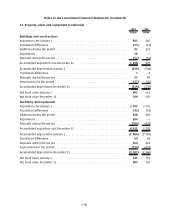

Nokia 2007 Annual Report Download - page 179

Download and view the complete annual report

Please find page 179 of the 2007 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

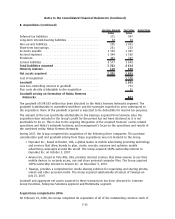

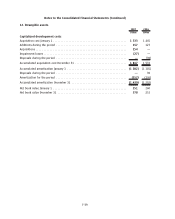

8. Acquisitions (Continued)

Intellisync Corporation. Intellisync is a leader in synchronization technology for platformindependent

wireless messaging and other business applications for mobile devices. The acquisition of Intellisync

will enhance Nokia’s ability to respond to its customers and effectively puts Nokia at the core of any

mobility solution for businesses of all sizes.

The total cost of the acquisition was EUR 325 million consisting of EUR 319 million of cash and

EUR 6 million of costs directly attributable to the acquisition.

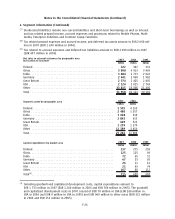

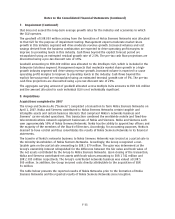

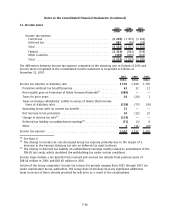

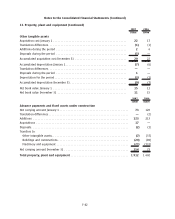

The following table summarises the estimated fair values of the assets acquired and liabilities

assumed at the date of acquisition. The carrying amount of Intellisync net assets immediately before

the acquisition amounted to EUR 50 million.

February 10, 2006

EURm

Intangible assets subject to amortization:

Technology related intangible assets ....................................... 38

Other intangible assets .................................................. 22

60

Deferred tax assets ..................................................... 45

Other noncurrent assets ................................................ 16

Noncurrent assets ..................................................... 121

Goodwill ............................................................. 290

Current assets ......................................................... 42

Total assets acquired .................................................. 453

Deferred tax liabilities .................................................. 23

Other noncurrent liabilties .............................................. 1

Noncurrent liabilities ................................................... 24

Current liabilities . ..................................................... 104

Total liabilities assumed ............................................... 128

Net assets acquired ................................................... 325

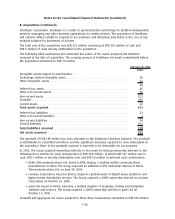

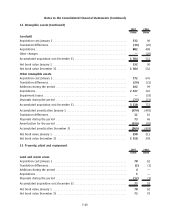

The goodwill of EUR 290 million has been allocated to the Enterprise Solutions segment. The goodwill

is attributable to assembled workforce and the significant synergies expected to arise subsequent to

the acquisition. None of the goodwill acquired is expected to be deductible for tax purposes.

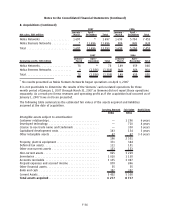

In 2006, the Group acquired ownership interests or increased its existing ownership interests in the

following three entities for total consideration of EUR 366 million, of which EUR 347 million was in

cash, EUR 5 million in directly attributable costs and EUR 14 million in deferred cash consideration:

• Nokia Telecommunications Ltd, based in BDA, Beijing, a leading mobile communications

manufacturer in China. The Group acquired an additional 22% ownership interest in Nokia

Telecommunications Ltd. on June 30, 2006.

• Loudeye Corporation, based in Bristol, England a global leader of digital music platforms and

digital media distribution services. The Group acquired a 100% ownership interest in Loudeye

Corporation on October 16, 2006.

• gate5 AG, based in Berlin, Germany, a leading supplier of mapping, routing and navigation

software and services. The Group acquired a 100% ownership interest in gate5 AG on

October 15, 2006.

Goodwill and aggregate net assets acquired in these three transactions amounted to EUR 198 million

F36

Notes to the Consolidated Financial Statements (Continued)