OG&E 2015 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2015 OG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OGE Energy Corp. 35

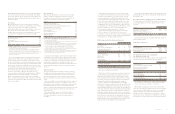

Consolidated Statements of Cash Flows

YearendedDecember31(Inmillions)2015 2014 2013

Cash Flows from Operating Activities

Netincome $ 271.3 $ 395.8 $ 393.8

Adjustmentstoreconcilenetincometonetcashprovidedfromoperatingactivities

Depreciationandamortization 307.9 281.4 298.6

Deferredincometaxesandinvestmenttaxcredits 102.6 177.3 125.9

Equityinearningsofunconsolidatedaffiliate (15.5) (172.6) (101.9)

Distributionsfromunconsolidatedaffiliate 94.1 143.7 51.7

Allowanceforequityfundsusedduringconstruction (8.3) (4.2) (6.6)

Gainondispositionofassets (0.2) (0.2) (8.6)

Stock-basedcompensation 5.9 (2.7) (3.5)

Regulatoryassets (9.1) 4.5 26.7

Regulatoryliabilities (27.5) (4.4) (32.5)

Otherassets 10.6 (16.3) 1.3

Otherliabilities 8.6 29.6 (7.0)

Changeincertaincurrentassetsandliabilities

Accountsreceivable,net 15.7 (9.4) (34.0)

Accountsreceivable–unconsolidatedaffiliate 3.9 6.8 3.7

Accruedunbilledrevenues 2.0 3.2 (1.3)

Incometaxesreceivable (1.2) (10.4) 1.6

Fuel,materialsandsuppliesinventories (56.5) 20.4 5.1

Fuelclauseunderrecoveries 68.3 (42.1) (26.2)

Othercurrentassets (17.2) (2.6) (4.4)

Accountspayable 30.9 (64.0) 56.9

Fuelclauseoverrecoveries 61.3 (0.4) (108.8)

Othercurrentliabilities 17.8 (11.8) (7.3)

NetCashProvidedfromOperatingActivities 865.4 721.6 623.2

Cash Flows from Investing Activities

Capitalexpenditures(lessallowanceforequityfundsusedduringconstruction) (547.8) (569.3) (990.6)

Returnofcapital–equitymethodinvestments 45.2 9.5 —

Proceedsfromsaleofassets 2.5 0.7 36.3

Investmentinunconsolidatedaffiliate — — (2.7)

NetCashUsedinInvestingActivities (500.1) (559.1) (957.0)

Cash Flows from Financing Activities

Proceedsfromlong-termdebt — 588.9 247.4

Issuanceofcommonstock 7.2 13.2 14.2

Dividendspaidoncommonstock (204.6) (184.1) (165.5)

Paymentoflong-termdebt (0.2) (240.2) (0.1)

(Decrease)increaseinshort-termdebt (98.0) (341.6) 8.7

Changesinadvanceswithunconsolidatedaffiliate — — 129.6

Contributionsfromnoncontrollinginterestpartners — — 107.0

Distributionstononcontrollinginterestpartners — — (2.5)

NetCash(Usedin)ProvidedfromFinancingActivities (295.6) (163.8) 338.8

Net Change in Cash and Cash Equivalents69.7 (1.3) 5.0

Cash and Cash Equivalents at Beginning of Period5.5 6.8 1.8

Cash and Cash Equivalents at End of Period $ 75.2 $ 5.5 $ 6.8

TheaccompanyingNotestoConsolidatedFinancialStatementsareanintegralparthereof.

3 4 OGE Energy Corp.

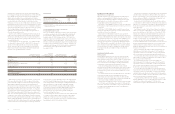

Consolidated Statements of Comprehensive Income

YearendedDecember31(Inmillions)2015 2014 2013

Net income $271.3 $395.8 $393.8

Othercomprehensiveincome(loss),netoftax

PensionPlanandRestorationIncomePlan:

Amortizationofdeferrednetloss,netoftaxof$2.2,$1.2,and$2.4,respectively 2.5 1.8 3.7

Netgain(loss)arisingduringtheperiod,netoftaxof($5.8),($7.0),and$7.8,respectively (9.5) (11.1) 12.4

Settlement(Curtailment)cost,netoftaxof$2.9,($0.1)and$1.9,respectively 4.6 (0.1) 3.0

PostretirementBenefitPlans

Amortizationofdeferrednetloss,netoftaxof$0.8,$0.5,and$1.3,respectively 1.2 0.9 2.0

Netgain(loss)arisingduringtheperiod,netoftaxof$5.6,($1.9),and$4.4,respectively 9.3 (3.1) 6.9

Amortizationofpriorservicecost,netoftaxof($1.1),($1.1),and($1.1),respectively (1.8) (1.8) (1.8)

Deferredcommoditycontractshedginglossesreclassifiedinnetincom ,netoftaxof

$0,$0,and$0.4,respectively — — 0.6

Amortizationofdeferredinterestrateswaphedginglosses,netoftaxof$0,$0.1

and$0.1,respectively — 0.2 0.3

Othercomprehensiveincome(loss),netoftax 6.3 (13.2) 27.1

Comprehensiveincome 277.6 382.6 420.9

Less:Comprehensiveincomeattributabletononcontrollinginterest — — 6.3

Less:DeconsolidationofEnogexHoldings — — 6.1

TotalcomprehensiveincomeattributabletoOGEEnergy $277.6 $382.6 $408.5

TheaccompanyingNotestoConsolidatedFinancialStatementsareanintegralparthereof.