PNC Bank 2014 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

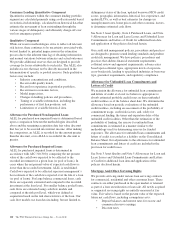

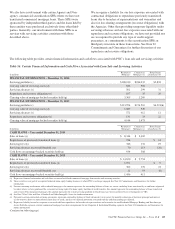

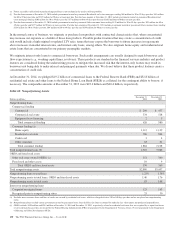

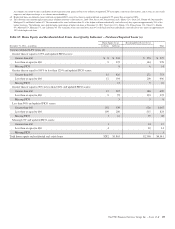

Table 59: Non-Consolidated VIEs

In millions

Aggregate

Assets

Aggregate

Liabilities

PNC Risk

of Loss (a)

Carrying Value of

Assets Owned by PNC

Carrying Value of

Liabilities Owned by PNC

December 31, 2014

Commercial Mortgage-Backed Securitizations (b) $ 53,436 $ 53,436 $1,550 $1,550 (d) $ 1 (f)

Residential Mortgage-Backed Securitizations (b) 62,236 62,236 3,385 3,385 (d) 4 (f)

Tax Credit Investments and Other (c) 7,493 2,933 2,270 2,304 (e) 777 (g)

Total $123,165 $118,605 $7,205 $7,239 $782

In millions

Aggregate

Assets

Aggregate

Liabilities

PNC Risk

of Loss (a)

Carrying Value of

Assets Owned by PNC

Carrying Value of

Liabilities Owned by PNC

December 31, 2013

Commercial Mortgage-Backed Securitizations (b) $ 65,757 $ 65,757 $1,747 $1,747 (d)

Residential Mortgage-Backed Securitizations (b) 37,962 37,962 4,171 4,171 (d) $ 5 (f)

Tax Credit Investments and Other (c) (h) 7,086 2,622 2,030 2,055 (e) 826 (g)

Total $110,805 $106,341 $7,948 $7,973 $831

(a) This represents loans, investments and other assets related to non-consolidated VIEs, net of collateral (if applicable). Our total exposure related to our involvement in loan sale and

servicing activities is disclosed in Table 56. Additionally, we also invest in other mortgage and asset-backed securities issued by third-party VIEs with which we have no continuing

involvement. Further information on these securities is included in Note 6 Investment Securities and values disclosed represent our maximum exposure to loss for those securities’

holdings.

(b) Amounts reflect involvement with securitization SPEs where PNC transferred to and/or services loans for an SPE and we hold securities issued by that SPE. Asset amounts equal

outstanding liability amounts of the SPEs due to limited availability of SPE financial information.

(c) Aggregate assets and aggregate liabilities are based on limited availability of financial information associated with certain acquired partnerships and certain LLCs engaged in solar

power generation to which PNC provides lease financing. The aggregate assets and aggregate liabilities of LLCs engaged in solar power generation may not be reflective of the size of

these VIEs due to differences in classification of leases by these entities.

(d) Included in Trading securities, Investment securities, Other intangible assets and Other assets on our Consolidated Balance Sheet.

(e) Included in Loans, Equity investments and Other assets on our Consolidated Balance Sheet.

(f) Included in Other liabilities on our Consolidated Balance Sheet.

(g) Included in Deposits and Other liabilities on our Consolidated Balance Sheet.

(h) PNC Risk of Loss and Carrying Value of Assets Owned by PNC have been updated to reflect the first quarter 2014 adoption of ASU 2014-01 related to investments in low income

housing tax credits.

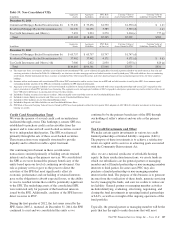

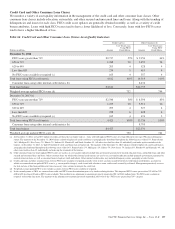

Credit Card Securitization Trust

We were the sponsor of several credit card securitizations

facilitated through a trust. This bankruptcy-remote SPE was

established to purchase credit card receivables from the

sponsor and to issue and sell asset-backed securities created

by it to independent third-parties. The SPE was financed

primarily through the sale of these asset-backed securities.

These transactions were originally structured to provide

liquidity and to afford favorable capital treatment.

Our continuing involvement in these securitization

transactions consisted primarily of holding certain retained

interests and acting as the primary servicer. We consolidated

the SPE as we were deemed the primary beneficiary of the

entity based upon our level of continuing involvement. Our

role as primary servicer gave us the power to direct the

activities of the SPE that most significantly affect its

economic performance and our holding of retained interests

gave us the obligation to absorb expected losses, or the ability

to receive residual returns that could be potentially significant

to the SPE. The underlying assets of the consolidated SPE

were restricted only for payment of the beneficial interests

issued by the SPE. Additionally, creditors of the SPE have no

direct recourse to PNC.

During the first quarter of 2012, the last series issued by the

SPE, Series 2007-1, matured. At December 31, 2014, the SPE

continued to exist and we consolidated the entity as we

continued to be the primary beneficiary of the SPE through

our holding of seller’s interest and our role as the primary

servicer.

Tax Credit Investments and Other

We make certain equity investments in various tax credit

limited partnerships or limited liability companies (LLCs).

The purpose of these investments is to achieve a satisfactory

return on capital and to assist us in achieving goals associated

with the Community Reinvestment Act.

Also, we are a national syndicator of affordable housing

equity. In these syndication transactions, we create funds in

which our subsidiaries are the general partner or managing

member and sell limited partnership or non-managing member

interests to third parties. In some cases PNC may also

purchase a limited partnership or non-managing member

interest in the fund. The purpose of this business is to generate

income from the syndication of these funds, generate servicing

fees by managing the funds, and earn tax credits to reduce our

tax liability. General partner or managing member activities

include identifying, evaluating, structuring, negotiating, and

closing the fund investments in operating limited partnerships

or LLCs, as well as oversight of the ongoing operations of the

fund portfolio.

Typically, the general partner or managing member will be the

party that has the right to make decisions that will most

The PNC Financial Services Group, Inc. – Form 10-K 127