Marks and Spencer 2004 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2004 Marks and Spencer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6

Marks and Spencer Group plc

Financial review continued

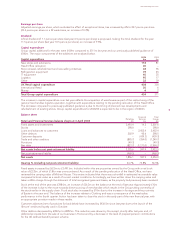

Financial Services 2004 2003

£m £m

Turnover 330.0 329.9

Operating profit 50.6 86.4

Personal Unit Life

Scale of current business Cards Lending Trusts Assurance

Number of accounts/policyholders (000s)

2004 5,163 441 328 88

2003 5,016 488 227 90

Customer advances/funds under management (£m)

2004 1,228 1,224 1,282 n/a

2003 631 1,385 1,017 n/a

The most significant event for Financial Services this year was the October launch of the ‘&more’ credit and loyalty card

within Marks & Spencer Money. The total impact of the launch on Money profit for the year was £58.6m. Underlying profit

was £89.5m and was impacted by the transfer of £300m of balances to the new ‘&more’ card and the costs of running the

enlarged cards business. Profit within Marks & Spencer Insurance, our Guernsey captive, increased by £5.8m to £19.7m, due

to an improvement in the performance of underlying investments year-on-year and a release of insurance reserves of £4.2m.

In Personal Loans, our focus was on maintaining net interest margin in an increasingly competitive marketplace. Also, during

the critical period around the launch of the credit card, promotional activity was curtailed to avoid customer confusion. As

a direct consequence, new business reduced by 15%. However, our earlier decision to concentrate on Marks & Spencer

customers, who are lower risk than the industry average, has meant that credit losses were substantially reduced, increasing

net income from Personal Loans by 14% year-on-year.

By the end of the year, the total amount of lending to customers had risen to £2.5bn, exceeding the previous peak of £2.3bn

in 2001. Within this total, balances on card accounts had reached £1.2bn, almost twice the level at the end of last year.

The bad debt charge as a percentage of total customer balances was 2.4% for the year which is similar to the rate charged

last year. Within the new credit card portfolio, levels of delinquency as well as bad debt and fraud losses to date were

negligible. Using experience based on the Chargecard, a provision of just under 1% of balances has been established. As

expected, the operating cost ratio climbed higher this year to reach a peak of 6.7% of average balances. This ratio will now

reduce as the rate of investment in new capability declines.

Within Savings and Protection, overall trading profit was down £1.3m, driven by a fall of £3.5m in Life income. The launch

in February of our new Mini Cash ISA product went well with new deposits of £325m by the end of the year. Other Savings

and Protection products performed well, with an 18% increase to £104m in gross unit trust retail investment, and a three-fold

increase in the number of travel insurance policies sold. Initial results from the motor insurance pilot were encouraging and

the product was launched nationally in April 2004. A series of new product and regional distribution trials are also planned

which if successful will be rolled out during the year ahead.

Card and Loyalty Roll-out

This year saw the successful delivery of the largest project ever undertaken by Marks & Spencer Money, with the launch of

the ‘&more’ credit and loyalty card, which was delivered on time and within budget. Approximately 2.6 million Chargecard

customers were given the option of converting to the ‘&more’ credit card and of these, 1.7 million chose to accept the offer

and activate the card. Those choosing not to activate the credit card have been retained as Chargecard customers. In

addition, 380,000 new accounts were opened which was ahead of our expectations. According to recent Mori data,

Marks & Spencer was ranked equal first in terms of new accounts issued across the UK credit card industry for the first quarter

of 2004. At the end of March 2004, there were 2.1 million customers with an ‘&more’ credit card account. This makes us a top

ten credit card operator from a standing start.

Within six months of launch, the average balance per account had reached £448, with the percentage of balances bearing

interest standing at 77% which is in line with the industry average. Initial data on the newly acquired customers, shows that

they spend more in store than converted Chargecard customers. Early results from the loyalty programme, although still in

its infancy, indicate that customers are not only spending their loyalty vouchers but also increasing their spend.

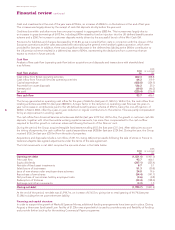

Interest

Net interest expense was £45.8m (£44.5m on a 52 week basis) compared to £40.5m for last year. The average rate of interest

on borrowings during the period was 5.3%.

Taxation

The tax charge reflects an effective tax rate for the full year of 30.1% before exceptional charges, compared to 28.7% last

year. The rate last year is lower due to the favourable resolution of a number of open prior year issues with the Inland

Revenue. In particular, the Revenue accepted that contributions to European subsidiary closure costs were tax deductible in

the UK. This one-off benefit resulted in a favourable adjustment which was reflected in the effective tax rate for last year.