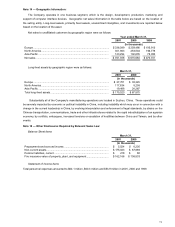

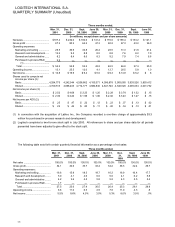

Logitech 2001 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2001 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NR

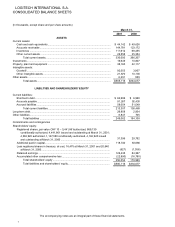

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

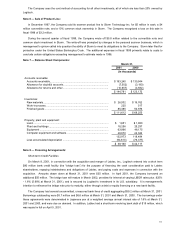

Fair Value of Financial Instruments

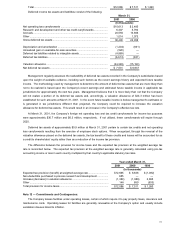

For certain of the Company's financial instruments, including cash and cash equivalents and accounts receivable,

accounts payable and accrued liabilities, short-term debt and current maturities of long-term debt, carrying value

approximates fair value due to their short maturities. The estimated fair value of publicly traded financial equity

instruments is determined by using quoted market prices. The carrying values of long-term debt do not materially differ

from their estimated fair values based upon quoted market prices for the same or similar instruments

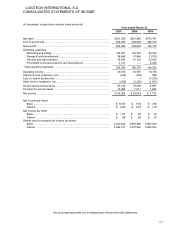

Net Income Per Share

Basic earnings per share is computed by dividing net income by the weighted average number of outstanding

registered shares. Diluted earnings per share is computed using weighted average registered shares and, if dilutive,

weighted average registered share equivalents. The registered share equivalents included in the Company’s diluted

earnings per share computations are registered shares issuable upon the exercise of stock option or stock purchase plan

agreements (using the treasury stock method).

Stock Split

In July 2000, Logitech completed a two-for-one stock split. All references to share and per-share amounts for all

periods presented have been adjusted to give effect to the stock split.

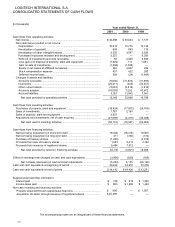

Stock-Based Compensation Plans

The Company has adopted the pro forma disclosure-only requirements of SFAS 123, "Accounting for Stock-Based

Compensation," which requires companies to measure employee stock compensation based on the fair value method of

accounting. As permitted by SFAS 123, the Company follows the accounting provisions of Accounting Principles Board

Opinion No. 25, "Accounting for Stock Issued to Employees.” Accordingly, compensation expense is not recognized

unless the exercise price of an option is less than the market value of the underlying stock on the grant date.

Comprehensive Income:

Comprehensive income is defined as the total change in shareholders’ equity during the period other than from

transactions with shareholders. For the Company, comprehensive income consists of net income, the net change in the

accumulated foreign currency translation adjustment account, and the net change in unrealized gains or losses on

marketable equity securities. Comprehensive income is presented as an element of shareholder’s equity.

Reclassifications

Certain amounts reported in prior years’ financial statements have been reclassified to conform with the current year

presentation.

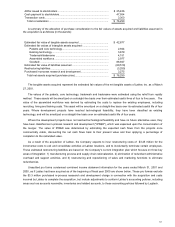

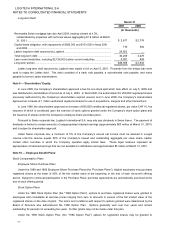

Note 3 — Acquisition of Labtec:

On March 27, 2001, the Company acquired Labtec, Inc. a publicly-traded Vancouver, Washington-based provider of

PC speakers, headsets and microphones, personal audio products for MP3 players and other portable audio devices, 3D

input devices, and other peripherals and accessories for computing, communications and entertainment. Under terms of

the merger agreement, Logitech purchased substantially all outstanding shares of Labtec for $73 million in cash and stock,

plus $3.3 million of transaction costs. Consideration for the purchase was obtained through: i) short-term borrowings of

$35 million under a term loan credit facility, ii) the issuance of 1,142,998 Logitech ADSs based upon an working capital

funds. The ADSs issued in the acquistion were valued using the 5-day weighted average market value of Logitech ADSs

encompassing the offer expiration date of March 20, 2001.

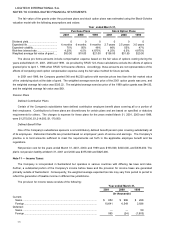

The acquisition was accounted for using the purchase method of accounting. Therefore, the assets acquired and

liabilities assumed were recorded at their estimated fair values as determined by the Company’s management based upon

information currently available and on current assumptions as to future operations. The Company obtained an

independent appraisal of the fair values of the acquired identifiable intangible assets. A summary of the purchase

consideration is as follows (in thousands):