OG&E 2015 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2015 OG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OGE Energy Corp. 13

2016 Outlook

Key assumptions for 2016 include:

OG&E

TheCompanyprojectsOG&Etoearnapproximately$288millionto

$300millionor$1.44to$1.50peraveragedilutedsharein2016and

isbasedonthefollowingassumptions:

• normalweatherpatternsareexperiencedfortheremainderof

theyear;

• newratestakeeffectinOklahomainmid2016;

• grossmarginonrevenuesofapproximately$1.405billionto

$1.415billionbasedonsalesgrowthofapproximatelyonepercent

onaweather-adjustedbasis;

• approximately$106millionofgrossmarginisprimarilyattributedto

regionallyallocatedtransmissionprojects;

• operatingexpensesofapproximately$885millionto$895million,

withoperationandmaintenanceexpensescomprising54percentof

thetotal;

• interestexpenseofapproximately$140millionwhichassumesa

$8millionallowanceforborrowedfundsusedduringconstruction

reductiontointerestexpense;

• otherincomeofapproximately$27millionincludingapproximately

$15millionofallowanceforequityfundsusedduringconstruction;

and

• aneffectivetaxrateofapproximately28percent.

OG&Ehassignificantseasonalityinitsea nings.OG&Etypically

showsminimalearningsinthefirstand ourthquarterswithamajority

ofearningsinthethirdquarterduetotheseasonalnatureofair

conditioningdemand.

OGE Enogex Holdings LLC

TheCompanyprojectstheearningscontributionfromitsownership

interestinEnableMidstreamtobeapproximately$56millionto

$66millionor$0.28to$0.33peraveragedilutedshare.

Consolidated OGE

TheCompany’s2016earningsguidanceisbetweenapproximately

$344millionand$366millionofnetincome,or$1.72to$1.83per

averagedilutedshareandisbasedonthefollowingassumptions:

• approximately200millionaveragedilutedsharesoutstanding;and

• aneffectivetaxrateofapproximately29percent.

Non-GAAP Financial Measures

OngoingEarningsandOngoingEarningsperAverageDilutedShare

aredefined ytheCompanyasGAAPEarningsandGAAPEarnings

perAverageDilutedShareadjustedtoexcludenon-cashcharges.

Thesefinancial measuresexcludednon-cashchargesofapproximately

$108.4millionor$0.33peraveragedilutedshareassociatedwith

theCompany’sshareofEnable’sgoodwillimpairmentaswellasa

non-cashpensionsettlementchargeofapproximately$5.8millionor

$0.02peraveragedilutedshare.TheCompany’smanagementbelieves

thatongoingearningsandongoingearningsperaveragedilutedshare

provideamoremeaningfulcomparisonofearningsresultsandare

morerepresentativeoftheCompany’sfundamentalcoreearnings

power.TheCompany’smanagementusesongoingearningsand

ongoingearningsperaveragedilutedshareinternallyforfinancial

planningandanalysis,forreportingofresultstotheBoardofDirectors,

andwhencommunicatingitsearningsoutlooktoanalystsand

investors.Reconciliationsofongoingearningsandongoingearnings

peraveragedilutedsharefortheyearendedDecember31,2015and

2014arebelow.

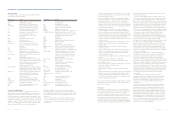

Reconciliation of Ongoing Earnings (Loss) to GAAP Earnings

(Loss)

Goodwill and 2015 2014GAAP

2015 GAAP Pension Ongoing andOngoing

Earnings Settlement Earnings Earnings

(Netoftax,inmillions)(Loss) Charges(A) (Loss) (Loss)(B)

OG&E $268.9 $ — $268.9 $292.0

NaturalGasMidstream

Operations 9.4 70.8 80.2 102.3

HoldingCompany (7.0) — (7.0) 1.5

Consolidated $271.3 $70.8 $342.1 $395.8

Reconciliation of Ongoing Earnings (Loss) per Average Diluted

Share to GAAP Earnings (Loss) per Average Diluted Share

Goodwill and 2015 2014GAAP

2015 GAAP Pension Ongoing andOngoing

Earnings Settlement Earnings Earnings

(Loss) per Charges per (Loss) per (Loss)per

Share Share(A) Share Share(B)

OG&E $ 1.35 $ — $ 1.35 $1.46

NaturalGasMidstream

Operations 0.05 0.35 0.40 0.51

HoldingCompany (0.04) — (0.04) 0.01

Consolidated $ 1.36 $0.35 $ 1.71 $1.98

(A)

OnSeptember30,2015,theCompanyrecognizedanon-cashpre-taxchargeof

$108.4millionor$0.33peraveragedilutedshareforitsportionofEnable’sgoodwill

impairment.Additionally,theCompanyrecognizedanon-cashpre-taxchargeof

$5.8millionor$0.02peraveragedilutedshareforapensionsettlementchargerelated

toEnable.

(B)

TherewerenosimilarchargesfortheyearendedDecember31,2014,therefore

ongoingearningsandGAAPearningsarethesame.

Grossmarginisdefined yOG&Easoperatingrevenueslessfuel,

purchasedpowerandcertaintransmissionexpenses.Grossmarginis

anon-GAAPfinancialmeasurebecauseit xcludesdepreciationand

amortization,andotheroperationandmaintenanceexpenses.

Expensesforfuelandpurchasedpowerarerecoveredthroughfuel

adjustmentclausesandasaresultchangesintheseexpensesare

offsetinoperatingrevenueswithnoimpactonnetincome.OG&E

believesgrossmarginprovidesamoremeaningfulbasisforevaluating

itsoperationsacrossperiodsthanoperatingrevenuesbecausegross

marginexcludestherevenueeffectoffluctuationsinthese xpenses.

Grossmarginisusedinternallytomeasureperformanceagainst

budgetandinreportsformanagementandtheBoardofDirectors.

OG&E’sdefinitionof rossmarginmaybedifferentfromsimilarterms

usedbyothercompanies.

12 OGE Energy Corp.

Overview

Company Strategy

TheCompany’smission,throughOG&Eanditsequityinterestin

Enable,istofulfillitsc iticalroleinthenation’selectricutilityand

naturalgasmidstreampipelineinfrastructureandmeetindividual

customers’needsforenergyandrelatedservicesfocusingonsafety,

efficienc ,reliability,customerserviceandriskmanagement.The

Company’scorporatestrategyistocontinuetomaintainitsexisting

businessmixanddiversifiedassetpositionofitsregulatedelect ic

utilitybusinessandinterestinapubliclytradedmidstreamcompany,

whileprovidingcompetitiveenergyproductsandservicesto

customers,aswellasseekinggrowthopportunitiesinbothbusinesses.

OG&Eisfocusedon:

• Providingexceptionalcustomerexperiencesbycontinuingtoimprove

customerinterfaces,tools,productsandservicesthatdeliverhigh

customersatisfactionandoperatingproductivity.

• Providingsafe,reliableenergytothecommunitiesandcustomers

weserve.Aparticularfocusisonenhancingthevalueofthegridby

improvingdistributiongridreliabilitybyreducingthefrequencyand

durationofcustomerinterruptionsandleveragingpreviousgrid

technologyinvestments.

• Maintainingstrongregulatoryandlegislativerelationshipsforthe

long-termbenefitofourcustomer ,investorsandmembers.

• Continuingtogrowazero-injurycultureanddelivertop-quartile

safetyresults.

• ComplyingwiththeEPA’sMATSandRegionalHazerequirements.

• Ensuringwehavethenecessarymixofgenerationresourcesto

meetthelong-termneedsofourcustomers.

• Continuingfocusonoperationalexcellenceandefficienciesinorder

toprotectthecustomerbill.

Additionally,theCompanywantstoachieveapremiumvaluation

ofitsbusinessesrelativetoitspeers,growearningspersharewitha

stableearningspattern,createahighperformancecultureandachieve

desiredoutcomeswithtargetstakeholders.TheCompany’sfinancial

objectivesincludealong-termannualearningsgrowthrateforOG&E

ofthreetofi epercentonaweather-normalizedbasis,maintaining

astrongcreditratingaswellastargetingdividendincreasesof

approximately10percentannuallythrough2019.Thetargetedannual

dividendincreasehasbeendeterminedafterconsiderationof

numerousfactors,includingthelargelyretailcompositionofthe

Company’sshareholderbase,theCompany’sfinancialposition,

theCompany’sgrowthtargetsandthecompositionoftheCompany’s

assetsandinvestmentopportunities.TheCompanyalsoreliesoncash

distributionsfromitsinvestmentinEnabletofunditscapitalneeds

andsupportfuturedividendgrowth.TheCompanybelievesitcan

accomplishthesefinancialobjecti esby,amongotherthings,pursuing

multipleavenuestobuilditsbusiness,maintainingadiversifiedasset

position,continuingtodevelopawiderangeofskillstosucceedwith

changesinitsindustries,providingproductsandservicestocustomers

efficientl ,managingriskseffectivelyandmaintainingstrongregulatory

andlegislativerelationships.

Summary of Operating Results

2015 compared to 2014.NetincomeattributabletoOGEEnergywas

$271.3million,or$1.36perdilutedshare,in2015ascomparedto

$395.8million,or$1.98perdilutedshare,in2014.Thedecreaseinnet

incomeattributabletoOGEEnergyof$124.5million,or31.5percent,

or$0.62perdilutedshare,in2015ascomparedto2014wasprimarily

dueto:

• adecreaseinnetincomeatOGEHoldingsof$92.9million,or

90.8percent,or$0.46perdilutedshareoftheCompany’scommon

stock,primarilyduetothegoodwillimpairmentadjustmentatEnable

inSeptember2015andlowerrevenuesdrivenbyloweraverage

naturalgasandNGLsprices;

• adecreaseinnetincomeatOGEEnergyof$8.5million,or$0.05per

dilutedshareoftheCompany’scommonstock,primarilydueto

chargesassociatedwithpre-constructionexpendituresfornewoffice

spacetoconsolidateOklahomaCitypersonnel;and

• adecreaseinnetincomeatOG&Eof$23.1million,or7.9percent,

or$0.11perdilutedshareoftheCompany’scommonstock,primarily

duetoanincreaseindepreciationexpenseduetoadditionalassets

beingplacedinservicein2015,andadecreaseingrossmargin

relatedtomilderweatheranddecreasedwholesaletransmission

revenues.Partiallyoffsettingtheseitemswasanincreasein

customergrowth,anincreaseinotherincomeandanincreasein

allowanceforequityfundsusedduringconstruction.

2014 compared to 2013. NetincomeattributabletoOGEEnergywas

$395.8million,or$1.98perdilutedshare,in2014ascomparedto

$387.6million,or$1.94perdilutedshare,in2013.Theincreaseinnet

incomeattributabletoOGEEnergyof$8.2million,or2.1percent,or

$0.04perdilutedshare,in2014ascomparedto2013wasprimarily

dueto:

• anincreaseinnetincomeatOGEHoldingsof$2.4million,or

2.4percent,or$0.01perdilutedshareoftheCompany’scommon

stock,duepartiallytotheaccretiveeffecttoOGEHoldingsofEnable

partiallyoffsetbyareductionindeferredstateincometaxesin2013

associatedwitharemeasurementoftheaccumulateddeferredtaxes

relatedtotheformationofEnable;

• anincreaseinnetincomeatOGEEnergyof$6.4million,or

$0.04perdilutedshareoftheCompany’scommonstock,primarily

duetodecreasedtransactionexpensesrelatedtotheformationof

Enableandadecreaseinlossesforthedeferredcompensation

plan;and

• adecreaseinnetincomeatOG&Eof$0.6million,or0.2percent,or

$0.01perdilutedshareoftheCompany’scommonstock,reflecting

anincreaseindepreciationexpenseduetoadditionalassetsbeing

placedinservicein2014,adecreaseingrossmarginrelatedto

milderweathercomparedto2013,anincreaseinotheroperationand

maintenanceexpenseandanincreaseininterestexpenserelatedto

theissuanceofdebt.Partiallyoffsettingtheseitemswasanincrease

inwholesaletransmissionrevenues,anincreaseincustomergrowth

andadecreaseinincentivecompensation.

Amoredetaileddiscussionregardingthefinancialper ormanceof

OG&EandtheNaturalGasMidstreamOperationscanbefoundunder

“ResultsofOperations”below.