OG&E 2015 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2015 OG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OGE Energy Corp. 17

InterestExpense.Interestexpensewas$141.5millionin2014

ascomparedto$129.3millionin2013,anincreaseof$12.2million,

or9.4percent,primarilyduetoa$9.1millionincreaseininterest

onlong-termdebtrelatedtoa$250.0milliondebtissuancethat

occurredinMay2013,a$250.0milliondebtissuancethatoccurred

inMarch2014andanadditional$250.0milliondebtissuancethat

occurredinDecember2014partiallyoffsetbytheearlyredemption

of$140.0millionseniornotesinAugust2014.Inaddition,therewas

a$2.0millionincreasereflectingareductionin2013interest xpense

relatedtotaxmattersoffsetbyadecreaseintheallowancefor

borrowedfundsusedduringconstructionof$1.0million.

IncomeTaxExpense.Incometaxexpensewas$111.6million

in2014ascomparedto$113.5millionin2013,adecreaseof

$1.9million,or1.7percent.Thereductionreflectsl werpretaxincome

partiallyoffsetbyareductioninstatetaxcreditsrecognizedduringthe

yearandanincreaseinFederalcreditsrecognized.

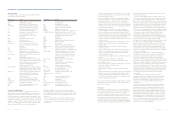

OGE Holdings (Natural Gas Midstream Operations)

Year Ended December 31,

(Inmillions)2015 2014 2013

Operatingrevenues $ — $ — $630.4

Costofsales — — 489.0

Otheroperationandmaintenance 7.5 1.2 60.9

Depreciationandamortization — — 36.8

Taxesotherthanincome — — 10.5

Operatingincome(loss) (7.5) (1.2) 33.2

Equityinearningsof

unconsolidatedaffiliate (A)15.5 172.6 101.9

Otherincome 0.4 — 10.2

Otherexpense — — 1.3

Interestexpense — — 10.6

Incometaxexpense (1.0) 69.1 26.9

Netincome 9.4 102.3 106.5

Less:Netincomeattributable

tononcontrollinginterests — — 6.6

NetincomeattributabletoOGEHoldings $ 9.4 $102.3 $ 99.9

(A) InSeptember2015,theCompanyrecordeda$108.4millionpre-taxchargeforits

shareofthegoodwillimpairment,asadjustedforthebasisdifference.SeeNote3for

furtherdiscussionofEnable’sgoodwillimpairment.

EffectiveMay1,2013,theCompanydeconsolidateditspreviously

heldinvestmentinEnogexHoldingsandacquireda28.5percent

equityinterestinEnable(26.3percentasofDecember31,2015)

whichisbeingaccountedforusingtheequitymethodofaccounting.

PriortoMay1,2013,theCompanyreportedtheresultsofEnogex

Holdingsinthenaturalgasmidstreamoperationssegment.

EquityinearningsofunconsolidatedaffiliatesincludesOGE

Energy’sshareofEnableearningsadjustedfortheamortizationofthe

basisdifferenceofOGEEnergy’soriginalinvestmentinEnogexLLC

anditsunderlyingequityinnetassetsofEnable.Thebasisdifference

istheresultoftheinitialcontributionofEnogexLLCtoEnableinMay

2013,andsubsequentissuancesofequitybyEnable,includingthe

initialpublicofferinginApril2014andtheissuanceofcommonunits

fortheacquisitionofCenterPoint’s24.95percentinterestinSESH.The

basisdifferenceisbeingamortizedoverapproximately30years,the

averagelifeoftheassetstowhichthebasisdifferenceisattributed.

Equityinearningsofunconsolidatedaffiliatesisalsoadjusted orthe

eliminationoftheEnogexHoldingsfairvalueadjustments.

ThedifferencebetweenOGEEnergy’sinvestmentinEnableandits

underlyingequityinthenetassetsofEnablewas$783.5millionasof

December31,2015.

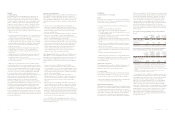

Reconciliation of Equity in Earnings of Unconsolidated Affiliates

ThefollowingtablereconcilesOGEEnergy’sequityinearningsofits

unconsolidatedaffiliates ortheyearsendedDecember31,2015

and2014.

Year Ended December 31,

(Inmillions)2015 2014

OGE’sshareofEnableNetIncome(Loss) $(16.0) $143.1

Amortizationofbasisdifference 13.5 14.0

EliminationofEnogexHoldingsfairvalue

andotheradjustments 18.0 15.5

Equityinearningsofunconsolidatedaffiliate $ 15.5 $172.6

Thefollowingtablerepresentssummarizedfinancialin ormationof

Enablefor2014and2015:

Enable Results of Operations

Year Ended December 31,

(Inmillions)2015 2014

Operatingrevenues $2,418 $3,367

Costofnaturalgasandnaturalgasliquids 1,097 1,914

Operatingincome(loss) (712) 586

Netincome(loss) $ (752) $ 530

Year Ended December 31, 2015 as Compared to

Year Ended December 31, 2014

Thetablesetforthbelowillustratestheimpactoftheoperatingresults

ofEnablefortheyearsendedDecember31,2015and2014.

Year Ended December 31,

(Inmillions)2015 2014

Operatingrevenues $ — $—

Costofnaturalgasandnaturalgasliquids —

—

Otheroperationandmaintenance 7.5 1.2

Depreciationandamortization —

—

Taxesotherthanincome —

—

Operatingincome(loss) (7.5) (1.2)

Equityinearningsof

unconsolidatedaffiliate (A)15.5 172.6

Otherincome/(expense) 0.4

—

Incomebeforetaxes 8.4 171.4

Incometaxexpense(benefit (1.0) 69.1

NetincomeattributabletoOGEHoldings $ 9.4 $102.3

(A) TheCompanyrecordeda$108.4millionpre-taxchargeduringthethirdquarterof

2015foritsshareofthegoodwillimpairment,asadjustedforthebasisdifferences.

SeeNote3forfurtherdiscussionofEnable’sgoodwillimpairment.

OGEHoldings’earningsbeforetaxesdecreased$163.0million,

or95.1percent,fortheyearendedDecember31,2015ascompared

tothesameperiodof2014primarilyduetoadecreaseinequityin

earningsofEnableof$157.1million.Inadditiontothegoodwill

impairment,Enable’sgatheringandprocessingbusinesssegment

reportedadecreaseinoperatingincomeprimarilyfromadecreasein

grossmargin,anincreaseindepreciationandamortizationexpense

16 OGE Energy Corp.

2014 compared to 2013. OG&E’snetincomedecreased$0.6million,

or0.2percent,in2014ascomparedto2013primarilyduetohigher

grossmargin,whichwasalmostoffsetbyhigherotheroperationsand

maintenanceexpense,higherdepreciationandamortizationexpense,

andinterestexpense.

GrossMargin

Operatingrevenueswere$2,453.1millionin2014ascomparedto

$2,262.2millionin2013,anincreaseof$190.9million,or8.4percent.

Costofsaleswere$1,106.6millionin2014ascomparedto

$965.9millionin2013,anincreaseof$140.7million,or14.6percent.

Grossmarginwas$1,346.5millionin2014ascomparedto

$1,296.3millionin2013,anincreaseof$50.2million,or3.9percent.

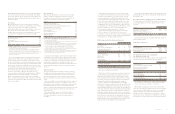

Thebelowfactorscontributedtothechangeingrossmargin:

(Inmillions) $Change

Wholesaletransmissionrevenue(A) $43.8

Newcustomergrowth 13.8

Pricevariance(B) 6.8

Non-residentialdemandandrelatedrevenues 1.4

Other (1.7)

Quantityvariance(primarilyweather) (13.9)

Changeingrossmargin $50.2

(A) IncreasedprimarilyduetohigherinvestmentsrelatedtocertainFERCapproved

transmissionprojectsincludedinformularates.

(B) IncreasedduetohigherriderrevenuesprimarilyfromtheOklahomaDemand

Programrider,theOklahomaStormRecoveryriderandtheArkansasDemand

ProgramriderpartiallyoffsetbylowerriderrevenuesfromtheOklahomaCrossroads

rider,OklahomaSmartGridrider,OklahomaSystemHardeningriderandthe

ArkansasCrossroadsrider.

CostofsalesforOG&Econsistsoffuelusedinelectricgeneration,

purchasedpowerandtransmissionrelatedcharges.Fuelexpense

was$627.5millionin2014ascomparedto$672.7millionin2013,a

decreaseof$45.2million,or6.7percent,primarilyduetolowernatural

gasusedoffsetbyhighernaturalgasprices.In2014,OG&E’sfuelmix

was61percentcoal,32percentnaturalgasandsevenpercentwind.

In2013,OG&E’sfuelmixwas53.0percentcoal,40.0percentnatural

gasandsevenpercentwind.Purchasedpowercostswere

$444.1millionin2014ascomparedto$267.6millionin2013,an

increaseof$176.5million,or66.0percent,primarilyduetoan

increaseinpurchasesfromtheSPP,reflectingtheimpactofOG&E s

participationintheSPPIntegratedMarketplace,whichbeganon

March1,2014.Transmissionrelatedchargeswere$35.0millionin

2014ascomparedto$25.6millionin2013,anincreaseof$9.4million,

or36.7percent,primarilyduetohigherSPPchargesforthebaseplan

projectsofotherutilities.

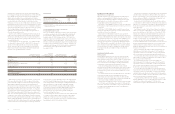

OperatingExpenses

Otheroperationandmaintenanceexpenseswere$453.2million

in2014ascomparedto$438.8millionin2013,anincreaseof

$14.4million,or3.3percent.Thebelowfactorscontributedtothe

changeinotheroperationsandmaintenanceexpense:

(Inmillions) $Change

Reductionincapitalizedlabor(A) $11.4

Corporateoverheadandallocations(B) 4.0

Contractprofessionalservices(primarilymarketingservices) 3.8

Ongoingmaintenanceatpowerplants 3.5

Othermarketing,salesandcommercial(C) 2.3

Softwareexpense(D) 2.3

Fees,permitsandlicenses(E) 2.3

Vegetationmanagement(F) (4.5)

Employeebenefit (G) (4.9)

Salariesandwages(H) (5.8)

Changeinotheroperationandmaintenanceexpense $14.4

(A) Portionoflaborcostscapitalizedintoprojectsdecreasedasaresultoflesswork

performedonstormrestoration.

(B) Increasedprimarilyduetohigherallocatedcostsfromtheholdingcompanyresulting

fromtheformationofEnableduring2013.

(C) Increasedprimarilyduetodemandsidemanagementcustomerpaymentswhichare

recoveredthroughariderpartiallyoffsetbyareductioninmediaservicesexpense.

(D) IncreasedasaresultofhigherexpendituresrelatedtoSmartGridsoftware.

(E) IncreasedprimarilyduetohigherSPPadministrationandassessmentfees.

(F) Decreasedprimarilyduetoincreasedspendingonsystemhardeningin2013which

includescoststhatarebeingrecoveredthrougharider.

(G) Decreasedprimarilyduetolowerpensionexpense,postretirementandotherbenefit .

(H) Decreasedprimarilyduetoincentivecompensationandlowerovertimewages

partiallyoffsetbyhigherregularsalariesandwages.

Depreciationandamortizationexpensewas$270.8millionin2014

ascomparedto$248.4millionin2013,anincreaseof$22.4million,

orninepercent,primarilyduetoadditionaltransmissionassetsbeing

placedinservicethroughout2013and2014,alongwithanincrease

resultingfromtheamortizationofthedeferredpensioncredits

regulatoryliabilitywhichwasfullyamortizedinJuly2014.Thesewere

offsetbythepensionregulatoryassetwhichwasfullyamortizedin

July2013.

AdditionalInformation

AllowanceforEquityFundsUsedDuringConstruction.Allowance

forequityfundsusedduringconstructionwas$4.2millionin2014

ascomparedto$6.6millionin2013,adecreaseof$2.4millionor

36.4percent,primarilyduetolowerconstructionworkinprogress

balancesresultingfromtransmissionprojectsbeingplacedinservice

in2014.

OtherIncome.Otherincomewas$4.8millionin2014ascompared

to$8.1millionin2013,adecreaseof$3.3millionor40.7percent,

primarilyduetodecreasedmarginsrecognizedintheguaranteedflat

billprogramduring2014asaresultofcoolerweatherinthefirst

quarterascomparedtothesameperiodin2013alongwithadecrease

inthetaxgrossuprelatedtotheallowanceforequityfundsused

duringconstruction.

OtherExpense.Otherexpensewas$1.9millionin2014as

comparedto$4.6millionin2013,adecreaseof$2.7millionor

58.7percent,primarilyduetodecreasedcharitabledonations

during2014.