National Grid 2011 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2011 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.National Grid Gas plc Annual Report and Accounts 2010/11 33

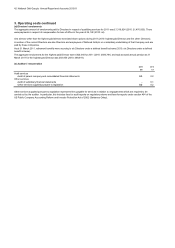

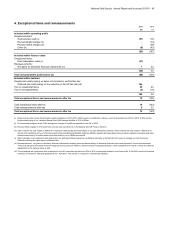

Adoption of new accounting standards

New IFRS accounting standards and

interpretations adopted in 2010/11

During the year ended 31 March 2011, the Company adopted

the following International Financial Reporting Standards

(IFRS), International Accounting Standards (IAS) or

amendments and interpretations by the IFRS Interpretations

Committee. None of the pronouncements had a material

impact on the Company’s consolidated results or assets and

liabilities.

IFRS 3R on business combinations

IAS 27R on consolidated and individual financial

statements

Amendment to IAS 39 Financial Instruments:

Recognition and measurement on eligible hedged items

Revised IFRS 1 on first time adoption of IFRS

IFRIC 17 on distribution of non-cash assets to owners -

Improvements to IFRS 2009

Amendment to IFRS 2 on group cash-settled share-

based payments

Amendment to IFRS 1 on first time adoption of IFRS

Amendment to IAS 32 on classification of rights issues

New IFRS accounting standards and

interpretations not yet adopted

The standards and interpretations listed below were not

effective for the year ended 31 March 2011.

The Company enters into a significant number of transactions

which fall within the scope of IFRS 9 on financial instruments.

The International Accounting Standards Board is completing

IFRS 9 on financial instruments in phases and the Company

is evaluating the impact of the standard as it develops.

IFRS 10, 11, 12 and 13 and the consequent amendments to

IAS 27 and IAS 28 were issued on 12 May 2011. The

Company is evaluating the impact of these standards on the

financial statements.

None of the other standards and interpretations listed below

are expected to have a material impact on the Company’s

consolidated results or assets and liabilities.

IFRS 9 on financial instruments

Revised IAS 24 on related party disclosures

IFRIC 19 on extinguishing financial liabilities with equity

instruments

Amendment to IFRIC 14 on prepayments of a minimum

funding requirement

Amendment to IFRS 1 on comparative IFRS 7

disclosures

Improvements to IFRS 2010

Amendment to IFRS 7 on disclosures for transfers of

financial assets

Amendment to IFRS 1 on severe hyperinflation and

removal of fixed dates for first-time adoption

Amendment to IAS 12 on deferred tax on recovery of

underlying assets

IFRS 10 on consolidated financial statements

IFRS 11 on joint arrangements

IFRS 12 on disclosures of interests in other entities

IFRS 13 on fair value measurements

IAS 27 on separate financial statements

IAS 28 on investment in associates and joint ventures