Logitech 2001 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2001 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NV

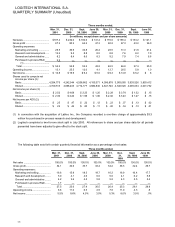

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

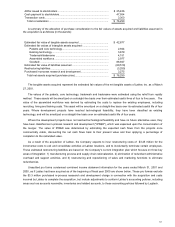

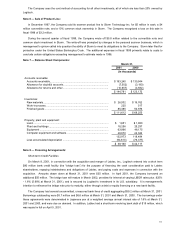

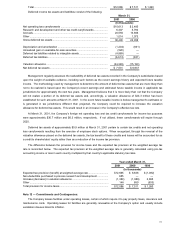

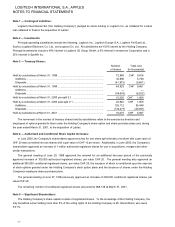

Long-term Debt

March 31

2001 2000

(In thousands)

Renewable Swiss mortgage loan due April 2004, bearing interest at 4.0%,

collateralized by properties with net book values aggregating $1.9 million at March

31, 2001..................................................................................................................... $ 2,671 $ 2,774

Capital lease obligation, with repayments of $565,000 and $151,000 in fiscal 2001

and 2002.................................................................................................................... 716 504

Labtec long-term debt assumed by Logitech................................................................. 26,822

Total long-term debt ...................................................................................................... 30,209 3,278

Less current maturities, including $2,736,000 Labtec current maturities....................... 3,301 344

Long-term portion.......................................................................................................... $26,908 $ 2,934

Labtec long-term debt assumed by Logitech was repaid in full on April 5, 2001. Proceeds from the bridge loan were

used to repay the Labtec debt. This debt consisted of a bank note payable, a subordinated note payable, and notes

payable to former Labtec shareholders.

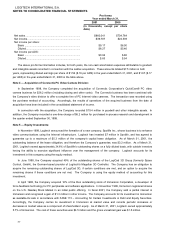

Note 9 — Shareholders' Equity:

In June 2000, the Company’s shareholders approved a two-for-one stock split which took effect on July 5, 2000 and

was distributed to stockholders of record as of July 4, 2000. In fiscal 2000, the authorization for 200,000 registered shares

previously authorized by the Company’s shareholders expired unused, and in June 2000, the Company’s shareholders

approved an increase of 1 million authorized registered shares for use in acquisitions, mergers and other transactions.

In June 1998, the shareholders approved an increase of 600,000 conditional registered shares, par value CHF 10, the

issuance of which is conditional upon the exercise of stock options granted under the Company's stock option plans and

the issuance of shares under the Company's employee share purchase plans.

Pursuant to Swiss corporate law, Logitech International S.A. may only pay dividends in Swiss francs. The payment of

dividends is limited to certain amounts of unappropriated retained earnings (approximately $63 million at March 31, 2001)

and is subject to shareholder approval.

Under Swiss corporate law, a minimum of 5% of the Company's annual net income must be retained in a legal

reserve until this reserve equals 20% of the Company's issued and outstanding aggregate par value share capital.

Certain other countries in which the Company operates apply similar laws. These legal reserves represent an

appropriation of retained earnings that are not available for distribution and approximated $5 million at March 31, 2001.

Note 10 — Employee Benefit Plans:

Stock Compensation Plans

Employee Share Purchase Plans

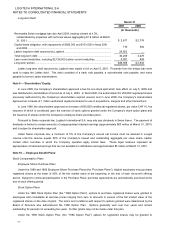

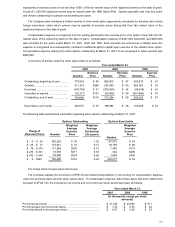

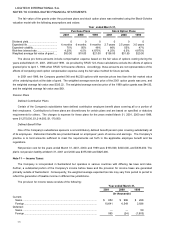

Under the 1989 and 1996 Employee Share Purchase Plans (the "Purchase Plans"), eligible employees may purchase

registered shares at the lower of 85% of the fair market value at the beginning or the end of each six-month offering

period. Subject to continued participation in the Purchase Plans, purchase agreements are automatically exercised at the

end of each offering period.

Stock Option Plans

Under the 1988 Stock Option Plan (the "1988 Option Plan"), options to purchase registered shares were granted to

employees and consultants at exercise prices ranging from zero to amounts in excess of the fair market value of the

registered shares on the date of grant. The terms and conditions with respect to options granted were determined by the

Board of Directors who administered the 1988 Option Plan. Options generally vest over four years and remain

outstanding for periods not exceeding ten years. Further grants may not be made under this plan.

Under the 1996 Stock Option Plan, (the “1996 Option Plan”) options for registered shares may be granted to