National Grid 2011 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2011 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

18 National Grid Gas plc Annual Report and Accounts 2010/11

Liquidity and treasury management

Treasury policy

Funding and treasury risk management for National Grid Gas is

carried out by the treasury function of National Grid under

policies and guidelines approved by the Finance Committees of

the Boards of National Grid and National Grid Gas. The

Finance Committees have authority delegated from the relevant

Boards and are responsible for regular review and monitoring of

treasury activity and for the approval of specific transactions,

the authority for which may be further delegated.

The primary objective of the treasury function is to manage the

funding and liquidity requirements of National Grid. A secondary

objective is to manage the associated financial risks, in the form

of interest rate risk and foreign exchange risk, to within

acceptable boundaries. Further details of the management of

funding and liquidity and the main risks arising from our

financing activities are set out below, as are the policies for

managing these risks, including the use of financial derivatives,

which are agreed and reviewed by the Boards and the Finance

Committees.

The treasury function is not operated as a profit centre. Debt

and treasury positions are managed in a non-speculative

manner, such that all transactions in financial instruments or

products are matched to an underlying current or anticipated

business requirement.

Commodity derivatives entered into in respect of gas

commodities are used in support of the business’s operational

requirements and their use is explained on page 20.

Current condition of the financial markets

The financial markets have essentially returned to normal for

National Grid following the turmoil in the capital markets in 2008

and 2009. Following National Grid’s rights issue, which

completed in June 2010, our funding requirements were

modest. Nevertheless, we issued approximately £350 million of

new long-term debt and also repurchased £368 million. We

remain confident of our ability to access the public debt markets

in the future.

Cash flow and cash flow forecasting

Cash flows from operations are largely stable annually and over

a period of years. Our gas transmission and distribution

operations are subject to multi-year price control agreements

with our regulator, Ofgem.

Both short and long-term cash flow forecasts are produced

regularly to assist the treasury function in identifying short-term

liquidity and long-term funding requirements, and we seek to

enhance our cash flow forecasting processes on an ongoing

basis. Cash flow forecasts, supplemented by a financial

headroom analysis, are monitored regularly to assess funding

adequacy for at least a 12 month period.

As part of our regulatory arrangements, our operations are

subject to a number of restrictions on the way we can operate.

These include regulatory ‘ring-fences’ that requires us to

maintain adequate financial resources and restricts our ability to

undertake transactions with other National Grid subsidiary

companies including paying dividends, lending cash or levying

charges.

Funding and liquidity management

We maintain medium-term note and commercial paper

programmes to facilitate long and short-term debt issuance into

capital and money markets.

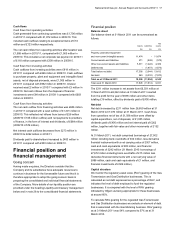

At 31 March 2011, we had a $2.5 billion US commercial paper

programme (unutilised), a $1.25 billion Euro commercial paper

programme (unutilised) and a €10.0 billion Euro medium-term

note programme (€5.2 billion issued).

In addition we have both committed and uncommitted bank

borrowing facilities that are available for general corporate

purposes to support our liquidity requirements. At 31 March

2011, the Company had £425 million of long-term committed

facilities (undrawn), expiring in April 2014.

To facilitate debt issuance into the capital and money markets,

we maintain credit ratings. Details of our long-term senior

unsecured debt and short-term debt credit ratings are provided

below within ‘credit ratings’.

We invest surplus funds on the money markets, usually in the

form of short-term fixed deposits and placements with money

market funds that are invested in highly liquid instruments of

high credit quality. Investment of surplus funds is subject to our

counterparty risk management policy, and we continue to

believe that our cash management and counterparty risk

management policies provide appropriate liquidity and credit

risk management. Details relating to cash, short-term

investments and other financial assets at 31 March 2011 are

shown in notes 15 and 16 to the consolidated financial

statements.

We believe that maturing amounts in respect of our contractual

obligations can be met from existing cash and investments,

operating cash flows and other financings that we reasonably

expect to be able to secure in the future, together with the use

of committed facilities if required.

In line with our normal treasury practice we expect to continue

to access the markets in order to manage actively our debt

portfolio, optimise our finance costs and manage our

refinancing risk.

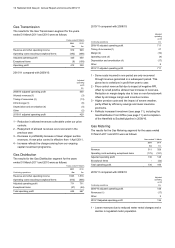

Credit ratings

It is a condition of the regulatory ring-fence around the

Company that it uses reasonable endeavours to maintain an

investment grade credit rating. As of 31 March 2011, the long-

term senior unsecured debt and short-term debt credit ratings

respectively provided by Moody’s Investor Services, Standard &

Poor’s and Fitch were as follows (all with outlooks of stable):

Moody’s Investor Services A3/P2

Standard & Poor’s A-/A2

Fitch A/F2

Use of derivative financial instruments

As part of our business operations, including our treasury

activities, we are exposed to risks arising from fluctuations in