Marks and Spencer 2000 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2000 Marks and Spencer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

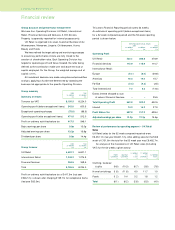

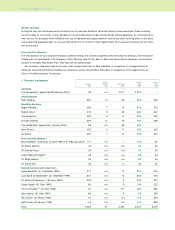

Estimated like for like sales for the same reporting periods are

below: 15 WEEKS 11 WEEKS

FIRST SECOND TO TO 52 WEEKS

QUARTER QUARTER 8 JAN 25 MARCH TOTAL

%%%%%

General (14.6) (15.1) (9.2) (6.0) (11.1)

Foods (4.2) (2.5) 0.8 (0.1) (1.3)

Total (10.3) (9.9) (5.6) (3.3) (7.2)

We have changed our method of calculating like for like sales

and now report the comparison of total sales with new and

developed stores excluded. We have adopted this revised

method for calculating like for like sales because it is more

commonly used and therefore familiar. The previous method,

which added back sales from deflected stores, is shown below

for comparison:

15 WEEKS 11 WEEKS

FIRST SECOND TO TO 52 WEEKS

QUARTER QUARTER 8 JAN 25 MARCH TOTAL

%%%%%

General (12.5) (11.3) (8.8) (4.8) (9.1)

Foods (3.1) (0.2) 1.2 0.6 (1.0)

Total (9.3) (7.0) (5.3) (2.5) (5.9)

At the end of March 2000 we had 296 stores with a selling space

of 12.27m sq ft compared with 11.96m sq ft the previous year, a

weighted average increase of 6.1%.

The UK shape of the chain, based on closing footage, is

shown below:

Cost of sales

On a 52 week comparative basis, the gross margin percentage

improved over last year’s level. However, the shortfall in sales

led to an overall fall in gross profit.

Operating expenses

Operating expenses increased by 3% (on a 52 week comparative

basis). The main cost movements were:

– £39m additional marketing costs, of which £13m is specifically

attributable to increased advertising and £14m to the visual

merchandising in stores.

– £13m additional consultancy fees principally arising from

the supply chain review and the restructuring of the UK Retail

business.

– £23m savings in estates and premises costs due to the

reduction in the development programme.

International Retail

(All sales and profit comparatives are given on a 52 week basis

at constant exchange rates.)

International Retail increased sales by 5.9%, and made an

operating profit before exceptional items of £0.3m (last year,

loss of £9.9m). The effect of the 53rd week was to increase

full year profits to £7.0m.

In Europe, the second half performance was considerably

better than the comparable period last year, helped by the

closure of seven under-performing stores (three in France and

four in Germany) and by the improved performance of our

franchises, particularly in Greece and Turkey. There was a small

improvement in the bought in margin, partly due to better buying

practices. We opened new stores in Barcelona and Frankfurt,

however overall footage reduced by 130,000 sq ft.

Sales in the Far East improved by 7% helped by an

improving economy and by significantly increased local

production. Costs have been well controlled and we have

reduced operating losses from £14m to £4m.

Although sales in Brooks increased by 8%, higher mark-

downs and additional costs arising from USexpansion impacted

on trading profits. Following a first half where operating losses

were £5m compared to profits of £1m in the previous year,

second half operating profits of £11m were in line with last year.

Kings Super Markets performed well, and we increased

sales by 7% and operating profit by 5%. Three new stores

were opened in the second half-year.

2Marks and Spencer p.l.c.

Financial review

Departmental

Stores 39% Regional

Centres 27%

High Street

Stores 19%

Small Stores

15%