans where the guarantee may not

result in collection of substantially all contractual principal

and interest and (iii) certain loans with borrowers in or

discharged from bankruptcy. In the first quarter of 2013,

nonperforming loans increased by $426 million and net

charge-offs increased by $134 million as a result of

completing the alignment of the aforementioned policies.

Additionally, overall delinquencies decreased $395 million

due to loans now being reported as either nonperforming or, in

the case of loans accounted for under the fair value option,

nonaccruing or having been charged off. Certain consumer

nonperforming loans were charged-off to the respective

collateral value less costs to sell, and any associated allowance

at the time of charge-off was reduced to zero. As the

interagency guidance was adopted, incremental provision for

credit losses was recorded if the related loan charge-off

exceeded the associated allowance. Subsequent declines in

collateral value for these loans will result in additional charge-

offs to maintain recorded investment at collateral value less

costs to sell.

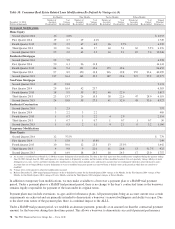

At December 31, 2014, TDRs included in nonperforming

loans were $1.4 billion, or 55%, of total nonperforming loans

compared to $1.5 billion, or 49%, of total nonperforming

loans as of December 31, 2013. Within consumer

nonperforming loans, residential real estate TDRs comprise

60% of total residential real estate nonperforming loans at

December 31, 2014, up from 59% at December 31, 2013.

Home equity TDRs comprise 54% of home equity

nonperforming loans at both December 31, 2014 and at

December 31, 2013. TDRs generally remain in nonperforming

status until a borrower has made at least six consecutive

months of both principal and interest payments under the

modified terms or ultimate resolution occurs. Loans where

borrowers have been discharged from personal liability

72 The PNC Financial Services Group, Inc. – Form 10-K