National Grid 2011 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2011 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

National Grid Gas plc Annual Report and Accounts 2010/11 37

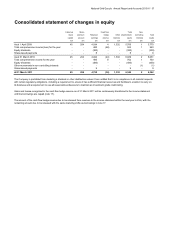

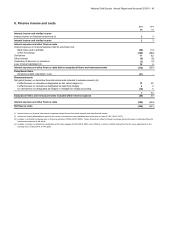

Consolidated statement of changes in equity

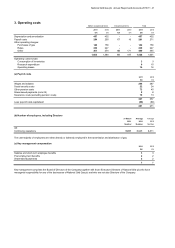

Called up Share Cash flow Total Non-

share premium Retained hedge Other shareholders' controlling Total

capital account earnings reserve reserves equity interests equity

£m £m £m £m £m £m £m £m

A

s at 1 April 2009 45 204 4,184 4 1,332 5,769 1 5,770

Total comprehensive income/(loss) for the year - - 600 (48) - 552 1 553

Equity dividends - - (300) - - (300) - (300)

Share-based payments - - 8 - - 8 - 8

A

s at 31 March 2010 45 204 4,492 (44) 1,332 6,029 2 6,031

Total comprehensive income for the year - - 694 8 - 702 1 703

Equity dividends - - (400) - - (400) - (400)

Other movements in non-controlling interests - - ----(1)(1)

Share-based payments - - 9 - - 9 - 9

At 31 March 2011 45 204 4,795 (36) 1,332 6,340 2 6,342

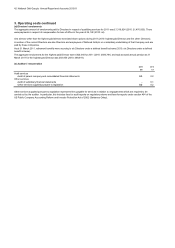

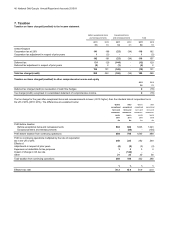

The Company is prohibited from declaring a dividend or other distribution unless it has certified that it is in compliance in all material respects

with certain regulatory obligations, including a requirement to ensure it has sufficient financial resources and facilities to enable it to carry on

its business and a requirement to use all reasonable endeavours to maintain an investment grade credit rating.

Gains and losses recognised in the cash flow hedge reserve as of 31 March 2011 will be continuously transferred to the income statement

until the borrowings are repaid (note 17).

The amount of the cash flow hedge reserve due to be released from reserves to the income statement within the next year is £5m, with the

remaining amount due to be released with the same maturity profile as borrowings in note 17.