Louis Vuitton 2003 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2003 Louis Vuitton annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

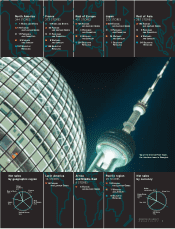

FINANCIAL HIGHLIGHTS

Net sales by business group

(EUR million) 2001 2002 2003

Wines and Spirits 2,232 2,266 2,116

Fashion and Leather Goods 3,612 4,207 4,149

Perfumes and Cosmetics 2,231 2,336 2,181

Watches and Jewelry 548 552 502

Selective Retailing 3,493 3,337 3,039

Other businesses and eliminations 113 (5) (25)

Total 12,229 12,693 11,962

Income from operations by business group

(EUR million) 2001 2002 2003

Wines and Spirits 676 750 796

Fashion and Leather Goods 1,274 1,280 1,311

Perfumes and Cosmetics 149 161 178

Watches and Jewelry 27 (13) (48)

Selective Retailing (213) 20 106

Other businesses and eliminations (353) (190) (161)

Total 1,560 2,008 2,182

(EUR million) 2001 2002 2003

Stockholders’equity(2) 8,701 8,842 8,769

Net financial debt

to equity ratio 95% 73% 62%

Net financial debt

to adjusted equity(3) 79% 66% 57%

(2) I ncludes minority interests.

(3) After deduction of the market value of the equity in Bouygues and treasury shares.

Net sales

(EUR million) Income from operations

(EUR millions)

Operating margin

(in %)

Dividend

per share including

tax credit

(EUR)

Cash flow

from

operations

(EUR million)

Capital

expenditures(1)

(EUR million)

2001 2002 2003

1.20 1.281.13

2001 2002 2003

1,518 1,949919

2001 2002 2003

559 578984

Net income before

amortization

of goodwill

and unusual items

(EUR million)

Net

income

(EUR million)

Earnings per share

before amortization

of goodwill

an unusual items

(EUR)

2001 2002 2003

556 72310

2001 2002 2003

1.67 2.090.68

(1) Acquisitions of intangible and tangible long-term assets.

6LVMH ANNUAL

REPORT 2003

F H

SIGNIFICANT GROWTH

IN ALL INDICATORS

2001 2002 2003

12,693 11,96212,229

2001 2002 2003

2,008 2,1821,560

16% 18%13%

2001 2002 2003

818 1,023334