Logitech 2001 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2001 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NQ

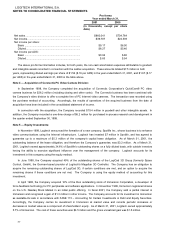

Cash Equivalents

The Company considers all highly liquid instruments purchased with an original maturity of three months or less to be

cash equivalents.

Concentration of Credit Risk

Financial instruments that potentially subject the Company to concentrations of credit risk consist principally of cash

and cash equivalents and accounts receivable. The Company maintains cash and cash equivalents with various financial

institutions to limit exposure with any one financial institution.

The Company sells to large OEMs and to high volume resellers and, as a result, maintains individually significant

receivable balances with large customers. At March 31, 2001, two customers represented 10.5% of total accounts

receivable and at March 31, 2000, three customers represented 23.6% of total accounts receivable. The Company's OEM

customers tend to be well capitalized, multi-national companies, while retail customers may be less well capitalized. The

Company controls its accounts receivable credit risk through ongoing credit evaluation of its customers’ financial condition

and by purchasing credit insurance on European retail accounts receivable. The Company generally does not require

collateral from its customers.

Inventories

Inventories are stated at the lower of cost or market. Cost is computed on a first-in, first-out basis. Provisions are

made for potentially obsolete, excess or slow moving inventories.

Investments

Investments in companies in which Logitech owns between 20% and 50%, and does not control, are accounted for by

the equity method. Under the equity method, the Company adjusts its carrying value to recognize its share of results of

operations. Investments less than 20% owned are carried at cost. The Company also has a marketable investment that

is classified as “available-for-sale”. The Company carries this investment at market value and records increases or

decreases in market value as a component of shareholders’ equity.

Property, Plant and Equipment

Property, plant and equipment are stated at cost. Additions and improvements are capitalized, whereas maintenance

and repairs are expensed as incurred. The Company capitalizes the cost of software developed for internal use in

connection with major projects. Costs incurred during the application development stage are capitalized, whereas costs

incurred during the feasibility stage are expensed. Depreciation is provided using the straight-line method over estimated

useful lives of five to 25 years for plant and buildings, one to five years for equipment and three to five years for software

development.

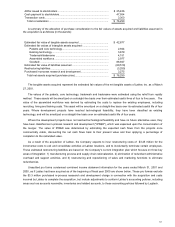

Intangible Assets

Intangible assets principally include goodwill, acquired technology, assembled workforce and trade names. Intangible

assets are recorded at cost and amortized on the straight-line method over periods not exceeding twenty years.

Accumulated amortization of intangible assets was $14.3 million and $6.8 million at March 31, 2001 and 2000.

Impairment of Long-Lived Assets

The Company reviews for impairment of long-lived assets, such as investments, property and equipment, and

goodwill and other intangible assets, whenever events indicate that the carrying amount might not be recoverable.

Management assesses recoverability by comparing the projected undiscounted net cash flows associated with those

assets to their carrying values. If impaired, the asset is written down to fair value, which is determined based on

discounted cash flows or appraised value, depending on the nature of the asset.

Income Taxes

The Company provides for income taxes using the liability method, which requires that deferred tax assets and

liabilities be recognized for the expected future tax consequences of temporary differences arising between the bases of

assets and liabilities for financial reporting and income tax purposes. In estimating future tax consequences, expected

future events are taken into consideration, with the exception of potential tax law or tax rate changes.