Nokia 2007 Annual Report Download - page 172

Download and view the complete annual report

Please find page 172 of the 2007 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

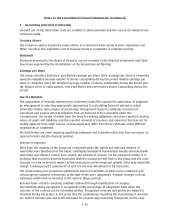

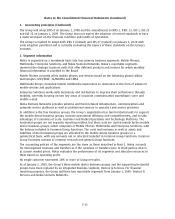

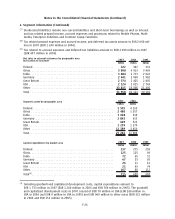

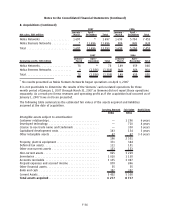

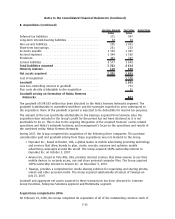

5. Pensions (Continued)

during the year and the funded status of the significant defined benefit pension plans showing the

amounts that are recognized in the Group’s consolidated balance sheet at December 31:

Domestic

Plans

Foreign

Plans

Domestic

Plans

Foreign

Plans

2007 2006

EURm EURm EURm EURm

Present value of defined benefit obligations at beginning of

year .............................................. (1 031) (546) (890) (495)

Foreign exchange ..................................... —27— (3)

Current service cost ................................... (59) (66) (63) (38)

Interest cost ......................................... (50) (54) (40) (26)

Plan participants’ contributions.......................... — (8) — (7)

Actuarial gain (loss) ................................... 115 126 (51) 14

Acquisitions ......................................... — (780) ——

Curtailment.......................................... 313—

Settlements ......................................... —15——

Benefits paid ........................................ 11 30 10 9

Present value of defined benefit obligations at end of year. . . . (1 011) (1 255) (1 031) (546)

Plan assets at fair value at beginning of year ............... 985 424 904 372

Foreign exchange ..................................... — (27) —3

Expected return on plan assets .......................... 49 46 41 21

Actuarial gain (loss) on plan assets ....................... (33) (2) (8) (3)

Employer contribution ................................. 73 90 59 32

Plan participants’ contributions.......................... —8—8

Benefits paid ........................................ (11) (30) (11) (9)

Settlements ......................................... — (3) ——

Acquisitions ......................................... — 605 ——

Plan assets at fair value at end of year .................... 1 063 1 111 985 424

Surplus/(Deficit) ...................................... 52 (144) (46) (122)

Unrecognized net actuarial (gains)/losses .................. 97 (41) 187 89

Prepaid/(Accrued) pension cost in balance sheet . . .......... 149 (185) 141 (33)

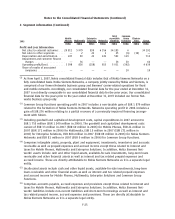

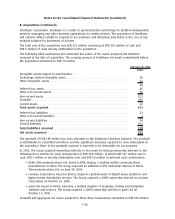

Present value of obligations include EUR 1 799 million (EUR 300 million in 2006) of wholly funded

obligations, EUR 333 million of partly funded obligations (EUR 1 244 million in 2006) and

EUR 134 million (EUR 33 million in 2006) of unfunded obligations.

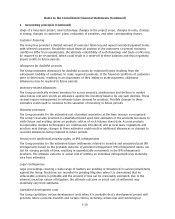

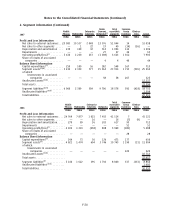

The amounts recognized in the profit and loss account are as follows:

2007 2006 2005

EURm EURm EURm

Current service cost ................................................. 125 101 69

Interest cost ....................................................... 104 66 58

Expected return on plan assets ........................................ (95) (62) (64)

Net actuarial losses recognized in year .................................. 10 89

Past service cost gain () loss (+)....................................... —31

Transfer from central pool ............................................ —— (24)

Curtailment ....................................................... (1) (4) (3)

Settlement ........................................................ (12) ——

Total, included in personnel expenses .................................. 131 112 46

F29

Notes to the Consolidated Financial Statements (Continued)