LinkedIn 2013 Annual Report Download - page 95

Download and view the complete annual report

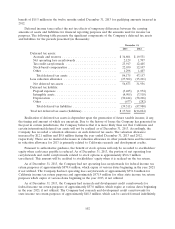

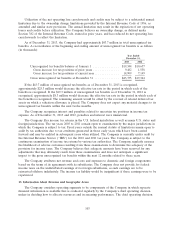

Please find page 95 of the 2013 LinkedIn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.one vote per share and each share of Class B common stock is entitled to ten votes per share. Shares of

Class B common stock may be converted into Class A common stock at any time at the option of the

stockholder, and are automatically converted upon sale or transfer to Class A common stock, subject to

certain limited exceptions.

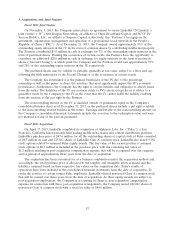

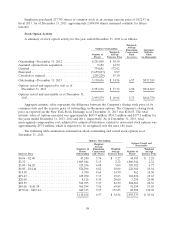

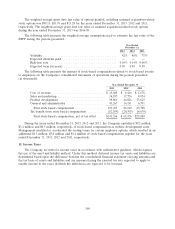

Basic net income per share is computed using the weighted-average number of common shares

outstanding during the period. Diluted net income per share is computed using the weighted-average

number of common shares and, if dilutive, potential common shares outstanding during the period. The

Company’s potential common shares consist of the incremental common shares issuable upon the exercise

of stock options, and to a lesser extent, shares issuable upon the release of RSUs and purchases related to

the 2011 Employee Stock Purchase Plan. The dilutive effect of these potential common shares is reflected

in diluted earnings per share by application of the treasury stock method. The computation of the diluted

net income per share of Class A common stock assumes the conversion of Class B common stock, while

the diluted net income per share of Class B common stock does not assume the conversion of Class A

common stock as Class A common stock is not convertible into Class B common stock.

The undistributed earnings are allocated based on the contractual participation rights of the Class A

and Class B common shares as if the earnings for the year have been distributed. As the liquidation and

dividend rights are identical, the undistributed earnings are allocated on a proportionate basis. Further, as

the conversion of Class B common stock is assumed in the computation of the diluted net income per

share of Class A common stock, the undistributed earnings are equal to net income for that computation.

93