Marks and Spencer 2004 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2004 Marks and Spencer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2

Marks and Spencer Group plc

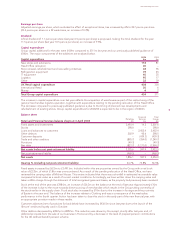

Group operating profit before

exceptional items increased last

year by 12% to £866 million (on a 53

week basis), due to the relatively

strong performance from Menswear,

Lingerie and women’s casualwear,

improved margins and tight control of

costs. On a 52 week basis Group

operating profit before exceptional

items increased by 6.5% to £822.9

million after absorbing £59 million for

the launch of the ‘&more’ card.

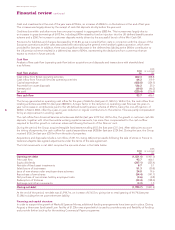

Clothing market share for the year

declined by 0.2 percentage points to

11%, because of a decline in

Womenswear and weak performance

in Childrenswear. We have

strengthened our clothing teams,

particularly in Womenswear, to deliver

our key priorities of improved ranges,

choice and value. This includes the

major expansion of our Limited

Collection, a new approach to our

‘smartwear’ offer, which will arrive in

66 stores from September 2004. We

are delivering greater choice to

customers in 90 stores, building on

the success of initial trials. And we will

make the Womenswear sales floors

easier to shop learning from our

success in Menswear. We continue to

reinvest part of our sourcing gains in

lower prices, particularly in our entry

price points.

Food held its market share last year,

benefiting from the roll-out of Simply

Food stores. Consumers are tending

to increase their spend on large,

‘weekly’, supermarket shops and,

with the increasing number of quality

convenience stores, are spreading

their ‘top up’ shops more widely.

We, therefore, face some significant

structural and competitive issues but

I’m confident that we can respond

to them.

Our customers continue to rate

our food offer more highly than our

competition. They see us as selling

food that is a real treat and of better

quality. We plan to develop the

appeal of our offer while reducing

reasons for customers to go elsewhere.

We are on-track against our existing

plans to open 500,000 sq ft of

additional Food-only space by March

2006. We are planning to extend this

total footage and will communicate

our plans later this year. We will

continue to develop our product

ranges in global and special occasion

food as well as in fresh and healthy

food. We aim to renew at least 30%

of our food ranges this year.

We will follow the opening of the

Marks & Spencer Lifestore in

Gateshead with two further pilot

stores. We will also continue to re-

position our Home offer, taking

lessons from the recent introduction

of new product.

Our significant investment in Money

has created a customer base of over

two million ‘&more’ credit and loyalty

card accounts. Our immediate priority

is to increase card spending and

balances so that the credit card moves

into profit during 2006.

More than five years ago we moved

manufacturing of our clothing offshore

and this now represents over 90% of

our production. This move improved

our margins by 7.6% between 2000

and 2003. We are committed to

achieve a further 3% increase in

margins by 2006 through additional

changes to our supply chain.

The rapid and low cost refurbishment

of our stores over the last three years

helped in our initial turnaround, but

we want to go further now, focusing

on our existing city centre and high

street stores and testing new concepts.

We are fortunate to have a dedicated

workforce with a relatively low staff

turnover, but we can be more efficient.

As a result we will be accelerating our

Retail Change Programme in stores

and cutting costs at our Head Offices

with the expected loss of 1,000 jobs.

I have strengthened my top team,

appointing Vittorio Radice to take

responsibility for Clothing, store

development and Home, Maurice

Helfgott to take charge of Food and

Mark McKeon to be Executive Director

of Retail, International and Outlets.

In the last three years we have

restructured the business, stabilised

our core operations and opened up

routes to future growth. However, we

still have a significant amount of work

to do to secure the full potential of

the business.

I am under no illusions about the

challenges we face, but I am confident

we can succeed. I believe that our

plans can put the business on a more

secure footing and deliver benefits to

our customers, employees,

shareholders and suppliers.

Roger Holmes

Chief Executive

Chief Executive’s review ROGER HOLMES

In the last year we have established new areas of growth in Money

and Home, but the initial surge in recovery of our core Clothing

and Food business faltered. We will now take fundamental action to

improve our products, supply chain, stores and ways of working.