LinkedIn 2013 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2013 LinkedIn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

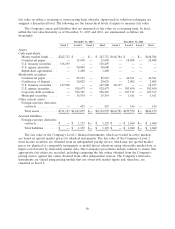

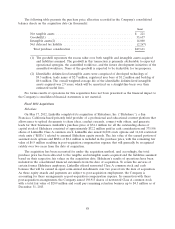

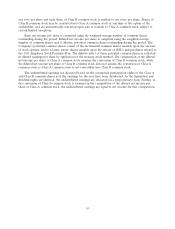

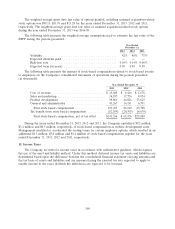

The following table presents the calculation of basic and diluted net income per share (in thousands,

except per share data):

Year Ended December 31,

2013 2012 2011

Class A Class B Class A Class B Class A Class B

Basic net income per share:

Numerator:

Allocation of undistributed earnings .............. $22,443 $ 4,326 $ 14,735 $ 6,874 $ 1,420 $10,492

Denominator:

Weighted-average common shares outstanding ....... 95,282 18,361 71,711 33,455 9,200 67,985

Basic net income per share ....................... $ 0.24 $ 0.24 $ 0.21 $ 0.21 $ 0.15 $ 0.15

Diluted net income per share:

Numerator:

Allocation of undistributed earnings for basic

computation ............................. $22,443 $ 4,326 $ 14,735 $ 6,874 $ 1,420 $10,492

Reallocation of undistributed earnings as a result of

conversion of Class B to Class A shares .......... 4,326 — 6,874 — 10,492 —

Reallocation of undistributed earnings to Class B shares — 713 — 902 — 364

Allocation of undistributed earnings .......... $ 26,769 $ 5,039 $ 21,609 $ 7,776 $ 11,912 $10,856

Denominator:

Number of shares used in basic calculation .......... 95,282 18,361 71,711 33,455 9,200 67,985

Weighted-average effect of dilutive securities

Add:

Conversion of preferred stock in connection with

initial public offering ..................... — — — — — 17,133

Conversion of Class B to Class A common shares

outstanding ............................ 18,361 — 33,455 — 85,118 —

Employee stock options ..................... 4,128 4,025 7,288 7,151 9,770 9,770

RSUs and other dilutive securities .............. 1,173 — 390 $ — 30 —

Number of shares used in diluted calculation ..... 118,944 22,386 112,844 40,606 104,118 94,888

Diluted net income per share ...................... $ 0.23 $ 0.23 $ 0.19 $ 0.19 $ 0.11 $ 0.11

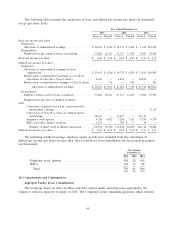

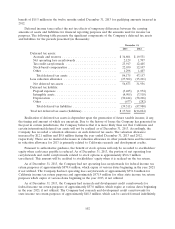

The following weighted-average employee equity awards were excluded from the calculation of

diluted net income per share because their effect would have been anti-dilutive for the periods presented

(in thousands):

Year Ended

December 31,

2013 2012 2011

Employee stock options ................................. 588 28 418

RSUs .............................................. 162 36 88

Total ............................................. 750 64 506

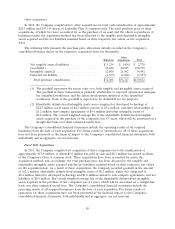

10. Commitments and Contingencies

Aggregate Future Lease Commitments

The Company leases its office facilities and data centers under operating lease agreements, the

longest of which is expected to expire in 2026. The Company’s future minimum payments, which exclude

94