Marks and Spencer 2000 Annual Report Download

Download and view the complete annual report

Please find the complete 2000 Marks and Spencer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

m

Annual report and financial statements 2000

MARKSAND SPENCER l ANNUAL REPORT AND FINANCIAL STATEMENTS2000

Table of contents

-

Page 1

m Annual report and financial statements 2000 -

Page 2

...report Directors' interests Directors' responsibilities Auditors' report Directors' report Consolidated profit and loss account Note of historical cost profits and losses Consolidated statement of total recognised gains and losses Balance sheets Consolidated cash flow information Accounting policies... -

Page 3

... Services and Ventures. A fifth division, Property, is separately reported for internal purposes only. UK Retail is organised into seven Customer Business Units: Womenswear, Menswear, Lingerie, Childrenswear, Home, Beauty and Foods. We have refined the target setting and monitoring processes... -

Page 4

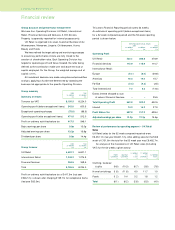

... weighted average increase of 6.1%. The UK shape of the chain, based on closing footage, is shown below: Departmental Stores 39% Regional Centres 27% High Street Stores 19% Small Stores 15% sales by 7% and operating profit by 5%. Three new stores were opened in the second half-year. Cost of sales... -

Page 5

... year's rate of 32%. The increase results from certain exceptional charges and unrelieved losses arising overseas. Earnings per share The credit activities are carried out within Marks and Spencer Financial Services Limited, a bank regulated by the FSA. The Unit Trust, Life Assurance and Corporate... -

Page 6

... the financial year 2000/01. We plan to open a further 230,000 sq ft of selling space, 64% of which will be in the UK. Financing During the financial year the Medium Term Note ('MTN') programme was increased to £2.0bn and this has been used as a flexible and cost effective source of funds. 23 MTNs... -

Page 7

... and with counterparties which fulfil predetermined credit criteria. The main types of instrument used are interest rate and currency swaps, forward rate agreements and forward currency contracts. The Group does not hedge balance sheet and profit and loss account translation exposures but, where... -

Page 8

... question and answer session is available after the Meeting. responsibilities, primarily reviewing the reporting of financial and non-financial information to shareholders, the systems of internal control and risk management, and the audit process. It comprises six non-executive directors, chaired... -

Page 9

... new corporate risk management process on behalf of the Board by reviewing a programme of risk assessment activity and a report from internal audit on the risk assessment process. Internal financial control The Board has overall responsibility for the Group's systems of internal financial control... -

Page 10

... of the new Business structure. Recruitment of directors During the year Luc Vandevelde was recruited as Executive Chairman on an annual salary of £650,000. Compensation was made for loss of benefits from his previous employment, given in the form of restricted shares at a cost of £1,997... -

Page 11

... with the executive directors. Non-executive directors do not participate in the Company's Profit Sharing, Save As You Earn or Executive Share Option Schemes, annual bonus scheme or the Early Retirement Plan. Their fees are non-pensionable. No increase in fees was made in the year under review other... -

Page 12

... During the year, two new directors have been recruited and appointed to the Board on the following terms: (i) Luc Vandevelde - Salary of £650,000 pa. - Compensation for loss of future benefits from previous employer in the form of 808,080 'restricted shares' purchased on his behalf at a cost of... -

Page 13

... State me nts 2000 4 D irectors' pension information Pension scheme The executive directors, management and employees all participate in the Company's Pension Scheme. The Scheme is non-contributory, fully funded and the subject of an Independent Trust. The normal retirement age under the Pension... -

Page 14

...is for the 14 months since his date of retirement. (6) The pension scheme entitlement for Lord Sieff and Clinton Silver is supplemented by an additional, unfunded, pension paid by the Company. (7) Due to the continuing ill health of Lord Sieff the Company has met some costs relating to his necessary... -

Page 15

...in 1987 and 1997. The Scheme is open to all employees, including executive directors, who have completed one year's service and who open an approved savings contract. Inland Revenue rules limit the maximum amount which can be saved to £250 per month. When the savings contract is started options are... -

Page 16

...Marks and Spe nce r p.l.c. Remuneration report 6 Long-term benefits (continued) AT 1 APRIL 1999 OR DATE OF APPOINTMENT GRANTED DURING THE YEAR EXERCISED/ LAPSED DURING THE YEAR AT 31 MARCH 2000 OR DATE OF RETIREMENT OPTION PRICE (PENCE) EXERCISE PRICE... exercisable (1) Weighted average price. 111,523... -

Page 17

15 Annual Re po rt and Financial State me nts 2000 6 Long-term benefits (continued) AT 1 APRIL 1999 OR DATE OF APPOINTMENT GRANTED DURING THE YEAR EXERCISED/ LAPSED DURING THE YEAR AT 31 MARCH 2000 OR DATE OF RETIREMENT OPTION PRICE (PENCE) EXERCISE PRICE (PENCE) OPTION PERIOD Retired directors ... -

Page 18

...to prepare financial statements for each financial year and to present them annually to the Company's members in Annual General Meeting. The financial statements, of which the form and content is prescribed by the Companies Act 1985 and applicable accounting standards, must give a true and fair view... -

Page 19

...accordance with applicable United Kingdom accounting standards. Our responsibilities, as independent auditors, are established in the United Kingdom by statute, the Auditing Practices Board, the Listing Rules of the Financial Services Authority and our profession's ethical guidance. We report to you... -

Page 20

...which provide account cards, personal loans, unit trust management, life assurance and pensions. The Group's Captive insurance company is also included in this segment as a significant part of its business is generated from the provision of related insurance services. Review of activities and future... -

Page 21

... this Report. The Special Business of the Meeting includes resolutions to adopt a new Executive Share Option Scheme and a new All-Employee Share Plan. The Company's policy concerning the payment of its trade creditors is as follows: General Merchandise is automatically paid for 11 working days... -

Page 22

... NOTES 53 WEEKS ENDED 1 APRIL 2000 £m 52 WEEKS ENDED 27 MARCH 1999 £m Profit attributable to shareholders Exchange differences on foreign currency translation 25 Unrealised surpluses on revaluation of investment properties 25 Total recognised gains and losses relating to the period 258.7 (16... -

Page 23

21 Annual Re po rt and Financial State me nts 2000 Balance sheets AT 31 MARCH 2000 THE GROUP NOTES 2000 £m 1999 £m 2000 £m THE COMPANY 1999 £m Fixed assets Goodwill Tangible assets: Land and buildings Fit out, fixtures, fittings and equipment Assets in the course of construction 12 1.3 2,... -

Page 24

22 Marks and Spe nce r p.l.c. Consolidated cash flow information FO R THE YEAR ENDED 31 MARCH 2000 Cash flow statement 2000 NOTES £m £m £m 1999 £m O perating activities Received from customers Payments to suppliers Payments to and on behalf of employees Other payments Cash inflow from ... -

Page 25

... 2000. Current asset investments Current asset investments are stated at market value. All profits and losses from such investments are included in net interest income or in Financial Services turnover as appropriate. D eferred taxation The Company's freehold and leasehold properties in the United... -

Page 26

.... Foreign currency assets and liabilities held at the year-end are translated at year-end exchange rates or the exchange rate of a related forward exchange contract where appropriate. The resulting exchange gain or loss is dealt with in the profit and loss account. Funded pension plans are... -

Page 27

... attributable to the Financial Services companies and the Captive insurance company and arises wholly within the United Kingdom and the Channel Islands. TURNOVER 2000 £m 1999 £m OPERATING PROFIT 2000 1999 £m £m OPERATING ASSETS 2000 1999 £m £m Retailing activities Before exceptional operating... -

Page 28

... of goods exported from the UK, including shipments to international subsidiaries, amounted to £460.2m (last year £440.2m). Turnover and operating profits for the Americas and Far East comprise: TURNOVER 2000 £m 1999 £m OPERATING PROFIT 2000 1999 £m £m The Americas Brooks Brothers (including... -

Page 29

...)/ profit on sale of property and other fixed assets 0.6 20.4 21.0 24.4 45.4 - - - - - 2000 £m 1999 £m Loss on sale of properties relating to European store closures(1) Loss on sale of investment properties(2) Profit arising on other disposals (Loss)/profit on sale of property and other fixed... -

Page 30

... 176.1 Included in the tax charge for the year is a credit of £19.0m (last year £7.6m) which is attributable to exceptional operating charges. 7. PROFIT FOR THE FINANCIAL YEAR As permitted by Section 230 of the Companies Act 1985, the profit and loss account of the Company is not presented as... -

Page 31

...'s share option schemes Weighted average ordinary shares for fully diluted earnings per share 10. EM PLOYEES 2,872.1 13.6 2,885.7 2,864.7 18.6 2,883.3 The average number of employees of the Group during the year was: 2000 1999 UK stores UK head office Financial Services Overseas Management and... -

Page 32

... adopted were: Price inflation Rate of increase in salaries Rate of increase in pensions in payment Rate of return on investments Rate of increase in dividend income Rate of interest applied to discount liabilities 3.5% 5.25% 3.5% 8.25% 4.5% 8.25% B Post-retirement health benefits The Company has... -

Page 33

31 Annual Re po rt and Financial State me nts 2000 10. EM PLOYEES (continued) E Executive Share O ption Schemes Under the terms of the 1997 Scheme the Board may offer options to purchase ordinary shares in the Company to executive directors and senior employees at the market price on a date to be ... -

Page 34

... £m LAND & BUILDINGS £m THE COMPANY FIT OUT, ASSETS FIXTURES, IN THE FITTINGS & COURSE OF EQUIPMENT CONSTRUCTION £m £m TOTAL £m TOTAL £m Cost or valuation At 1 April 1999 Additions Transfers Disposals Revaluation surplus Differences on exchange At 31 M arch 2000 Accumulated depreciation At... -

Page 35

33 Annual Re po rt and Financial State me nts 2000 13. TANGIBLE FIXED ASSETS (continued) C Tangible fixed assets at cost Gerald Eve, Chartered Surveyors, valued the Company's freehold and leasehold properties in the United Kingdom as at 31 March 1982. This valuation was on the basis of open market... -

Page 36

... Spencer Unit Trust Management Limited Marks and Spencer Savings and Investments Limited Marks and Spencer Life Assurance Limited MS Insurance Limited St Michael Finance p.l.c. Marks & Spencer Finance p.l.c. Marks and Spencer Property Holdings Limited Holding Company Holding Company Holding Company... -

Page 37

... RATE RATE IS FIXED % YEARS 1999 WEIGHTED AVERAGE PERIOD FOR WHICH RATE IS FIXED YEARS Currency Sterling US dollar Other C Analysis of financial assets 7.0 6.0 4.4 6.7 6.4 6.2 7.5 7.3 6.1 5.1 8.9 3.0 THE GROUP 2000 £m 1999 £m Cash at bank and in hand Current asset investments Customer... -

Page 38

... Marks and Spe nce r p.l.c. Notes to the financial statements 19. CREDITORS: AM OUNTS FALLING DUE WITHIN ONE YEAR THE GROUP 2000 £m 1999 £m THE COMPANY 2000 1999 £m £m Bank loans and overdrafts Medium term notes (see note 21B) Trade creditors Amounts owed to Group undertakings Taxation Social... -

Page 39

37 Annual Re po rt and Financial State me nts 2000 21. ANALYSIS OF FINANCIAL LIABILITIES (continued) B M aturity of financial liabilities THE GROUP 2000 £m 1999 £m Repayable within one year: Bank loans, overdrafts and commercial paper Medium term notes Other creditors 469.0 700.4 27.1 1,196.5... -

Page 40

... for post-retirement health benefits represents the estimated value of the Company's subsidy of the Marks & Spencer Health Insurance Scheme, in so far as it relates to private medical benefits for retired employees and their dependants, for whom the Company meets the whole, or part, of the cost (see... -

Page 41

...options exercised under the Marks and Spencer United Kingdom Employees' Save As You Earn Share Option Scheme. The Company provided £1.1m to the QUEST for this purpose. The cost of this contribution has been transferred by the Company directly to the profit and loss account reserve (see note 25). At... -

Page 42

... gains and losses relating to the year New share capital subscribed Amounts deducted from profit and loss account reserve in respect of shares issued to the QUEST Goodwill transferred to profit and loss account on closure of Canada N et additions to shareholders' funds Shareholders' funds at 1 April... -

Page 43

...and servicing of finance C Taxation UK corporation tax paid Overseas tax paid Cash outflow for taxation D Capital expenditure and financial investment Purchase of tangible fixed assets Sale of tangible fixed assets Purchase of fixed asset investments Sale of fixed asset investments N et cash outflow... -

Page 44

... (see note 29) Shares issued under employees' share schemes N et cash inflow from financing 29. ANALYSIS OF NET DEBT AT 1 APRIL 1999 £m CASH FLOW £m EXCHANGE MOVEMENT £m AT 31 MARCH 2000 £m N et cash: Cash at bank and in hand (see note 18C) Less: deposits treated as liquid resources (see below... -

Page 45

...principal foreign exchange rates used in the financial statements are as follows (local currency equivalent of £1): SALES AVERAGE RATE 2000 1999 PROFIT AVERAGE RATE 2000 1999 BALANCE SHEET RATE 2000 1999 Republic of Ireland France Belgium Germany The Netherlands Portugal Spain United States Canada... -

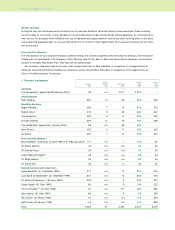

Page 46

... record FO R THE YEAR ENDED 31 MARCH Profit and loss account(1)(2) Turnover: General Foods Financial Services Total turnover (excluding sales taxes) Retailing - continuing - discontinued Financial Services O perating profit United Kingdom Europe (excluding UK)(3) Americas(4) Far East Excess... -

Page 47

...on investments and servicing of finance Taxation Capital expenditure and financial investment Acquisitions and disposals Equity dividends paid Cash outflow before management of liquid resources and financing Management of liquid resources Financing Increase/ (decrease) in cash D ecrease in net funds... -

Page 48