Marks and Spencer 2000 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2000 Marks and Spencer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6 Long-term benefits

The Company operates two types of share option scheme:

(i) a Save As You Earn (SAYE) Option Scheme approved by shareholders in 1981 and renewed by shareholders in 1987 and 1997.

The Scheme is open to all employees, including executive directors, who have completed one year’s service and who open an

approved savings contract. Inland Revenue rules limit the maximum amount which can be saved to £250 per month. When the

savings contract is started options are granted to acquire the number of shares that the total savings will buy when the savings

contract matures; options cannot normally be exercised until a minimum of three years has elapsed.

(ii) an Executive Share Option Scheme, approved by shareholders in 1997, which is open to all senior management. The Company

has operated this type of scheme for over 20 years, following shareholder approval for earlier schemes in 1977, 1984 and 1987.

The 1997 Scheme is a two-tier scheme, comprising first tier options of up to four times annual earnings, and second tier options up to

four times annual earnings, with an overall scheme limit of eight times annual earnings. The Remuneration Committee has imposed

performance criteria for the exercise of all options granted since 1996. The performance criteria for the 1997 Scheme are:

• First tier options will be exercisable between three and 10 years from grant, and will be exercisable if the growth in the Company’s

normalised earnings per share, over the three-year period, has exceeded growth in the Retail Price Index over that period, by an

average of at least 3% per annum.

• Second tier options will be exercisable between five and 10 years from grant, if the Company’s normalised earnings per share

growth, over any five year period, would place it in the upper quartile of the FTSE 100 companies.

All grants in the past 10 years will count towards the overall limit of eight times earnings.

Participants who hold options granted under the 1984 and 1987 Schemes will continue to be bound by their Maximum Option

Value (MOV) of four times earnings, and may only exercise options up to this value. This means that many participants hold more

options than they will be able to exercise. At the discretion of the Committee, MOV can be increased in line with earnings. As soon

as options have been exercised up to a value of four times earnings, all outstanding options automatically lapse.

Following the 1996 Finance Act, new grants of Inland Revenue Approved Options have been limited to £30,000. Grants in excess

of this limit, under the 1997 Scheme, will be Unapproved Options which confer no tax advantage on the participants.

At the discretion of the Remuneration Committee, retiring directors can take their options for all schemes into retirement.

Options held under the 1984 and 1987 Schemes continue to be bound by their MOV and can be exercised subject to the option

period. For options held under the 1997 Scheme the performance criteria and time restrictions are waived but they will lapse if not

exercised within 12 months of retirement.

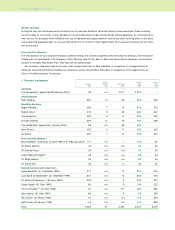

Directors’ long-term benefits

The options detailed in the table below may not be exercisable for any one of the following reasons:

(i) their value is in excess of the MOV

(ii) the options have not been held for three years and therefore cannot be exercised under scheme rules

(iii) the options have not met the appropriate performance criteria.

The market price of the shares at the end of the financial year was 250.5p; the highest and lowest share prices during the financial

year were 461p and 222.75p respectively.

AT 1 APRIL AT 31 MARCH

1999 GRANTED EXERCISED/ 2000 OPTION EXERCISE

OR DATE OF DURING LAPSED DURING OR DATE OF PRICE PRICE

APPOINTMENT THE YEAR THE YEAR RETIREMENT (PENCE) (PENCE) OPTION PERIOD

Luc Vandevelde(2)

Not exercisable – 3,984,674 – 3,984,674 261.0 – Mar 03 – Mar 10

Peter Salsbury

Exercisable 204,824 – – 351,895 359.0(1) – May 94 – May 05

Not exercisable 435,134 – – 727,539 421.0(1) – May 98 – Jun 09

Granted – 439,476 – –358.0 – Jun 02 – Jun 09

SAYE 5,550 – – 5,550 351.0(1) – Jan 03 – Jun 04

(1) Weighted average price.

(2) Grant based on anticipated total earnings up to 31 March 2001 (including 100% bonus).

13 Annual Report and Financial Statements 2000