Marks and Spencer 2004 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2004 Marks and Spencer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

11

www.marksandspencer.com

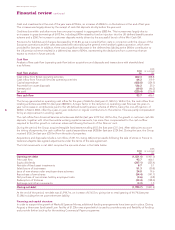

International Financial Reporting Standards

It will become mandatory for all EU listed companies to report their consolidated financial statements under International

Financial Reporting Standards (IFRS) from 2005 onwards. This will apply to the Group for its 31 March 2006 year end. We

have set up a programme to ensure compliance with IFRS is met. We have identified that the greatest impact on the Group

is likely to be changes in the accounting treatment for property, share-based payments, financial instruments and software

capitalisation.

Outlook for 2004/05

The planned opening of new footage, plus the annualisation of footage opened in 2003/04, will add c.2% sales contribution

to Clothing and c.5% to Food, on a weighted average basis.

We anticipate further improvements in the Clothing bought-in margin of approximately 0.75 percentage points. We remain

on track to deliver a total of 3 percentage points improvement to the Clothing bought-in margin in the three years to

2005/06.

UK retailing operating costs, including logistics, but excluding any accrual for performance-related bonuses, will increase by

5%. The investment in new footage, including the annualisation of costs associated with footage opened in 2003/04, will

account for over 4% of this increase.

If performance proves to be in line with business plans agreed by the Board, a bonus provision will be made. Guidance,

reporting the impact on operating costs, will be given at the appropriate time.

The revenue costs of the Head Office move to Paddington Basin will be c.£10m, compared to £19.6m incurred this year.

These costs will be treated as exceptional.

The Head Office restructuring programme, recently announced, will incur termination costs that will be treated as

exceptional. We have made a provision of £22.5m for the cost relating to the first phase of approximately 500 roles in the

financial statements for 2003/04. The cost relating to the second phase of the programme will be provided for in 2004/05.

The effect of the continued development of the ‘&more’ credit and loyalty card business will be to reduce the impact of the

credit card launch on Financial Services profits by c.£20m, from £58.6m this year to c.£40m in 2004/05.

The effective tax rate is estimated to be c.31%, compared to a rate for 2003/04 of c.30%.

FRS 17 has been adopted for the first time in this year’s financial statements. We anticipate the charge to operating profit for

the UK defined benefit scheme to be broadly similar to 2003/04 (at c.£117m). We estimate a net charge to interest relating to

FRS 17 in 2004/05 of c.£10m, taking into account the funding cost of the £400m public issue.

Group capital expenditure for 2004/05 will be c.£400m.

Going concern statement

After making enquiries, the directors have a reasonable expectation that the Group has adequate resources to continue in

operational existence for the foreseeable future. For this reason, they have adopted the going concern basis in preparing

the financial statements.