Marks and Spencer 2000 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2000 Marks and Spencer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

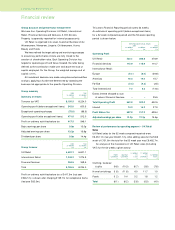

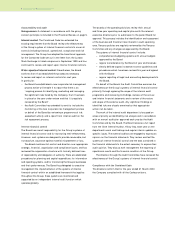

Cash flow

The analysis of the increase in net debt shows the operating cash

flows within Retailing and Financial Services activities. The cash

outflow from Financial Services operating activities includes a

£206.2m increase in loans and advances to customers.

Of the resulting net debt of £1,251m, £1,616m relates to

Financial Services. (See Balance Sheet commentary below.)

Cash flow analysis £m

Net debt at 31 M arch 1999 (1,182)

Cash inflow from Retail operating activities 728

Cash outflow from Financial Services

operating activities (87)

Capital expenditure (net of disposals) (167)

Dividends (413)

Tax (146)

Other 16

Increase in net debt (69)

Net debt at 31 M arch 2000 (1,251)

New footage

During the year, total worldwide footage (excluding Canadian

closures) increased by 300,000 sq ft as shown below:

sq ft

UK 300,000

Europe (130,000)

North America 130,000

300,000

Stores totalling 300,000 sq ft were closed in Canada, leaving

net worldwide footage unchanged at 15.4m sq ft.

New store openings account for 66% of additional UK

footage mainly because of the new Braehead store in Glasgow

(91,000 sq ft) and the relocation of our Manchester store

(198,400 sq ft replacing the 98,800 sq ft temporary site).

Seven European stores were closed during the year –

Dortmund, Essen, Wuppertal and Frankfurt (Nord West Zentrum)

in Germany and Grand Littoral (Marseille), Rouen and Parinor

in France. Two new stores were opened (Plaza Catalunya in

Barcelona and the Zeil in Frankfurt). The overall effect was

to reduce European footage by 130,000 sq ft.

Brooks Brothers US opened 19 new stores, and closed

four stores, resulting in net additional footage of 83,000 sq ft.

Openings include a new flagship store at Fifth Avenue in

New York (22,400 sq ft).

Capital expenditure

Capital expenditure (gross) during the year totalled £451m.

Capital expenditure is expected to fall in the financial year

2000/01. We plan to open a further 230,000 sq ft of selling

space, 64% of which will be in the UK.

Financing

During the financial year the Medium Term Note (‘MTN’)

programme was increased to £2.0bn and this has been used as a

flexible and cost effective source of funds. 23 MTNs were issued

during the year in various currencies with a sterling equivalent of

£768m. Maturities ranged from 6 months to 7 years and were

swapped into operating currencies. The Group’s total

outstandings within this programme at the end of the financial

year were equivalent to £1,387m.

Other sources of finance were US$ Commercial Paper and

bank borrowings both in the London money market and by

individual international subsidiaries. A committed facility of

$50m and uncommitted credit facilities of £655m are in place

in the UK.

Details of the maturity profile of borrowings are given in

note 21B, page 37.

During the year, both the leading credit agencies reduced

the Group’s long-term credit ratings: Standard & Poor’s to AA

and Moody’s to Aa3.

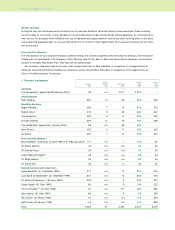

Balance sheet

The Group balance sheet consolidates Retailing and Financial

Services businesses which have very different characteristics.

The salient figures are disaggregated below:

Retail & Financial Services balance sheets 1 April 2000

FINANCIAL TOTAL

RETAILING SERVICES GROUP

2000 2000 2000

£m £m £m

Fixed assets 4,282.0 16.4 4,298.4

Stocks 474.4 – 474.4

Loans & advances to customers – 2,141.4 2,141.4

Other debtors 334.9 78.9 413.8

Net cash/(debt) 364.5 (1,615.9) (1,251.4)

Trade & other creditors (982.7) (172.1) (1,154.8)

Net assets 4,473.1(1) 448.7 4,921.8

(1) Retailing includes £21.4m of liabilities classified as

unallocated in the segmental analysis (see note 2, page 25).

Loans and advances to customers have increased to £2.1bn (last

year £1.9bn). Within this, £1.5bn relates to personal lending

with the balance representing storecard debt.

4Marks and Spencer p.l.c.

Financial review