National Grid 2011 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2011 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.National Grid Gas plc Annual Report and Accounts 2010/11 19

interest rates and exchange rates. We use financial

instruments, including financial derivatives, to manage

exposures of this type. Our policy is not to use financial

derivatives for trading purposes. More details on derivative

financial instruments are provided in note 12 to the consolidated

financial statements.

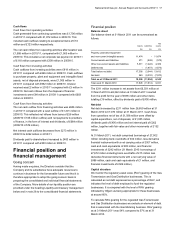

Refinancing risk management

Refinancing risk is controlled mainly by limiting the amount of

debt maturities arising on borrowings in any financial year.

Note 17 to the consolidated financial statements sets out the

contractual maturities of our borrowings over the next five

years, with total contracted borrowings maturing over 41 years.

We expect to be able to refinance this debt through the capital

and money markets as we have done during the year to 31

March 2011.

Interest rate risk management

Our interest rate exposure arising from borrowings and deposits

is managed by the use of fixed and floating rate debt and

derivative financial instruments, including interest rate swaps,

swaptions and forward rate agreements. The interest rate risk

management policy is to seek to minimise total financing costs

(being interest costs and changes in the market value of debt)

subject to constraints so that, even with an extreme movement

in interest rates, neither the interest cost nor the total financing

cost is expected to exceed preset limits with a high degree of

certainty.

Some of our bonds in issue are inflation-linked, that is their cost

is linked to changes in the UK Retail Prices Index (RPI). We

believe that these bonds provide an appropriate hedge for

revenues and our regulatory asset values that are also RPI

linked under our price control formulas.

The performance of the treasury function in interest rate risk

management is measured by comparing the actual total

financing costs of the National Grid debt with those of a

passively managed benchmark portfolio with set ratios of fixed

rate to floating-rate debt, to identify the impact of actively

managing National Grid’s interest rate risk. This is monitored

regularly by the Finance Committee of National Grid.

Within the constraints of our interest rate risk management

policy, and as approved by the Finance Committee, we actively

manage our interest rate exposure and therefore the interest

rate profile will change over time.

In 2011/12, we expect our financing costs to continue to benefit

from low short-term interest rates, some of which have already

been locked in using short-term interest rate derivatives.

More information on the interest rate profile of our debt is

included in note 28(a) to the consolidated financial statements.

Foreign exchange risk management

We have a policy of managing our foreign exchange transaction

risk by hedging contractually committed foreign exchange

transactions over a prescribed minimum size. This covers a

minimum of 75% of such transactions occurring in the next six

months and a minimum of 50% of transactions occurring six to

twelve months in the future. Cover generally takes the form of

forward sale or purchase of foreign currencies and must always

relate to forecast underlying operational cash flows.

The result of this hedging activity is that our cash flow has

limited exposure to foreign currencies.

Our capital expenditure programme over the next few years will

result in material foreign currency exposures as we purchase

raw materials and components from overseas suppliers. The

treasury function will seek to manage these exposures through

a range of hedging strategies and instruments.

In addition, we are exposed to currency exposures on

borrowings in currencies other than sterling, principally the

euro. This currency exposure is managed through the use of

cross-currency swaps, so that post derivatives the currency

profile is almost entirely sterling.

More details can be found in note 28(a) to the consolidated

financial statements.

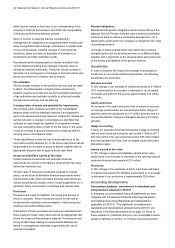

Counterparty risk management

Counterparty risk arises from the investment of surplus funds,

from the use of derivative instruments, and from commercial

contracts entered into by the businesses, including commodity

contracts. The National Grid Finance Committee has agreed a

policy for managing such risk on a portfolio basis across

National Grid. This policy sets limits as to the exposure that

National Grid can have with any one counterparty, based on

that counterparty’s credit rating from independent credit rating

agencies. National Grid’s exposure to individual counterparties

is monitored daily and counterparty limits are regularly updated

for changes in credit ratings. The treasury function is

responsible for managing the policy. Where contracts carrying

credit risk are entered into outside the treasury function, part of

the relevant counterparty limit can be allocated to the business

area involved. This ensures that National Grid’s overall

exposure is managed within the appropriate limit.

Where multiple transactions are entered into with a single

counterparty, a netting arrangement is usually put in place to

reduce our exposure to credit risk of that counterparty. When

transacting interest rate and exchange rate derivatives, we use

market standard documentation, which provides for netting in

respect of all transactions governed by a specific ISDA

agreement with a counterparty.

Further information on the management of counterparty risk is

provided in note 28(c) to the consolidated financial statements.

Valuation and sensitivity analysis

We calculate the fair value of debt and financial derivatives by

discounting all future cash flows by the market yield curve at the

balance sheet date, including the credit spread for debt, and in

the case of financial derivatives taking into account the credit

quality of both parties. The market yield curve for each currency

is obtained from external sources for interest and foreign

exchange rates. In the case of instruments that include options,

the Black’s variation of the Black-Scholes model is used to

calculate fair value.