Marks and Spencer 2000 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2000 Marks and Spencer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

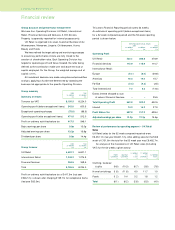

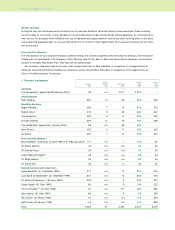

Financial Services

This Operating Division includes five profit centres:

Store Cards

Personal Lending

Unit Trusts

Life Assurance

MS Insurance (Guernsey)

The overall results are given in the segmental analysis (see note

2, page 25).

The first four of the five profit centres are managed as a

single operation (the results for the Life Assurance company

being aggregated on an Embedded Value basis). MS Insurance

derives the majority of its underwriting business from the other

Financial Services activities.

The scale of current business levels is indicated below:

ACCOUNT PERSONAL UNIT LIFE

CARDS LENDING TRUSTS ASSURANCE

Number of accounts/

policy holders (000s)

2000 5,101 567 186 58

1999 5,166 548 171 30

Customer outstandings/funds

under management (£m)

2000 646 1,495 1,166 n/a

1999 652 1,283 1,101 n/a

The credit activities are carried out within Marks and Spencer

Financial Services Limited, a bank regulated by the FSA. The

Unit Trust, Life Assurance and Corporate PEP/ISA businesses are

carried out by companies regulated by IMRO, PIA and the FSA.

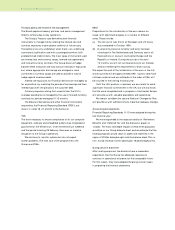

Exceptional items (£139.7m)

(a) UK Restructuring (£63.3m) – of this total, £16.0m of

redundancy costs were reported at the half year in respect

of the rationalisation of UK store management and the

closure of a distribution centre. The additional £47.3m

includes:

– Head Office costs of £18.5m mainly resulting from the

restructuring of UK Retail into seven Customer Business

Units

– £28.8m which reflects reductions in store management

supervision numbers.

(b) European Restructuring (£17.0m) – the loss on sale of

property of £8.3m relates to the European store closures

announced during the period. After including the redundancy

and related costs of £8.7m the total was £17.0m.

(c) Canada (£45.4m) – the closure of our Canadian business

was completed at a cost of £21m compared to an estimate

of £25m. Goodwill previously written off to reserves of

£24.4m increased the exceptional charge.

(d) The net loss on other property disposals was £14.0m

(excluding European store closures referred to in (b) above),

of which a £17.2m loss relates to the disposal of The Gyle

Shopping Centre (see note 4C, page 27). As an investment

property, the Gyle had been revalued annually since its

acquisition in January 1997 and the cumulative revaluation

had been recognised through the Statement of Total

Recognised Gains and Losses in previous years. As a

consequence, the Group has realised a profit of £53.4m

based on net sale proceeds less the original purchase price

which has not been reflected in the profit and loss account.

Interest

Net interest income fell to £14.2m from £27.9m last year.

This was caused by lower average sterling cash balances

(including interest-bearing investments) of £422m (last year

£820m), offset by an increase in sterling interest rates.

Interest payments on intra group and external borrowings

for the Financial Services business are charged to that business

as cost of sales. The operating profit for Financial Services is

shown in the segmental analysis (see note 2, page 25). The total

interest cost incurred by Financial Services was £105.5m (last

year £102.3m).

Taxation

The Group tax charge for the year is £158.2m, giving an

effective rate of 38% after exceptional charges. This is an

increase on the previous year’s rate of 32%. The increase

results from certain exceptional charges and unrelieved

losses arising overseas.

Earnings per share

An adjusted earnings per share figure of 13.2p (last year 15.6p)

has been calculated to give a clearer understanding of the

trading performance of the Group. It excludes the effect of the

exceptional items noted above. Details of the calculation are

given in note 9, page 29.

Dividend

The reduction of the dividend payout to 9.0p was a difficult

decision for the Company, but our confidence in the future is

reflected by the fact that shareholders will receive a payment

equivalent to the full net profits for the year just ended. This will

re-base the dividend to a level from which appropriate earnings

cover can be re-established more quickly, improving our ability

to invest in the Group’s future growth.

3Annual Report and Financial Statements 2000