Marks and Spencer 2004 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2004 Marks and Spencer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4

Marks and Spencer Group plc

Financial review continued

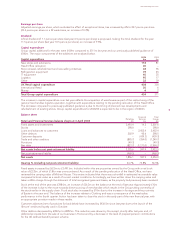

UK Retail 2003

2004 52 weeks

52 weeks As restated

Turnover (£m) 7,159.8 7,027.1

Operating profit (before exceptional items) (£m) 728.1 643.8

Number of stores (at the end of the year) 375 331

Selling space at the end of the year (m sq ft) 12.8 12.3

Turnover, including VAT, was up 1.8% on last year, down 0.4% on a like-for-like basis.

The performance of Clothing for the year as a whole was disappointing, with total Clothing sales down 0.5% on last year.

Womenswear, in particular, performed below expectations with a strong performance from per una and casualwear, held

back by the performance in other areas. Elsewhere, Lingerie and Menswear performed ahead of last year until the last

quarter when sales were marginally lower. Childrenswear was again weak. Clothing market share for the year declined by

0.2 percentage points to 11.0%.

In Home, we are repositioning our offer and broadening our appeal to more customers. A pilot Marks & Spencer Lifestore

was opened in Gateshead in February and new product introduced down the chain. Customers responded well to the

Lifestore environment and were excited by the concept, but the product in some areas has been too contemporary and

sales were down on last year. A second Marks & Spencer Lifestore is due to open in Kingston in the summer followed by one

in Thurrock, taking forward the learnings in environment, product appeal and price.

In Food, we maintained our market share over the year as a whole. We out-performed the market in the first half of the year,

but our like-for-like performance was not as strong in the second half in a competitive sector. We continue to benefit from

additional footage as we extend the reach of the Food offer. We opened 49 Food stores during the year, of which 40 are

Simply Food stores, 10 in partnership with Compass. We remain on plan to open 500,000 sq ft of new food space by

March 2006. Like-for-like food inflation for the year was c.1%.

We are continuing to realise gains in our Clothing bought-in margin as a result of work on the supply chain and actions

taken in previous years to increase overseas production and consolidate our supply base. For the year as a whole, this

delivered an improvement in the bought-in margin which was ahead of plan, helped by a weak dollar. Total markdown

costs were marginally ahead of last year, offset by slightly lower shrinkage. Overall, the full year Clothing gross margin was

1.5 percentage points ahead of last year. We expect the bought-in margin in 2004/05 to be 0.75 percentage points ahead of

this year, and remain on track to deliver a 3 percentage point improvement to the Clothing bought-in margin in the three

years to 2005/06.

The Food gross margin for the full year was 0.5 percentage points ahead of the same period last year. The improvements

seen in Food waste in the first half were negated in the second half as a result of the weaker sales performance and, for the

year as a whole, waste as a per cent to sales was in line with last year.

Logistics costs of £310m, which are included in cost of sales, were broadly in line with the same period last year. The changes

to the general merchandise logistics operation, which were announced at the end of last year, were completed during

the first half of the year. Ten distribution centres are now operated by two contractors, Exel and Christian Salvesen. These

new arrangements will generate ongoing annual savings of approximately £20m, of which £11.5m have been realised in

the second half of the year. Alongside the change of contractors, progress was made in acquiring the assets used in the

distribution network. We have purchased six warehouses, in addition to one we already owned, and agreed leases on three

more, incurring capital expenditure of £78.1m.

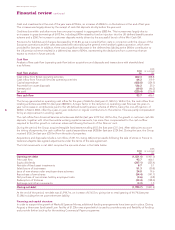

UK Retail operating costs of £1,835m, excluding exceptional charges, increased by 1.2% over last year:

•employee costs decreased by 1.3% to £912.8m; within this, performance bonuses for management and store staff were

down £29m on last year;

•property, repair and renewal costs of £323.6m decreased by 3.4%;

•depreciation was £227.3m, an increase of 4.4%; and

•other operating costs of £371.3m increased by 10.7%. This was largely due to costs incurred in improving business

efficiency in Retail Change and the supply chain and IT costs to support the growth initiatives of Simply Food,

Home and Loyalty.

Including logistics costs, operating expenses have increased by 1.0% on last year. Underlying UK Retail operating expenses,

which exclude the incremental costs of the growth initiatives, were down 1.3%.