Marks and Spencer 2004 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2004 Marks and Spencer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10

Marks and Spencer Group plc

Financial review continued

(e) Financial Services

Interest rate exposures for Financial Services are managed, as far as practical, by matching the periods of borrowings and

their interest basis with that of the customer debt. Interest rate swaps are used to convert fixed rate income to floating rate

income and floating rate borrowings to fixed rate borrowings as applicable, to meet this purpose.

The details of derivatives and other financial instruments required by FRS 13 – ‘Derivatives and Other Financial Instruments:

Disclosures’, are shown in notes 18, 21 and 23 to the financial statements.

Accounting changes

Accounting for pensions

At the end of last year, we reported that the FRS 17 valuation of the Group’s UK defined benefit pension scheme showed a

deficit of £1.2bn (£0.9bn after deferred tax) and announced that we would bring forward the next formal actuarial valuation

of the scheme.

In March 2004, we announced the results of this valuation which showed a shortfall of £585m. We have subsequently made a

cash contribution of £400m to the scheme, demonstrating our commitment to ensuring that the scheme is adequately

funded and providing reassurance to scheme members.

At the same time, we announced the adoption of accounting standard FRS 17 – ‘Retirement Benefits’ for this financial year.

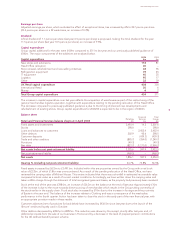

The impact of adopting FRS 17 on the profit and loss account charge for the UK scheme together with what the charge

would have been under the previous policy based on SSAP 24, is as follows:

Year ended Year ended

3 April 2004 29 March 2003

FRS 17 SSAP 24 FRS 17 SSAP 24

£m £m £m £m

Operating cost 117 175 122 136

Other finance (income)/charges 14 – (27) –

Net charge before tax 131 175 95 136

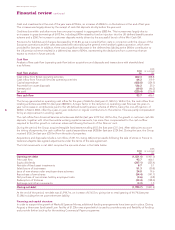

The FRS 17 charge for the year for the Group as a whole was £139.0m compared to a restated £104.8m last year. As a

consequence of adopting FRS 17, a deficit of £470m net of deferred tax (£670m before tax) at 3 April 2004 is reflected on the

Group’s balance sheet.

These changes have been accounted for by way of a prior year adjustment and previously reported figures have been

restated accordingly. The impact of adopting the new policy on the current financial year is to increase profit before tax by

£43.2m. The impact of adopting the policy on the year ended 29 March 2003 was to increase profit before tax by £41.6m.

The cumulative effect of this prior year adjustment on the balance sheet as at 29 March 2003 is an increase in the provision

for retirement benefits of £1,249.3m, offset by a deferred tax asset of £373.8m, a decrease in pension assets of £42.7m and

a reduction in the deferred tax liability of £12.5m, giving rise to a decrease in reserves of £905.7m.

Other accounting changes

The Group has also adopted Application Note G of FRS 5 – ‘Revenue Recognition’ and UITF 38 – ‘Accounting for ESOP Trusts’.

Application Note G of FRS 5 requires a provision to be established for customer returns. A provision has now been made,

representing the Group’s cumulative estimate of the amount of merchandise sold during the year which will be returned and

refunded in the following year. The new Application Note also requires turnover to be stated net of any discounts given.

Accordingly:

•staff discounts, previously reported as part of employee costs, have been reclassified and are now deducted from

turnover; and

•discounts provided to certain customers at Kings Super Markets, previously reported as a deduction from gross margin,

have been reclassified as deductions from turnover.

These changes have been accounted for by way of a prior year adjustment and previously reported figures have been

restated accordingly.

UITF 38 – ‘Accounting for ESOP Trusts’ has also been adopted for the first time this year. As required by this UITF, own

shares held by employee trusts have been reclassified from fixed asset investments to a reduction in shareholders’ funds.

This change has been accounted for as a prior year adjustment and previously reported figures have been restated

accordingly.

The impact of adopting these new policies on the current financial year is to reduce turnover by £49.8m with a negligible

impact on profit before tax. The impact of adopting the policy on the year ended 29 March 2003 was to reduce turnover

by £58.1m and profit before tax by £3.4m. The cumulative effect of these prior year adjustments on the balance sheet as at

29 March 2003 is a decrease in fixed asset investments of £1.8m, an increase in the provision for customer returns of

£32.1m, offset by a deferred tax asset of £9.5m giving rise to a decrease in reserves of £24.4m.