Marks and Spencer 2000 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2000 Marks and Spencer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Principal activities

The principal activities of the Group are Retailing and

Financial Services.

Retailing consists of the Group’s retail activities under the

Marks & Spencer, Brooks Brothers and Kings Super Markets

brand names and includes the activity of M&S Direct.

Financial Services consists of the operations of the Group’s

Retail Financial Services companies, which provide account

cards, personal loans, unit trust management, life assurance

and pensions. The Group’s Captive insurance company is also

included in this segment as a significant part of its business is

generated from the provision of related insurance services.

Review of activities and future performance

A review of the Group’s activities and of the future development

of the Group is contained in the Chairman’s Statement and the

Chief Executive’s Review within the Annual Review and

Summary Financial Statement.

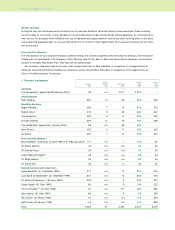

Profit and dividends

The profit for the financial year, after taxation and minority

interests, amounts to £258.7m. The directors have declared

dividends as follows: £m

Ordinary shares

Interim paid, 3.7p per share (last year 3.7p) 106.3

Proposed final, 5.3p per share (last year 10.7p) 152.3

Total ordinary dividends, 9.0p per share (last year 14.4p) 258.6

The final dividend will be paid on 28 July 2000 to shareholders

whose names are on the Register of Members at the close of

business on 5 June 2000.

Share capital

(i) Issue of new shares

During the year ended 31 March 2000, 3,964,345 ordinary

shares in the Company were issued as follows:

A264,240 under the terms of the 1984 Executive Share Option

Scheme at prices between 175p and 254p each.

B28,331 under the terms of the 1987 Executive Share Option

Scheme at prices between 329p and 341p.

C3,671,774 issued into the Qualifying Employee Share

Ownership Trust of which 3,203,511 were issued under the

terms of the United Kingdom Employees’ Save As You Earn

Share Option Scheme at prices between 229p and 467p.

(ii) Purchase of own shares

The directors are authorised by the shareholders to purchase, in

the market, the Company’s own shares, as permitted under the

Company’s Articles of Association. Although no such purchases

have been made, the directors will seek to renew the authority

from its shareholders at the AGM.

M ajor shareholders

As at 14 May 2000, the Company’s share register of substantial

shareholdings showed the following interests in 3% or more of

the Company’s shares:

ORDINARY % SHARE

SHARES CAPITAL

Brandes Investment Partners, L.P. 214,237,570 7.45%

Franklin Resources, Inc. 169,299,710 5.89%

In addition, JP Morgan have notified us that they are holding

122,828,784 ordinary shares (4.27%) as American Depositary

Receipts, 111,358,482 of which are included in above figures

for Brandes Investment Partners and Franklin Resources.

Directors and their interests

The current directors are listed on page 25 of the Annual Review

and Summary Financial Statement.

Derek Hayes, Chris Littmoden and John Sacher retired as

executive directors on 31 May 1999.

Sir Richard Greenbury retired as Chairman on 22 June 1999.

James Benfield and Lord Stone of Blackheath retired as

executive directors on 31 December 1999.

Alan McWalter and Luc Vandevelde were appointed to the

Board on 1 January 2000 and 28 February 2000 respectively.

The beneficial interests of the directors and their families in

the shares of the Company and its subsidiaries, together with

their interests as trustees of both charitable and other trusts,

are given on page 16.

Employee involvement

We have maintained our commitment to employee involvement

throughout the business.

Employees are kept well informed of the performance and

objectives of the Group through personal briefings, regular

meetings and e-mail. These are supplemented by our employee

publication, On Your Marks, and video presentations. ‘Focus

teams’ in stores, distribution centres and head office provide

opportunities for employee representatives to contribute to the

everyday running of the business.

The fifth meeting of the European Council took place

last July. This council provides an additional forum for

communicating with employee representatives from the

countries in which we trade in the European Community.

Directors and senior management regularly visit stores and

discuss, with employees, matters of current interest and concern

to the business.

We have long-established Employees’ Profit Sharing and

Savings-Related Share Option Schemes, membership of which

is service-related, details of which are given on page 30.

18 Marks and Spencer p.l.c.

Directors’ report