OG&E 2015 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2015 OG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OGE Energy Corp. 15

2015 compared to 2014. OG&E’snetincomedecreased$23.1million,

or7.9percent,in2015ascomparedto2014primarilyduetohigher

depreciationexpenseandlowergrossmarginpartiallyoffsetbyhigher

otherincomeandanincreaseinallowanceforequityfundsusedin

construction.

GrossMargin

Operatingrevenueswere$2,196.9millionin2015ascomparedto

$2,453.1millionin2014,adecreaseof$256.2million,or10.4percent.

Costofsaleswere$865.0millionin2015ascomparedto

$1,106.6millionin2014,adecreaseof$241.6million,or21.8percent.

Grossmarginwas$1,331.9millionin2015ascomparedto

$1,346.5millionin2014,adecreaseof$14.6million,or1.1percent.

Thebelowfactorscontributedtothechangeingrossmargin:

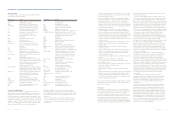

(Inmillions) $Change

Quantityvariance(primarilyweather)(A) $(25.8)

Wholesaletransmissionrevenue(B) (19.8)

ExpirationofAVECcontract(C) (11.5)

Industrialandoilfieldsale (4.5)

Other 2.1

Non-residentialdemandandrelatedrevenues 3.7

Pricevariance(D) 19.8

Newcustomergrowth 21.4

Changeingrossmargin $(14.6)

(A)Theoverallcoolingdegreedaysdecreasedtwopercentin2015comparedto2014

withAugustdecreasingby14percent.

(B)DecreasedprimarilyduetoatrueupforthebaseplanprojectsintheSPPformula

ratefor2014and2015aswellasareductioninthepoint-to-pointcreditssharedwith

retailcustomers.

(C)OnJune30,2015,thewholesalepowercontractwithAVECexpired.

(D)Increasedprimarilyduetosalesandcustomermix.

CostofsalesforOG&Econsistsoffuelusedinelectricgeneration,

purchasedpowerandtransmissionrelatedcharges.Fuelexpense

was$458.5millionin2015ascomparedto$627.5millionin2014,

adecreaseof$169.0million,or26.9percent,primarilyduetolower

naturalgaspricesoffsetbyhighernaturalgasusedaswellasless

coalburnedoffsetbyhighercoalprices.In2015,OG&E’sfuelmixwas

49.0percentcoal,44.0percentnaturalgasandsevenpercentwind.

In2014,OG&E’sfuelmixwas61.0percentcoal,32.0percentnatural

gasandsevenpercentwind.Purchasedpowercostswere$362.6million

in2015ascomparedto$444.1millionin2014,adecreaseof

$81.5million,or18.4percent,primarilyduetoadecreaseinpurchases

fromtheSPP,reflectingtheimpactofOG&E sparticipationintheSPP

IntegratedMarketplace,whichbeganonMarch1,2014.Transmission

relatedchargeswere$43.9millionin2015ascomparedto

$35.0millionin2014,anincreaseof$8.9million,or25.4percent,

primarilyduetohigherSPPchargesforthebaseplanprojectsof

otherutilities.

Theactualcostoffuelusedinelectricgenerationandcertain

purchasedpowercostsarepassedthroughtoOG&E’scustomers

throughfueladjustmentclauses.Thefueladjustmentclausesare

subjecttoperiodicreviewbytheOCC,theAPSCandtheFERC.

TheOCC,theAPSCandtheFERChaveauthoritytoreviewthe

appropriatenessofgastransportationchargesorotherfeesOG&E

paystoitsaffiliat ,Enable.

OperatingExpenses

Otheroperationandmaintenanceexpenseswere$444.5million

in2015ascomparedto$453.2millionin2014,adecreaseof

$8.7million,or1.9percent.Thebelowfactorscontributedtothe

changeinotheroperationsandmaintenanceexpense:

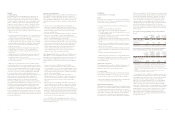

(Inmillions) $Change

Additionalcapitalizedlabor(A) $(9.2)

Maintenanceatpowerplants(B) (7.0)

Professionalservicecontracts(C) (2.1)

Other (1.0)

Employeebenefit (D) 1.0

Othermarketing,salesandcommercial(E) 2.8

Salariesandwages(F) 6.8

Changeinotheroperationandmaintenanceexpense $(8.7)

(A)Decreasedprimarilyduetomorecapitalprojectsandstormcostsexceedingthe

$2.7millionthreshold,whichweremovedtoaregulatoryasset.

(B)Decreasedprimarilyduetolessworkatthepowerplants.

(C)Decreasedprimarilyduetodecreasedengineeringservices.

(D)Increasedprimarilyduetohighermedicalcostsincurredpartiallyoffsetbylower

pensioncosts.

(E)Increasedprimarilyduetohigherdemandsidemanagementcustomerpayments.

(F)Increasedprimarilyduetoannualsalaryincreasesandincreasedovertimerelated

tostorms.

Depreciationandamortizationexpensewas$299.9millionin2015

ascomparedto$270.8millionin2014,anincreaseof$29.1million,or

10.7percent,primarilyduetoadditionalassetsbeingplacedinservice,

alongwithanincreaseresultingfromtheamortizationofdeferred

pensioncreditsandpost-retirementmedicalregulatoryliabilities

whichwerefullyamortizedinJuly2014andamortizationofdeferred

stormcosts.

AdditionalInformation

AllowanceforEquityFundsUsedDuringConstruction.Allowancefor

equityfundsusedduringconstructionwas$8.3millionin2015as

comparedto$4.2millionin2014,anincreaseof$4.1millionor

97.6percent,primarilyduetohigherconstructionworkinprogress

balancesresultingfromincreasedspendingforenvironmentalprojects.

OtherIncome.Otherincomewas$13.3millionin2015ascompared

to$4.8millionin2014,anincreaseof$8.5million,primarilydueto

increasedguaranteedflatbillmarginsandanincreaseinthetax ross

uprelatedtohigherallowanceforfundsusedduringconstruction.

IncomeTaxExpense.Incometaxexpensewas$104.8millionin

2015ascomparedto$111.6millionin2014,adecreaseof

$6.8million,or6.1percent,primarilyduetolowerpretaxincome

partiallyoffsetbyareductioninFederaltaxcredits.

14 OGE Energy Corp.

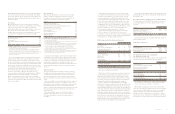

Reconciliation of Gross Margin to Revenue

YearEndedDecember31,(Dollarsinmillions) 2016(A)

Operatingrevenues $2,162

Costofsales 752

GrossMargin $1,410

(A) BasedonthemidpointofOG&Eearningsguidancefor2016.

Results of Operations

Thefollowingdiscussionandanalysispresentsfactorsthataffected

theCompany’sconsolidatedresultsofoperationsfortheyearsended

December31,2015,2014and2013andtheCompany’sconsolidated

financialpositionatDecember31,2015and2014 Thefollowing

informationshouldbereadinconjunctionwiththeConsolidated

FinancialStatementsandNotesthereto.Knowntrendsand

contingenciesofamaterialnaturearediscussedtotheextent

consideredrelevant.

YearendedDecember31

(Inmillionsexceptpersharedata)2015 2014 2013

Netincomeattributable

toOGEEnergy $ 271.3 $ 395.8 $ 387.6

Basicaveragecommon

sharesoutstanding 199.6 199.2 198.2

Dilutedaveragecommon

sharesoutstanding 199.6 199.9 199.4

Basicearningsperaverage

commonshareattributable

toOGEEnergycommon

shareholders $ 1.36 $ 1.99 $ 1.96

Dilutedearningsperaverage

commonshareattributable

toOGEEnergycommon

shareholders $ 1.36 $ 1.98 $ 1.94

Dividendsdeclared

percommonshare $1.05000 $0.95000 $0.85125

Results by Business Segment

YearendedDecember31

(Inmillions)2015 2014 2013

NetIncomeattributabletoOGEEnergy

OG&E(ElectricUtility) $268.9 $292.0 $292.6

OGEHoldings(Natural

GasMidstreamOperations)(A)9.4 102.3 99.9

OtherOperations(B)(7.0) 1.5 (4.9)

Consolidatednetincome

attributabletoOGEEnergy $271.3 $395.8 $387.6

(A)SubsequenttothecompletionoftheOctober1,2014annualgoodwillimpairmenttest

andpreviousinterimassessmentasofDecember31,2014,thecrudeoilandnatural

gasindustrywasimpactedbyfurthercommoditypricedeclines,whichconsequently

resultedindecreasedproduceractivityincertainregionsinwhichEnableoperates.

Asaresult,whenEnableperformedthefirststepofitsan ualgoodwillimpairment

analysisasofOctober1,2015,itdeterminedthatthecarryingvalueofthegathering

andprocessingandtransportationandstoragesegmentsexceededfairvalue.Enable

completedthesecondstepofthegoodwillimpairmentanalysiscomparingtheimplied

fairvalueforthosereportingunitstothecarryingamountofthatgoodwilland

determinedthatgoodwillforthoseunitswascompletelyimpairedintheamountof

$1,086.4millionasofSeptember30,2015.Accordingly,theCompanyrecordeda

$108.4millionpre-taxchargeduringthethirdquarterof2015foritsshareofthe

goodwillimpairment,asadjustedforthebasisdifferences.SeeNote3forfurther

discussionofEnable’sgoodwillimpairment.

(B)OtherOperationsprimarilyincludestheoperationsoftheholdingcompanyand

consolidatingeliminations.

Thefollowingoperatingresultsanalysisbybusinesssegmentincludes

intercompanytransactionsthatareeliminatedintheConsolidated

FinancialStatements.

OG&E (Electric Utility)

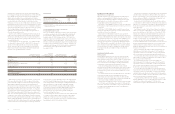

YearendedDecember31(Dollarsinmillions)2015 2014 2013

Operatingrevenues $2,196.9 $2,453.1 $2,262.2

Costofsales 865.0 1,106.6 965.9

Otheroperationandmaintenance 444.5 453.2 438.8

Depreciationandamortization 299.9 270.8 248.4

Taxesotherthanincome 87.1 84.5 83.8

Operatingincome 500.4 538.0 525.3

Allowanceforequityfundsused

duringconstruction 8.3 4.2 6.6

Otherincome 13.3 4.8 8.1

Otherexpense 1.6 1.9 4.6

Interestexpense 146.7 141.5 129.3

Incometaxexpense 104.8 111.6 113.5

Netincome $ 268.9 $ 292.0 $ 292.6

Operatingrevenuesbyclassificatio

Residential $ 896.5 $ 925.5 $ 901.4

Commercial 535.0 583.3 554.2

Industrial 190.6 224.5 220.6

Oilfield 162.8 188.3 176.4

Publicauthoritiesandstreetlight 194.2 220.3 214.3

Salesforresale 21.7 52.9 59.4

Systemsalesrevenues 2,000.8 2,194.8 2,126.3

Off-systemsalesrevenues 48.6 94.1 14.7

Other 147.5 164.2 121.2

Totaloperatingrevenues $2,196.9 $2,453.1 $2,262.2

Reconciliationofgrossmargintorevenue:

Operatingrevenues $2,196.9 $2,453.1 $2,262.2

Costofsales 865.0 1,106.6 965.9

Grossmargin $1,331.9 $1,346.5 $1,296.3

MWHsalesbyclassificatio (inmillions)

Residential 9.2 9.4 9.4

Commercial 7.4 7.2 7.1

Industrial 3.6 3.8 3.9

Oilfield 3.4 3.4 3.4

Publicauthoritiesandstreetlight 3.1 3.2 3.2

Salesforresale 0.5 1.0 1.2

Systemsales 27.2 28.0 28.2

Off-systemsales 1.7 2.2 0.4

Totalsales 28.9 30.2 28.6

Numberofcustomers 824,776 814,982 806,940

Weighted-averagecostofenergy

perkilowatt-hour–cents

Naturalgas 2.529 4.506 3.905

Coal 2.187 2.152 2.273

Totalfuel 2.196 2.752 2.784

Totalfuelandpurchasedpower 2.874 3.493 3.178

Degreedays(A)

Heating–Actual 3,038 3,569 3,673

Heating–Normal 3,349 3,349 3,349

Cooling–Actual 2,071 2,114 2,106

Cooling–Normal 2,092 2,092 2,092

(A)

Degreedaysarecalculatedasfollows:Thehighandlowdegreesofaparticularday

areaddedtogetherandthenaveraged.Ifthecalculatedaverageisabove65degrees,

thenthedifferencebetweenthecalculatedaverageand65isexpressedascooling

degreedays,witheachdegreeofdifferenceequalingonecoolingdegreeday.Ifthe

calculatedaverageisbelow65degrees,thenthedifferencebetweenthecalculated

averageand65isexpressedasheatingdegreedays,witheachdegreeofdifference

equalingoneheatingdegreeday.Thedailycalculationsarethentotaledforthe

particularreportingperiod.