National Grid 2011 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2011 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

74 National Grid Gas plc Annual Report and Accounts 2010/11

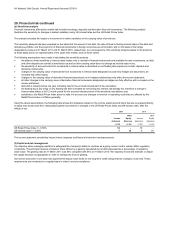

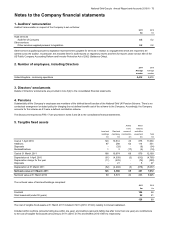

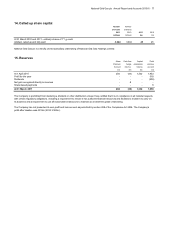

6. Investments

Shares in

subsidiary

undertakings

£m

Cost and net book value at 31 March 2010 and 31 March 2011 17

The names of the principal subsidiary undertakings are included in note 31 to the consolidated financial statements.

The directors believe that the carrying value of the investments is supported by their underlying net assets.

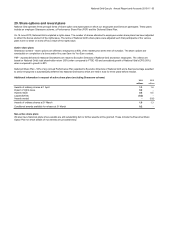

7. Stock

2011 2010

£m £m

Raw materials and consumables 40 43

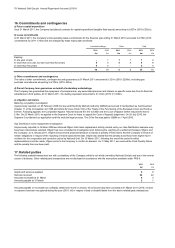

8. Debtors

2011 2010

£m £m

A

mounts falling due within one year:

Trade debtors 36 58

A

mounts owed by fellow subsidiary undertakings 15 24

Corporation tax -10

Other debtors 85

Prepayments and accrued income 173 200

232 297

A

mounts falling due after more than one year:

Other debtors 10 8

A

mounts owed by immediate parent undertaking 5,611 5,611

5,621 5,619

Total debtors 5,853 5,916

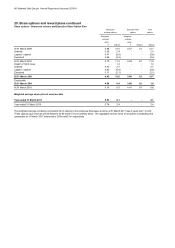

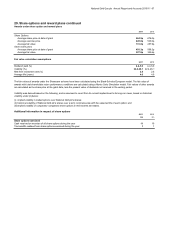

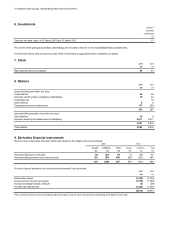

9. Derivative financial instruments

The fair value of derivative financial instruments shown on the balance sheet is as follows:

Assets Liabilities Total Assets Liabilities Total

£m £m £m £m £m £m

A

mounts falling due in one year 80 (22) 58 72 (30) 42

A

mounts falling due after more than one year 535 (86) 449 565 (121) 444

615 (108) 507 637 (151) 486

2011 2010

£m £m

Interest rate swaps (5,199) (3,154)

Cross-currency interest rate swaps (1,578) (1,748)

Foreign exchange forward contracts (4) (39)

Forward rate agreements (1,832) (1,730)

(8,613) (6,671)

*The notional contract amounts of derivatives indicate the gross nominal value of transactions outstanding at the balance sheet date

For each class of derivative the notional contract amounts* are as follows:

2011 2010