Marks and Spencer 2004 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2004 Marks and Spencer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1

www.marksandspencer.com

During this time we have changed our

business fundamentally by:

•continuing to improve our

management team;

•developing our supply chain,

which will deliver further efficiency

and reduce costs; this is only

possible because of the painful but

necessary shift to overseas

sourcing. In 1998, we sourced just

20% of our clothing overseas and

today that figure is 90%;

•exiting loss-making operations in

Europe and the UK;

•ensuring that the balance sheet is

more efficient, with the return of

£2 billion to shareholders in 2002;

•delivering impactful but low-cost

improvements to our stores

throughout the chain; and

•making our special foods more

accessible to more customers

through the roll-out of the Simply

Food format.

More specifically, in the past year

we’ve seen progress in creating new

sources of growth. In our Food

business, we’ve further extended our

reach with the opening of more

Simply Food and Food only stores.

In Financial Services, now re-branded

Marks & Spencer Money, we’ve

introduced the ‘&more’ credit and

loyalty card. And we’ve opened the

first stand-alone Marks & Spencer

Lifestore as a major step towards

becoming one of the UK leaders

in home retail.

All these changes have contributed

to a strong recovery in the operating

profit of our core UK retailing

business. This has enabled us to

deliver a 24.7 pence earnings per

share this year, more than double

the level of 2001. Combined with the

restructuring of our balance sheet

and capital return in 2002, we have

delivered a current return on equity,

adjusted for exceptional items, that

is ahead of that achieved in 1998, the

year of peak Group profitability.

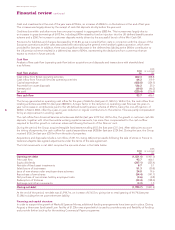

Group operating profit increased by

12% to £866 million and Group profit

before tax by 6% to £805 million, all

on a 53-week basis. Group operating

cash flow is £1,066.5 million before a

pension contribution of £400 million.

A final dividend of 7.1 pence per

share shows an increase of 9.2%

making the total dividend for the year

11.5 pence compared to 10.5 pence

last year.

Although we planned for better sales

figures overall, we have made

progress in Menswear, Lingerie and

women’s casualwear. These sales

figures should not obscure the hard

work throughout the business to

ensure better choice and value,

more appealing stores and greater

efficiencies, all of which will translate

into shareholder value over the

longer term.

You can read how we’re doing in

corporate social responsibility (CSR)

in our second CSR publication, now

available on our website. You can see

details of our Marks & Start

programme that we think sets a new

standard of effective, measurable

social involvement.

Regarding my own role, the

unexpected death last year of my very

close friend Paul Louis Halley has

meant that I must honour, earlier than

anticipated, a personal commitment

to the Halley family. This will require

me to play a significant role in

representing their interests and, as

a result, I have reluctantly informed

the Board of my wish to leave the

Company’s Board of Directors. I will

remain in post for as long as necessary

to establish my successor.

I have said previously that we can

never claim to have ‘made it’ and that

we must always be looking for ways to

improve our business. Looking back

on my time at Marks & Spencer, I feel

immense pride that we have

accomplished a considerable amount.

I do, however, recognise that there is

still much more to do. I have greatly

enjoyed this role and would like to

extend my appreciation and thanks for

the support shown to me by

colleagues, shareholders and

suppliers.

Luc Vandevelde

Chairman

Chairman’s message LUC VANDEVELDE

We have delivered financial performance which I would describe

as ‘solid’ but clearly we are not satisfied with our saIes progress.

The market share gains that we had hoped to achieve were not

delivered and Roger, in his summary opposite, will update you on

the actions we are taking to improve our performance. However, it

would be easy to lose sight of the fact that we are building this next

stage on secure foundations, which we have put in place over the

last three years.