Marks and Spencer 2004 Annual Report Download

Download and view the complete annual report

Please find the complete 2004 Marks and Spencer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual report and financial statements 2004

Table of contents

-

Page 1

Annual report and financial statements 2004 -

Page 2

... Financial review Corporate governance Remuneration report Directors' interests Directors' responsibilities Directors' report Auditors' report Consolidated profit and loss account Note of group historical cost profits and losses Consolidated statement of total recognised gains and losses Balance... -

Page 3

.... These sales ï¬gures should not obscure the hard work throughout the business to ensure better choice and value, more appealing stores and greater efï¬ciencies, all of which will translate into shareholder value over the longer term. You can read how we're doing in corporate social responsibility... -

Page 4

... our Retail Change Programme in stores and cutting costs at our Head Ofï¬ces with the expected loss of 1,000 jobs. I have strengthened my top team, appointing Vittorio Radice to take responsibility for Clothing, store development and Home, Maurice Helfgott to take charge of Food and Mark McKeon to... -

Page 5

... results have been prepared using the same accounting policies as stated in last year's annual report with the exception of those policies that have been amended by the adoption of FRS 17 - 'Retirement Beneï¬ts' and Application Note G of FRS 5 - 'Revenue Recognition' (see page 10). Where relevant... -

Page 6

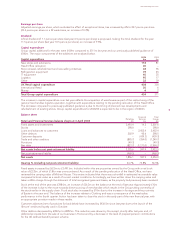

... due to costs incurred in improving business efï¬ciency in Retail Change and the supply chain and IT costs to support the growth initiatives of Simply Food, Home and Loyalty. Including logistics costs, operating expenses have increased by 1.0% on last year. Underlying UK Retail operating expenses... -

Page 7

... charge, once our plans are further developed. International Retail 2004 52 weeks 2003 52 weeks As restated Turnover (£m) - Marks & Spencer branded businesses - Kings Super Markets Operating proï¬t (£m) - Marks & Spencer branded businesses - Kings Super Markets Number of stores (at the end... -

Page 8

... review Financial Services Turnover Operating proï¬t continued 2004 £m 2003 £m 330.0 50.6 329.9 86.4 Scale of current business Number of accounts/policyholders (000s) 2004 2003 Customer advances/funds under management (£m) 2004 2003 Cards Personal Lending Unit Trusts Life Assurance... -

Page 9

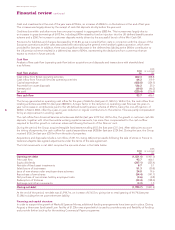

...the timing of planned new developments and refurbishment of existing stores. Group capital expenditure for 2004/05 is expected to be in the region of £400m. Balance sheet Retail and Financial Services balance sheets at 3 April 2004 Fixed assets and investments Stocks Loans and advances to customers... -

Page 10

... Opening net debt Free cash ï¬,ow Equity dividends Net sale of ï¬xed asset investments Sale/closure of businesses Issue of new shares under employee share schemes Repurchase of own shares Net purchase of own shares held by employee trusts Redemption of B shares Exchange and other movements Closing... -

Page 11

... through a 10-year Public Bond Issue under the existing MTN programme at a ï¬xed rate of 5.625%, in order to fund a cash contribution into the UK deï¬ned beneï¬t pension scheme. Debt raised to fund the Financial Services operation is a mix of short to medium term instruments designed to match, on... -

Page 12

... also requires turnover to be stated net of any discounts given. Accordingly: • staff discounts, previously reported as part of employee costs, have been reclassiï¬ed and are now deducted from turnover; and • discounts provided to certain customers at Kings Super Markets, previously reported as... -

Page 13

... footage opened in 2003/04, will account for over 4% of this increase. If performance proves to be in line with business plans agreed by the Board, a bonus provision will be made. Guidance, reporting the impact on operating costs, will be given at the appropriate time. The revenue costs of the Head... -

Page 14

... corporate entities or assets; development and protection of the brand; matters of public interest that could affect the Group's reputation; public announcements including statutory accounts; signiï¬cant changes in accounting policy; capital structure and dividend policy; operating plans and... -

Page 15

... Company's auditors and to review the effectiveness and objectivity of the audit process. Additional items reviewed during the year include: food stock accuracy, store assurance, international accounting standards, assurance procedures for CSR reporting and the updated fraud policy. Private meetings... -

Page 16

...long-term shareholder value whilst exceeding the expectations of our customers, employees and partners. In doing so, the directors recognise that creating value is the reward for taking and accepting risk. The Board has overall responsibility for the Group's approach to assessing risk and systems of... -

Page 17

.... The Board has put in place an organisational structure with formally deï¬ned lines of responsibility and delegation of authority. There are also established procedures for planning, capital expenditure, information and reporting systems, and for monitoring the Group's businesses and their... -

Page 18

... such as the Company's performance, market conditions, the level of increase awarded to employees throughout the business and the wish to reward individual performance. Current annual salaries for executive directors are set out in the Directors' emoluments table (page 20). Under the terms of Luc... -

Page 19

...Decile Median Below Median 1 Ratio of Matching Award to relevant portion of Invested Bonus 2.5:1 Pro rata between 1:1 and 2.5:1 1:1 Zero3 TSR - The return to shareholders comprising the increase or decrease in share price plus the value of dividends received assuming that they are reinvested. 2The... -

Page 20

... in the share schemes open to all employees of the Company, currently the SAYE scheme and the Share Incentive Plan. Details of grants and awards made to executive directors under all schemes are given in part 2 of this report. A Save As You Earn (SAYE) Option Scheme was approved by shareholders in... -

Page 21

... on summary termination. All executive directors have rolling service contracts, which can be terminated by the Company giving 12 months' notice and by the director giving 6 months' notice. Mark McKeon was appointed to the Board on 5 April 2004 with a 12-month rolling contract. His current annual... -

Page 22

... retired from the Board on 31 March 2004. His termination payment includes one year's salary of £340,000 and £414,000 for loss of beneï¬ts which includes bonus, car beneï¬ts and loss of pensionable service. 1 2 Directors' interests in long-term incentive schemes a) Executive Share Matching Plan... -

Page 23

...an independent data services provider). 2 Market price on award date was 339p. After two years of the 2002-05 performance period, Marks & Spencer's TSR is ranked 64th out of 96 in the FTSE 100 Comparator Group and 16th out of 19 in the Retailers Comparator Group. None of the matching shares would be... -

Page 24

... attached to the Executive Share Matching plan and Executive Share Option schemes as described in long-term incentive schemes (section (a) and (b) on pages 17 and 18) have been audited. 3 Directors' pension information a) Pension Beneï¬ts The directors' remuneration report regulations 2002 require... -

Page 25

...Listings Rules, the additional pension earned relates to the increase in the deferred pension during the year gross and net of inï¬,ation respectively. The transfer value of the deferred pension calculated as at 3 April 2004 is based on factors supplied by the actuary of the relevant Company pension... -

Page 26

... between the end of the ï¬nancial year and one month prior to the notice of the Annual General Meeting, except for the agreed monthly salary of 13,500 shares for Luc Vandevelde on 8 April 2004 and 10 May 2004. The Register of Directors' Interests (which is open to shareholders' inspection) contains... -

Page 27

... activities under the Marks & Spencer and Kings Super Markets brand names. Financial Services consists of the operations of the Group's retail ï¬nancial services companies, which provide credit and account cards, personal loans, unit trust management, life assurance, personal insurance and pensions... -

Page 28

... the terms of payment; and • pay in accordance with its contractual and other legal obligations. The main trading company's (Marks and Spencer plc) policy concerning the payment of its trade creditors is as follows: • general merchandise is automatically paid for 11 working days from the end of... -

Page 29

...' responsibilities, the directors' report, the group ï¬nancial record and the Annual Review. We review whether the corporate governance statement reï¬,ects the Company's compliance with the seven provisions of the Combined Code (issued in June 1998) speciï¬ed for our review by the Listing Rules of... -

Page 30

....2 CONSOLIDATED STATEMENT OF TOTAL RECOGNISED GAINS AND LOSSES Notes 53 weeks ended 3 April 2004 £m 52 weeks ended 29 March 2003 As restated £m Proï¬t attributable to shareholders Exchange differences on foreign currency translation Unrealised surplus/(deï¬cit) on revaluation of investment... -

Page 31

... Called up share capital Share premium account Capital redemption reserve Revaluation reserve Other reserve Proï¬t and loss account Shareholders' funds (including non-equity interests) Equity shareholders' funds Non-equity shareholders' funds Total shareholders' funds Approved by the Board 24 May... -

Page 32

... Non-equity dividends paid Net cash outï¬,ow from returns on investments and servicing of ï¬nance Taxation UK corporation tax paid Overseas tax paid Cash outï¬,ow for taxation Capital expenditure and ï¬nancial investment Purchase of tangible ï¬xed assets Sale of tangible ï¬xed assets Purchase of... -

Page 33

... less an appropriate deduction for actual and expected returns, discounts and loyalty scheme voucher costs, and is stated net of Value Added Tax and other sales taxes. Financial Services turnover comprises interest receivable from customers together with other income attributable to the Financial... -

Page 34

... the value are included in the proï¬t and loss account grossed up at the standard rate of corporation tax applicable to insurance companies. Derivative ï¬nancial instruments The Group uses derivative ï¬nancial instruments to manage its exposures to ï¬,uctuations in foreign currency exchange rates... -

Page 35

... which will be returned and refunded in the following year; • staff discounts, previously reported as part of employee costs, have been reclassiï¬ed and are now deducted from turnover; and • discounts provided to certain customers at Kings Super Markets, previously reported as a deduction from... -

Page 36

... set out in the formats of the Companies Act 1985. 1 Included in 'Other costs' is the auditors' remuneration for audit and non-audit services as follows: 2004 £m Group 2003 £m 2004 £m Company 2003 £m Statutory audit services Annual audit Non-audit related services Further assurance services... -

Page 37

... in turnover of Financial Services Interest expenditure Less: interest charged to cost of sales of Financial Services Net interest expense Interest expenditure comprises: Amounts repayable within ï¬ve years: Bank loans, overdrafts and other borrowings Medium term notes Securitised loan notes... -

Page 38

... share are set out below: 2004 Basic pence per share Diluted pence per share As restated Basic pence per share 2003 As restated Diluted pence per share 36 £m As restated £m Basic earnings Exceptional operating charges Proï¬t on sale of property and other ï¬xed assets Loss on sale/termination... -

Page 39

... award of approximately £220) was made. These shares are purchased in the market: 2,556,366 ordinary shares were purchased by the Proï¬t Sharing Trustees in respect of the 2002/03 allocation. D United Kingdom Employees' Save As You Earn Share Option Scheme Under the terms of the Scheme, the Board... -

Page 40

...nancial statements continued 10. EMPLOYEES continued E Executive Share Option Schemes Under the terms of the current Scheme, approved by shareholders in 2002, the Board may offer options to purchase ordinary shares in the Company to executive directors and senior employees at the market price on... -

Page 41

... The balance of the annual bonus may be invested voluntarily. The pre-tax value of the invested bonus will be matched by an award of shares, with the extent of the match determined by performance conditions over a three-year period. Further details of the plan are given in the Remuneration Report on... -

Page 42

... gain/(loss) Exchange movement Post-retirement liability at end of year 1 (1,278.2) (123.8) 533.7 (15.2) 213.8 0.2 (669.5) (420.8) (131.8) 140.8 27.0 (893.4) - (1,278.2) The UK deï¬ned beneï¬t pension scheme is closed to new members and so under the projected unit method the service cost rate... -

Page 43

... emoluments Termination payments 3,769 754 6,838 451 B Transactions with directors During the year, transactions entered into by Marks and Spencer Financial Services plc with directors and connected persons resulted in the following outstanding balances on their combined credit and loyalty cards... -

Page 44

... £2.7m). Investments include listed securities held by a subsidiary. The difference between their book value and market value is negligible. 3 UITF 38 - 'Accounting for ESOP Trusts' has been adopted for the ï¬rst time in these ï¬nancial statements. As a result, shares in Marks and Spencer Group... -

Page 45

... Services Holdings Limited Marks and Spencer Financial Services plc Marks and Spencer Unit Trust Management Limited Marks and Spencer Savings and Investments Limited Marks and Spencer Life Assurance Limited M.S. Insurance L.P. M.S. II Insurance L.P. Marks and Spencer Investments Limited St Michael... -

Page 46

...£m 44 Listed investments: Government securities Listed in the United Kingdom Listed overseas Unlisted investments 86.9 191.8 42.6 4.6 325.9 131.4 108.5 59.5 4.6 304.0 Listed investments include £175.5m (last year £160.9m) in relation to the long-term assurance business. 17. CASH AT BANK AND... -

Page 47

... for which rate is ï¬xed Years Group 2003 Weighted average period for which rate is ï¬xed Years Currency Sterling US dollar Euro Other C Analysis of ï¬nancial assets 5.6 - - - 5.6 3.8 4.8 2.6 2.5 - - - 10.1 9.5 8.9 6.6 45 2004 £m Group 2003 £m Current asset investments Cash at bank and... -

Page 48

... As restated £m Company 2004 £m 2003 £m Bank loans, overdrafts and commercial paper1 Medium term notes (see note 21B) Securitised loan notes (see note 21B) Trade creditors Amounts owed to Group undertakings Taxation Social security and other taxes Other creditors2 Customer deposits Accruals and... -

Page 49

...nance costs. It relates to a ï¬xed rate bond at a rate of 6.282% and is repayable in full on 12 December 2026. C Borrowing facilities At 3 April 2004, the Group had undrawn committed facilities of £405m (last year £385m) linked to its commercial paper programme and subject to annual review. The... -

Page 50

...investments and cash at bank are predominantly short-term deposits placed with banks, ï¬nancial institutions and on money markets, and investments in short-term securities. Therefore, these fair values closely approximate book values. Interest rate, cross currency swaps and forward foreign currency... -

Page 51

... were redeemed at par at a total cost of £33.4m. The nominal value of £33.3m has been transferred to the capital redemption reserve (see note 25). The holders of B shares are not entitled to receive notiï¬cation of any general meeting of Marks and Spencer Group plc, or to attend, speak or vote... -

Page 52

... account £m Total £m At 30 March 2003 as previously reported Prior year adjustment (see below) Opening shareholders' funds as restated Purchase of own shares Redemption of B shares Purchase of own shares held by employee trusts Shares issued on exercise of share options Revaluation of investment... -

Page 53

...of shares held by employee trusts New share capital subscribed Amounts deducted from proï¬t and loss account reserve in respect of shares issued to the QUEST Redemption of B shares Purchase of own shares Net increase/(decrease) in shareholders' funds Opening shareholders' funds as previously stated... -

Page 54

...UK restructuring costs paid Head ofï¬ce relocation Restructuring of general merchandise logistics operations Exceptional operating cash outï¬,ow B Management of liquid resources Increase in cash deposits treated as liquid resources Net sale/(purchase) of government securities Net purchase of listed... -

Page 55

... 31. FOREIGN EXCHANGE RATES The principal foreign exchange rates used in the ï¬nancial statements are as follows (local currency equivalent of £1): Weighted average sales rate 2004 2003 Weighted average proï¬t rate 2004 2003 Balance sheet rate 2004 2003 53 Euro US dollar Hong Kong dollar 1.44... -

Page 56

... £m Proï¬t and loss account Turnover: Continuing operations Retailing Financial Services Total continuing operations Discontinued operations Total turnover (excluding sales taxes) Operating proï¬t Continuing operations United Kingdom Overseas Excess interest charged to cost of sales of Financial... -

Page 57

... Returns on investments and servicing of ï¬nance Taxation Capital expenditure and ï¬nancial investment Acquisitions and disposals Equity dividends paid Cash (outï¬,ow)/inï¬,ow before management of liquid resources and ï¬nancing Management of liquid resources Financing Increase/(decrease) in cash... -

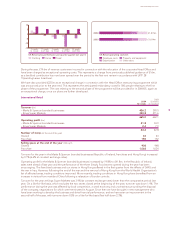

Page 58

...n/a Retail ï¬xed charge cover 7.3x 6.9x 12.6x 10.2x 10.8x Capital expenditure 1 2 £433.5m £311.0m £290.5m £255.7m £450.6m Based on results from continuing operations only. Stated before goodwill written off of £368.2m in 2002, dividend cover and return on equity are 0.6 times and... -

Page 59

... cover Dividend per share E Earnings per share Employee emoluments Employee numbers ESOP trusts Equity shareholders' funds F Financial assets Financial instruments Financial liabilities Financial record Financial review Financial Services Fixed assets Fixed charge cover Foreign exchange Free cash... -

Page 60

Corporate social responsibility report 2004 (only available on-line at www.marksandspencer.com) Annual review and summary financial statement 2004 www.marksandspencer.com/thecompany THE QUEEN'S AWARD FOR ENTERPRISE INNOVATION 2000 THE QUEEN'S AWARD FOR ENTERPRISE INNOVATION 2003 Additional ...