OG&E 2015 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2015 OG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OGE Energy Corp. 25

Common Stock

TheCompanydoesnotexpecttoissueanycommonstockin2016

fromitsAutomaticDividendReinvestmentandStockPurchasePlan.

SeeNote9ofNotestoConsolidatedFinancialStatementsfora

discussionoftheCompany’scommonstockactivity.

Distributions by Enable

PursuanttotheEnablelimitedpartnershipagreement,theamountof

distributionstheCompanyreceivedfromEnablewere$139.3million

and$143.7millionduringtheyearsendedDecember31,2015and2014.

Critical Accounting Policies and Estimates

TheConsolidatedFinancialStatementsandNotestoConsolidated

FinancialStatementscontaininformationthatispertinentto

Management’sDiscussionandAnalysis.InpreparingtheConsolidated

FinancialStatements,managementisrequiredtomakeestimatesand

assumptionsthataffectthereportedamountsofassetsandliabilities

anddisclosureofcontingentassetsandcontingentliabilitiesatthe

dateoftheConsolidatedFinancialStatementsandthereported

amountsofrevenuesandexpensesduringthereportingperiod.

Changestotheseassumptionsandestimatescouldhaveamaterial

effectontheCompany’sConsolidatedFinancialStatements.However,

theCompanybelievesithastakenreasonablepositionswhere

assumptionsandestimatesareusedinordertominimizethenegative

financialimpacttotheCompa ythatcouldresultifactualresultsvary

fromtheassumptionsandestimates.Inmanagement’sopinion,the

areasoftheCompanywherethemostsignificantjudgmentis

exercisedforallCompanysegmentsincludesthedeterminationof

PensionPlanassumptions,incometaxes,contingencyreserves,asset

retirementobligationsanddepreciablelivesofproperty,plantand

equipment.Fortheelectricutilitysegment,significantjudgmentisalso

exercisedinthedeterminationofregulatoryassetsandliabilitiesand

unbilledrevenues.Theselection,applicationanddisclosureofthe

followingcriticalaccountingestimateshavebeendiscussedwiththe

Company’sAuditCommittee.TheCompanydiscussesitssignificant

accountingpolicies,includingthosethatdonotrequiremanagementto

makedifficult,subjecti eorcomplexjudgmentsorestimates,inNote1

ofNotestoConsolidatedFinancialStatements.

Pension and Postretirement Benefit Plans

TheCompanyhasaPensionPlanthatcoversasignificantamountof

theCompany’semployeeshiredbeforeDecember1,2009.Also,

effectiveDecember1,2009,theCompany’sPensionPlanisnolonger

beingofferedtoemployeeshiredonorafterDecember1,2009.The

Companyalsohasdefinedbenefitpostretirementplansthat vera

significantamountofitsempl yees.Pensionandotherpostretirement

planexpensesandliabilitiesaredeterminedonanactuarialbasisand

areaffectedbythemarketvalueofplanassets,estimatesofthe

expectedreturnonplanassets,assumeddiscountratesandthelevel

offunding.Actualchangesinthefairmarketvalueofplanassetsand

differencesbetweentheactualreturnonplanassetsandtheexpected

returnonplanassetscouldhaveamaterialeffectontheamountof

pensionexpenseultimatelyrecognized.Thepensionplanrate

assumptionsareshowninNote12ofNotestoConsolidatedFinancial

Statements.Theassumedreturnonplanassetsisbasedon

management’sexpectationofthelong-termreturnontheplanassets

portfolio.Thediscountrateusedtocomputethepresentvalueofplan

liabilitiesisbasedgenerallyonratesofhigh-gradecorporatebonds

withmaturitiessimilartotheaverageperiodoverwhichbenefitswillbe

paid.Theleveloffundingisdependentonreturnsonplanassetsand

futurediscountrates.Higherreturnsonplanassetsandanincreasein

discountrateswillreducefundingrequirementstothePensionPlan.

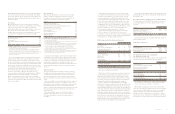

ThefollowingtableindicatesthesensitivityofthePensionPlanfunded

statustothesevariables.

Impacton

Change FundedStatus

Actualplanassetreturns +/-1percent +/-$5.8million

Discountrate +/-0.25percent +/-$14.1million

Contributions +/-$10million +/-$10.0million

Income Taxes

TheCompanyusestheassetandliabilitymethodofaccountingfor

incometaxes.Underthismethod,adeferredtaxassetorliabilityis

recognizedfortheestimatedfuturetaxeffectsattributabletotemporary

differencesbetweenthefinancialstatementbasisandthetaxbasisof

assetsandliabilitiesaswellastaxcreditcarryforwardsandnet

operatinglosscarryforwards.Deferredtaxassetsandliabilitiesare

measuredusingenactedtaxratesexpectedtoapplytotaxableincome

intheyearsinwhichthosetemporarydifferencesareexpectedtobe

recoveredorsettled.Theeffectondeferredtaxassetsandliabilitiesof

achangeintaxratesisrecognizedintheperiodofthechange.

Theapplicationofincometaxlawiscomplex.Lawsandregulations

inthisareaarevoluminousandoftenambiguous.Interpretationsand

guidancesurroundingincometaxlawsandregulationschangeover

time.Accordingly,itisnecessarytomakejudgmentsregardingincome

taxexposure.Asaresult,changesinthesejudgmentscanmaterially

affectamountstheCompanyrecognizedinitsConsolidatedFinancial

Statements.TaxpositionstakenbytheCompanyonitsincometax

returnsthatarerecognizedinthefinancialstatements ustsatisfya

morelikelythannotrecognitionthreshold,assumingthattheposition

willbeexaminedbytaxingauthoritieswithfullknowledgeofall

relevantinformation.

24 OGE Energy Corp.

2015 Capital Requirements, Sources of Financing

and Financing Activities

Totalcapitalrequirements,consistingofcapitalexpendituresand

maturitiesoflong-termdebt,were$548.0millionandcontractual

obligations,netofrecoveriesthroughfueladjustmentclauses,were

$85.6millionresultingintotalnetcapitalrequirementsandcontractual

obligationsof$633.6millionin2015,ofwhich$130.6millionwasto

complywithenvironmentalregulations.Thiscomparestonetcapital

requirementsof$809.5millionandnetcontractualobligationsof

$88.2milliontotaling$897.7millionin2014,ofwhich$31.5million

wastocomplywithenvironmentalregulations.

In2015,theCompany’ssourcesofcapitalwerecashgeneratedfrom

operations,proceedsfromtheissuanceofshortandlong-termdebt,

proceedsfromthesalesofcommonstockanddistributionsfrom

Enable.Changesinworkingcapitalreflecttheseasonalnatureofthe

Company’sbusiness,therevenuelagbetweenbillingandcollection

fromcustomersandfuelinventories.See“WorkingCapital”fora

discussionofsignificantchangesinnet orkingcapitalrequirements

asitpertainstooperatingcashfl wandliquidity.

The Dodd-Frank Act

DerivativeinstrumentsareutilizedinmanagingOG&E’scommodity

priceexposures.OnJuly21,2010,PresidentObamasignedintolaw

theDodd-FrankAct.Amongotherthings,theDodd-FrankActprovides

foranewregulatoryregimeforderivatives,includingmandatory

clearingofcertainswapsandmarginrequirements.TheDodd-Frank

Actcontainsprovisionsthatshouldexemptcertainderivatives

end-userssuchasOG&Efrommuchoftheclearingrequirements.The

regulationsrequirethatthedecisiononwhethertousetheend-user

exceptionfrommandatoryclearingforderivativetransactionsbe

reviewedandapprovedbyan“appropriatecommittee”oftheBoardof

Directors.OnJanuary12,2015,PresidentObamasignedintolaw

anamendmenttotheDodd-FrankActthatexemptsfrommargin

requirementsswapsusedbyend-userstohedgeormitigate

commercialrisk.Thereare,however,somerulemakingsthathaveno

yetbeenfinali ed.EvenifOG&Equalifies ortheend-userexception

toclearingandmarginrequirementsarenotimposedonend-users,

itsderivativecounterpartiesmaybesubjecttonewcapital,margin

andbusinessconductrequirementsasaresultofthenewregulations,

whichmayincreaseOG&E’stransactioncostsormakeitmoredifficult

toenterintoderivativetransactionsonfavorableterms.OG&E’s

inabilitytoenterintoderivativetransactionsonfavorableterms,orat

all,couldincreaseoperatingexpensesandputOG&Eatincreased

exposuretorisksofadversechangesincommoditiesprices.The

impactoftheprovisionsoftheDodd-FrankActonOG&Ecannotbe

fullydeterminedatthistimeduetouncertaintyoverforthcoming

regulationsandpotentialchangestothederivativesmarketsarising

fromnewregulatoryrequirements.

Future Sources of Financing

Managementexpectsthatcashgeneratedfromoperations,proceeds

fromtheissuanceoflongandshort-termdebt,proceedsfromother

offeringsanddistributionsfromEnablewillbeadequateoverthenext

threeyearstomeetanticipatedcashneedsandtofundfuturegrowth

opportunities.TheCompanyutilizesshort-termborrowings(through

acombinationofbankborrowingsandcommercialpaper)tosatisfy

temporaryworkingcapitalneedsandasaninterimsourceoffinancing

capitalexpendituresuntilpermanentfinancingisar anged.

Short-Term Debt and Credit Facilities

Short-termborrowingsgenerallyareusedtomeetworkingcapital

requirements.TheCompanyborrowsonashort-termbasis,as

necessary,bytheissuanceofcommercialpaperandbyborrowings

underitsrevolvingcreditagreement.TheCompanyhasrevolving

creditfacilitiestotalingintheaggregate$1,150.0million.Thesebank

facilitiescanalsobeusedasletterofcreditfacilities.Short-termdebt

hadnobalanceatDecember31,2015comparedtoabalanceof

$98.0millionatDecember31,2014.Theaveragebalanceofshort-term

debtin2015was$75.2millionataweighted-averageinterestrateof

0.46percent.Themaximummonth-endbalanceofshort-termdebtin

2015was$180.0million.AtDecember31,2015,theCompanyhad

$1,148.1millionofnetavailableliquidityunderitsrevolvingcredit

agreements.OG&Ehasthenecessaryregulatoryapprovalstoincur

upto$800.0millioninshort-termborrowingsatanyonetimefora

two-yearperiodbeginningJanuary1,2015andendingDecember31,

2016.AtDecember31,2015,theCompanyhad$75.2millionincash

andcashequivalents.SeeNote11ofNotestoConsolidatedFinancial

StatementsforadiscussionoftheCompany’sshort-termdebtactivity.

InDecember2011,theCompanyandOG&Eenteredintounsecured

fi e-yearrevolvingcreditagreementstototalintheaggregate

$1,150.0million($750.0millionfortheCompanyand$400.0millionfor

OG&E).Eachofthecreditfacilitiescontainedanoption,whichcouldbe

exerciseduptotwotimes,toextendthetermforanadditionalyear.In

thethirdquarterof2013,theCompanyandOG&Eutilizedoneofthese

one-yearextensions,andreceivedconsentfromallofthelenders,to

extendthematurityoftheircreditagreementsfromDecember13,2016

toDecember13,2017.Inthesecondquarterof2014,theCompany

andOG&Eutilizedtheirsecondextensiontoextendthematurityoftheir

respectivecreditfacilityfromDecember13,2017toDecember13,

2018.AsofDecember31,2015,commitmentsofapproximately

$16.3millionand$8.7millionoftheCompany’sandOG&E’scredit

facilities,respectively,however,werenotextendedand,unlessthe

non-extendinglenderisreplacedinaccordancewiththetermsofthe

creditfacility,suchcommitmentswillexpireDecember13,2017.