Marks and Spencer 2000 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2000 Marks and Spencer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4 Directors’ pension information (continued)

(2) The pension entitlement shown above is that which would be paid on retirement based on service to 31 March 2000 or date of

retirement if earlier.

(3) Luc Vandevelde does not participate in the Company Pension Scheme (see section 1, footnote 4 – Directors’ emoluments).

(4) Alan McWalter joined the scheme on 1 January 2000, and is therefore subject to the statutory pension earnings ‘cap’ (£90,600 at

31 March 2000) which is reviewed by the Government annually. His pension is based on a uniform accrual of two-thirds of that

‘cap’ less the pension which he has accrued from membership of previous employers’ pension schemes (see section 1, footnote 4

– Directors’ emoluments).

(5) Sir Richard Greenbury accrued no further benefit in the scheme since taking a lump sum in July 1997. This year’s accrued

entitlement has increased over last year due to two factors (i) the pension, having been deferred has, in line with normal practice,

been increased by a late retirement factor, (ii) a notional increase has been applied in line with the pension increase for all

current pensions.

(6) Chris Littmoden was, until immediately prior to his retirement on 31 May 1999, employed in North America, during which time

his pension had ceased to accrue. His accrued entitlement at the time of his transfer to North America was £64,000. On the

cessation of his overseas assignment, his accrued pension entitlement was restored fully, at a value of £140,000. This represents

an increase in pension earned of £76,000 with a transfer value of £1,821,000.

(7) The greater part of the actuarial increase in respect of these directors relates to the effect, on the year, of their full pension being

paid immediately, following their retirement.

(8) The accrued entitlement for James Benfield and Derek Hayes has fallen during the year. This reflects the fact that the reduction

factor due to their early retirement more than offsets any increase in pension for service completed during the year.

(9) The pension entitlement shown excludes any additional pension purchased by the member’s Additional Voluntary Contributions.

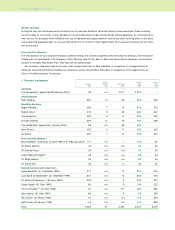

5 Payments to former directors

Details of payments made under the Early Retirement Plan and other payments made to former directors during the year are:

DATE OF PAID IN

RETIREMENT PAYABLE UNTIL PAID IN YEAR 1999

£000 £000

Early retirement pensions

(1)

James Benfield(2) 31 December 1999 22 April 2009 17 –

Lord Stone of Blackheath(2) 31 December 1999 7 September 2002 23 –

Derek Hayes(3) 31 May 1999 19 November 2008 52 –

Chris Littmoden(3) 31 May 1999 28 September 2003 70 –

John Sacher(4) 31 May 1999 n/a 56 –

Paul Smith 31 March 1999 20 December 2000 65 –

Keith Oates(5) 31 January 1999 3 July 2002 197 –

Don Trangmar 31 March 1998 16 November 1999 38 56

Unfunded pensions

Lord Sieff of Brimpton(6) 30 September 1985 Death 65 63

Clinton Silver(6) 31 July 1994 Death 84 82

Other payments

Lord Sieff of Brimpton(7) 30 September 1985 31 October 1999 53 73

Clinton Silver(8) 31 July 1994 30 September 1999 35 70

(1) Under the Company’s Early Retirement Plan the Remuneration Committee may, at its discretion, offer an unfunded Early Retirement

Pension, separate from the Company pension, which will be payable from the date of retirement to age 60. To ensure that early

retirement does not confer an advantage over continued employment the value of the Early Retirement Pension may not exceed the

value of the individual’s total net Company pension from actual date of retirement to age 60. Each Early Retirement Pension must

be approved individually by the Remuneration Committee. The Early Retirement Pension is fully taxable; it is normally fully

commutable at the election of the recipient. With effect from 31 March 2000, the Early Retirement Plan has been withdrawn.

(2) James Benfield and Lord Stone were awarded £68,000 and £91,000 respectively pa.

(3) Derek Hayes and Chris Littmoden were awarded £62,000 and £84,000 respectively pa.

(4) John Sacher was awarded £53,000 pa and chose to commute this award for a lump sum of £56,000.

(5) Keith Oates was awarded £166,000 pa. The payment above is for the 14 months since his date of retirement.

(6) The pension scheme entitlement for Lord Sieff and Clinton Silver is supplemented by an additional, unfunded, pension paid

by the Company.

(7) Due to the continuing ill health of Lord Sieff the Company has met some costs relating to his necessary daily care assistant.

(8) Payments made to Clinton Silver in respect of consultancy services provided to the Company.

12 Marks and Spencer p.l.c.

Remuneration report