Logitech 2001 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2001 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ON

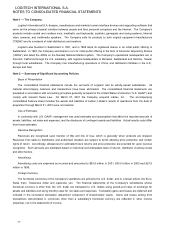

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

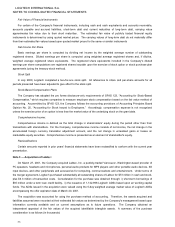

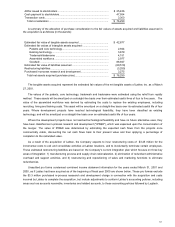

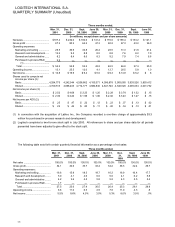

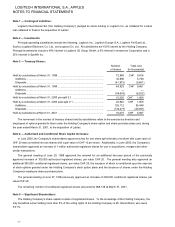

The fair value of the grants under the purchase plans and stock option plans was estimated using the Black-Scholes

valuation model with the following assumptions and values:

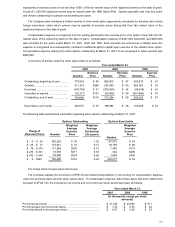

Year ended March 31,

Purchase Plans Stock Option Plans

2001 2000 1999 2001 2000 1999

Dividend yield........................................ 0 0 0 0 0 0

Expected life ......................................... 6 months 6 months 6 months 2.7 years 2.5 years 3.0 years

Expected volatility ................................. 70% 50% 48% 66% 55% 47%

Risk-free interest rate............................ 4.25% 6.5% 4.875% 4.25% 6.5% 4.875%

Weighted average fair value of grant .... $90.00 $19.00 $21.00 $138.00 $31.50 $20.00

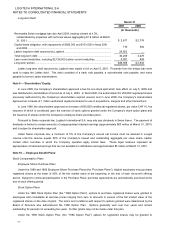

The above pro forma amounts include compensation expense based on the fair value of options vesting during the

years ended March 31, 2001, 2000 and 1999. As provided by SFAS 123, these calculations exclude the effects of options

granted prior to April 1, 1996 when SFAS 123 became effective. Accordingly, these amounts are not representative of the

effects of computing stock option compensation expense using the fair value method for future periods.

In 2001 and 1999, the Company granted 540 and 86,220 options with exercise prices less than the fair market value

of the underlying stock at the date of grant. The weighted average exercise price of the 2001 option grants was zero, and

the weighted average fair value was $335.22. The weighted average exercise price of the 1999 option grants was $44.50,

and the weighted average fair value was $63.

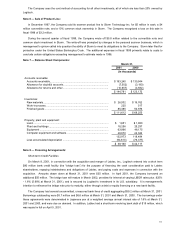

Pension Plans

Defined Contribution Plans

Certain of the Company's subsidiaries have defined contribution employee benefit plans covering all or a portion of

their employees. Contributions to these plans are discretionary for certain plans and are based on specified or statutory

requirements for others. The charges to expense for these plans for the years ended March 31, 2001, 2000 and 1999,

were $1,275,000, $1,214,000, $1,170,000.

Defined Benefit Plan

One of the Company's subsidiaries sponsors a noncontributory defined benefit pension plan covering substantially all

of its employees. Retirement benefits are provided based on employees' years of service and earnings. The Company's

practice is to fund amounts sufficient to meet the requirements set forth in the applicable employee benefit and tax

regulations.

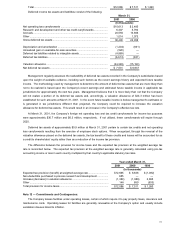

Net pension cost for the years ended March 31, 2001, 2000, and 1999 were $193,000, $340,000, and $339,000. The

plan’s net pension liability at March 31, 2001 and 2000 was $375,000 and $625,000.

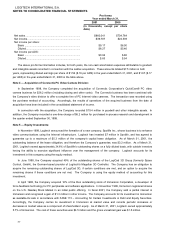

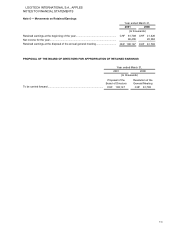

Note 11 — Income Taxes:

The Company is incorporated in Switzerland but operates in various countries with differing tax laws and rates.

Further, a substantial portion of the Company's income before taxes and the provision for income taxes are generated

primarily outside of Switzerland. Consequently, the weighted average expected tax rate may vary from period to period to

reflect the generation of taxable income in different tax jurisdictions.

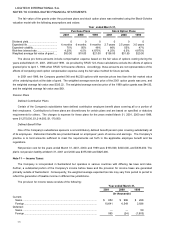

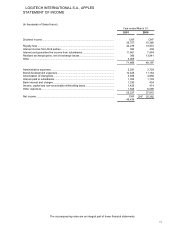

The provision for income taxes consists of the following:

Year ended March 31,

2001 2000 1999

(In thousands)

Current:

Swiss ....................................................................................................... $ 852 $ 986 $ 268

Foreign..................................................................................................... 10,641 6,549 2,836

Deferred:

Swiss ....................................................................................................... —59

Foreign..................................................................................................... 593 (24) (1,903)