National Grid 2011 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2011 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

National Grid Gas plc Annual Report and Accounts 2010/11 67

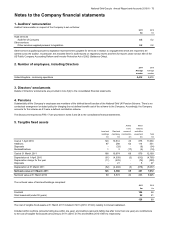

29. Share options and reward plans continued

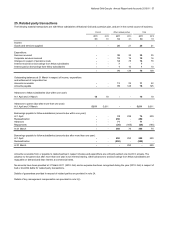

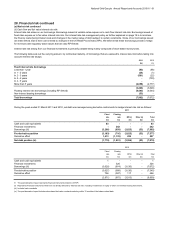

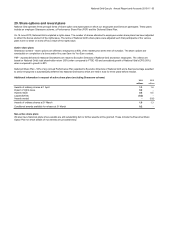

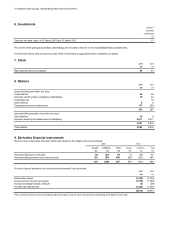

Awards under share option and reward plan

s

2011 2010

Share Options:

A

verage share price at date of grant 564.5p 676.0p

A

verage exercise price 445.0p 520.0p

A

verage fair value 131.6p 287.9p

Other share plans

A

verage share price at date of grant 493.3p 598.2p

A

verage fair value 327.8p 355.6p

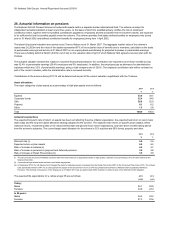

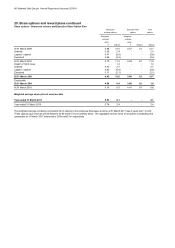

2011 2010

Dividend yield (%) 4.4-5.0 4.4-5.0

Volatility (%) 22.4-26.1 22.4-26.1

Risk-free investment rate (%) 2.5 2.5

A

verage life (years) 4.0 4.0

(i) implied volatility in traded options over National Grid plc's shares;

(ii)

(iii) implied volatility of comparator companies where options in their shares are traded.

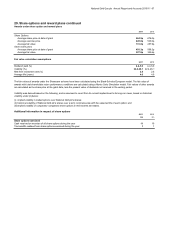

Additional information in respect of share option

s

2011 2010

£m £m

Share options exercised

Cash received on exercise of all share options during the year 11 10

Tax benefits realised from share options exercised during the year 11

Volatility was derived based on the following, and is assumed to revert from its current implied level to its long-run mean, based on historical

volatility under (ii) below:

The fair values of awards under the Sharesave scheme have been calculated using the Black-Scholes European model. The fair value of

awards with total shareholder return performance conditions are calculated using a Monte Carlo Simulation model. Fair values of other awards

are calculated as the share price at the grant date, less the present value of dividends not received in the vesting period.

historical volatility of National Grid plc's shares over a term commensurate with the expected life of each option; and

Fair value calculation assumptions