Marks and Spencer 2004 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2004 Marks and Spencer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8

Marks and Spencer Group plc

Financial review continued

Cash and investments at the end of the year were £720.6m, an increase of £248.7m on the balance at the end of last year.

This increase was largely driven by the receipt of cash ISA deposits shortly before the year end.

Creditors due within and after more than one year increased in aggregate by £883.4m. This increase was largely due to

an increase in gross borrowings of £413.9m, including £400m raised to fund an injection into the UK defined benefit pension

scheme and a £360.7m increase in customer deposits mainly driven by the successful launch of the Mini Cash ISA.

Provisions for liabilities and charges decreased by £136.8m as we incurred further costs in connection with the closure of the

European operations and the costs associated with rationalising the general merchandise logistics operation, which were

provided for last year. In addition, there was a significant decrease in the deferred tax liability as the £400m contribution to

the UK pension scheme resulted in a deferred tax asset of £90m, representing the deductions from current tax that we

expect to receive in future periods.

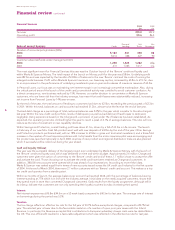

Cash flow

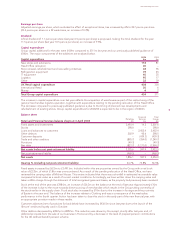

Analysis of free cash flow (operating cash flow before acquisitions and disposals and transactions with shareholders)

is as follows:

2003

2004 As restated

Cash flow analysis £m £m

Cash inflow from Retail operating activities 602.3 848.8

Cash inflow from Financial Services operating activities 64.2 319.9

Capital expenditure (428.8) (324.5)

Proceeds from asset disposals 126.2 25.0

Interest paid (49.8) (46.2)

Tax paid (220.4) (216.9)

Free cash flow 93.7 606.1

The Group generated an operating cash inflow for the year of £666.5m (last year £1,168.7m). Within this, the cash inflow from

retailing activities was £602.3m (last year £848.8m). A major factor in the reduction in operating cash flow was the year-on-

year net increase in contributions paid to the UK defined benefit pension scheme of £357m, being the one-off injection of

£400m in March 2004, offset by a year-on-year reduction in regular contributions to the scheme. This was partly compensated

for by an improvement in working capital.

The cash inflow from Financial Services activities was £64.2m (last year £319.9m). Within this, the growth in customer cash ISA

deposits, together with other favourable working capital movements, has more than compensated for the cash outflow

required to fund the growth in customer advances following the launch of the ‘&more’ card.

During the period, the Group acquired tangible fixed assets totalling £433.5m (last year £311.0m). After taking into account

the timing of payments, the cash outflow for capital expenditure was £428.8m (last year £324.5m). During the year, the Group

received £126.2m (last year £25.0m) from the sale of properties.

Acquisitions and disposals include a net inflow of £51.3m, being deferred proceeds following the sale of stores in France to

Galeries Lafayette less agreed adjustments under the terms of the sale agreement.

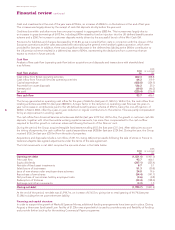

The total movements in net debt comprise the amounts shown in the table below:

2003

2004 As restated

£m £m

Opening net debt (1,831.4) (1,907.0)

Free cash flow 93.7 606.1

Equity dividends (247.1) (225.4)

Net sale of fixed asset investments 8.7 5.1

Sale/closure of businesses 51.3 (30.8)

Issue of new shares under employee share schemes 24.8 19.6

Repurchase of own shares (54.4) (141.7)

Net purchase of own shares held by employee trusts (3.6) (0.8)

Redemption of B shares (33.4) (158.0)

Exchange and other movements (3.3) 1.5

Closing net debt (1,994.7) (1,831.4)

At the end of the period, net debt was £1,994.7m, an increase of £163.3m, giving rise to retail gearing of 44.7% (last year

53.0%) including the net post-retirement liability.

Financing and capital structure

In order to support the growth of Marks & Spencer Money, additional funding arrangements have been put in place. During

August, a three-year Syndicated Loan Facility of £1.25bn was signed which is used to provide surety and flexibility of funding

and provide further back-up for the existing Commercial Paper programme.