Logitech 2001 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2001 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OM

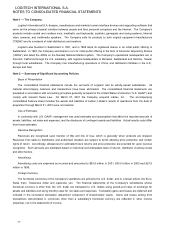

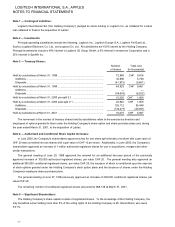

employees at exercise prices of not less than 100% of the fair market value of the registered shares on the date of grant.

A total of 1,200,000 registered shares may be issued under the 1996 Option Plan. Options generally vest over four years

and remain outstanding for periods not exceeding ten years.

The Company also maintains a limited number of other small option agreements, principally for directors and certain

foreign executives, under which options may be granted at exercise prices discounted from fair market value of the

registered shares on the date of grant.

Compensation expense is recognized over the vesting period when the exercise price of an option is less than the fair

market value of the underlying stock on the date of grant. Compensation expense of $437,000, $422,000, and $283,000

was recorded for the years ended March 31, 2001, 2000 and 1999. Such amounts are accrued as a liability when the

expense is recognized and subsequently credited to additional paid-in capital upon exercise of the related stock option.

Compensation expense arising from stock options outstanding at March 31, 2001 to be recognized in future periods was

$500,000.

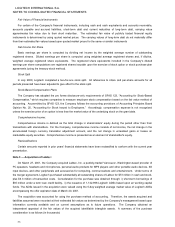

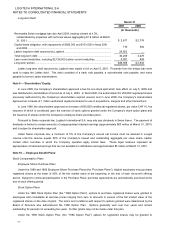

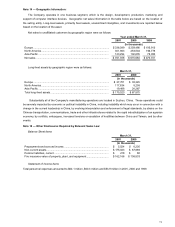

A summary of activity under the stock option plans is as follows:

Year ended March 31,

2001 2000 1999

............

Number

Exercise

Price

............

Number

Exercise

Price

...........

Number

Exercise

Price

Outstanding, beginning of year ............ 770,554 $ 58 856,002 $ 47 623,910 $ 61

Granted................................................ 211,218 $288 234,060 $ 85 963,304 $ 52

Exercised ............................................. (154,729) $ 51 (229,550) $ 44 (49,348) $ 42

Cancelled or expired ............................ (42,377) $133 (89,958) $ 58 (681,864) $ 70

Outstanding, end of year...................... 784,666 $116 770,554 $ 58 856,002 $ 47

Exercisable, end of year ...................... 245,077 $ 53 186,984 $ 48 153,498 $ 44

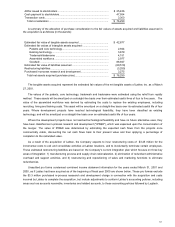

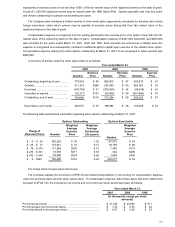

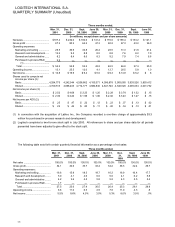

The following table summarizes information regarding stock options outstanding at March 31, 2001:

Options Outstanding Options Exercisable

Range of

Exercise Prices

..............

..............

........

Number

Weighted

Average

Exercise

Price

Weighted

Average

Contractual

Life (years)

.

.................

.................

.

Number

Weighted

Average

Exercise

Price

$ 0 - $ 64 382,523 $ 39 7.32 181,875 $ 44

$ 65 - $ 77 174,841 $ 70 8.13 54,188 $ 68

$ 78 - $ 275 117,264 $230 9.10 7,480 $119

$ 276 - $ 331 74,058 $311 9.30 442 $296

$ 332 - $ 340 35,980 $338 9.26 1,092 $338

$ 0 - $340 784,666 $116 8.04 245,077 $ 53

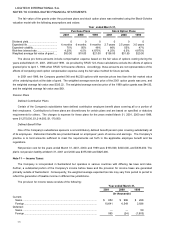

Pro Forma Stock Compensation Disclosure

The Company applies the provisions of APB 25 and related interpretations in accounting for compensation expense

under the purchase plans and the stock option plans. If compensation expense under these plans had been determined

pursuant to SFAS 123, the Company's net income and net income per share would have been as follows:

Year ended March 31,

2001 2000 1999

(In thousands, except per share

amounts)

Pro forma net income ........................................................................ $ 31,353 $ 23,584 $ 911

Pro forma basic net income per share ............................................... $ 7.42 $ 5.93 $ .24

Pro forma diluted net income per share............................................. $ 6.67 $ 5.39 $ .23