Marks and Spencer 2000 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2000 Marks and Spencer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

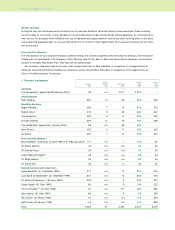

1 Directors’ emoluments (continued)

(1) Luc Vandevelde was appointed to the Board as Executive Chairman on 28 February 2000. Included within his benefits is

compensation for loss of future benefits from his previous employer in the form of restricted shares at a cost of £1,997,000

(see section 2, below). As a result of this award, Luc Vandevelde is the highest paid director with total emoluments of £2,070,000.

Last year, the highest paid director was Sir Richard Greenbury, whose emoluments were £810,000 with an accrued pension

entitlement at the end of last year of £465,000.

(2) Alan McWalter was appointed to the Board on 1 January 2000. Included within his benefits is compensation of £75,000 for

loss of future benefits from his previous employer.

(3) In line with all other employees, executive directors performing their duties mainly in the UK are allocated a profit share based

on a percentage of their salary following the qualifying period. Further information on profit sharing is given in note 10C to the

financial statements.

(4) Benefits for UK directors relate mainly to the provision of cars, fuel and travel. In addition, a payment is made to both

Luc Vandevelde and Alan McWalter in respect of pension (see section 2 below). For expatriate directors see footnote (5).

(5) Expatriate directors carrying out their duties overseas have their remuneration adjusted to take account of local living costs.

This adjustment is to put them in a position, after taking into account taxation differentials, where they are no better or worse

off as a result of carrying out their duties overseas. Payments made to them, or on their behalf, such as allowances for working

overseas and the provision of accommodation are treated as benefits for the purpose of the above table and are non-pensionable.

(6) Included in the salary figures for Lord Stone of Blackheath, James Benfield, Derek Hayes, Chris Littmoden, John Sacher and

Sir Richard Greenbury are contractual non-pensionable payments in lieu of holiday entitlement.

(7) Sir Richard Greenbury retired as Chairman on 22 June 1999. His salary includes a 3 month payment in lieu of notice in

accordance with his contract as Chairman.

(8) Dame Stella Rimington was appointed Chairman of the Remuneration Committee on 1 July 1999 and received an associated

increase of £16,000 pa.

(9) Brian Baldock was appointed non-executive Chairman on 23 June 1999 on a salary of £220,000 pa.

2 Recruitment of directors

During the year, two new directors have been recruited and appointed to the Board on the following terms:

(i) Luc Vandevelde

– Salary of £650,000 pa.

– Compensation for loss of future benefits from previous employer in the form of 808,080 ‘restricted shares’ purchased on his

behalf at a cost of £1,997,000. He is the beneficial owner of the shares but they will not be transferred to him until the third

anniversary of employment irrespective of him being employed at that time or the second anniversary where employment is

not renewed by the Company at the end of his initial two year contract (included within benefits in section 1).

– Supplement of 16% of base salary to compensate for the fact that he is not a member of the Company Pension Scheme

(included within benefits in section 1).

– Award of shares under 1997 Executive Share Option Scheme with a market value at the date of employment of eight times

salary including bonus (see section 6 – Long-term benefits).

(ii) Alan McWalter

– Salary of £275,000 pa.

– A payment of £75,000 as compensation for loss of future benefits from previous employer (included within benefits in section 1).

– Supplement of 10% of the difference between the pension earnings cap and his basic salary (see section 4 – Pensions)

(included within benefits in section 1).

– Award of shares under 1997 Executive Share Option Scheme with a market value at the date of employment of eight times

salary (see section 6 – Long-term benefits).

3 Gains made on directors’ share options

No Executive Share Options were exercised during the year. Two directors exercised SAYE contracts but gains were negligible

(see section 6, page 14). Last year the total gain of £116,000 made by directors on the exercise of their share options included:

Peter Salsbury £4,000, Roger Aldridge £7,000, Clara Freeman £14,000, Guy McCracken £7,000, James Benfield £7,000, Lord Stone

of Blackheath £11,000, Derek Hayes £10,000 and Paul Smith £56,000.

10 Marks and Spencer p.l.c.

Remuneration report