LinkedIn 2013 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2013 LinkedIn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Advertising Costs

Advertising costs are expensed when incurred and are included in sales and marketing expense in the

accompanying consolidated statements of operations. The Company incurred advertising costs of

$3.9 million, $3.6 million and $2.4 million for the years ended December 31, 2013, 2012 and 2011,

respectively.

Stock-Based Compensation

Stock-based compensation expense is measured at the grant date based on the fair value of the award

and is recognized on a straight-line basis over the requisite service period of the award, which is generally

four years. For further information, see Note 11, Stockholders’ Equity.

Leases and Asset Retirement Obligations

The Company leases its office facilities and data centers under operating lease agreements. Office

facilities subject to an operating lease and the related lease payments are not recorded on the Company’s

balance sheet. The terms of certain lease agreements provide for increasing rental payments; however, the

Company recognizes rent expense on a straight-line basis over the lease period in accordance with

authoritative accounting guidance. Any lease incentives are recognized as reductions of rental expense on

a straight-line basis over the term of the lease. The lease term begins on the date of the initial possession

of the leased property for purposes of recognizing lease expense.

The Company establishes assets and liabilities for the present value of estimated future costs to retire

long-lived assets at the termination or expiration of a lease. Such assets are depreciated over the lease

period into operating expense, and the recorded liabilities are accreted to the future value of the

estimated retirement costs.

Rental expense, principally for leased office space and data centers under operating lease

commitments, was $54.9 million, $30.7 million and $10.1 million for the years ended December 31, 2013,

2012 and 2011, respectively.

Income Taxes

The Company records income taxes using the asset and liability method which requires the

recognition of deferred tax assets and liabilities for the expected future tax consequences of events that

have been recognized in the Company’s consolidated financial statements or tax returns. In estimating

future tax consequences, generally all expected future events other than enactments or changes in the tax

law or rates are considered. Valuation allowances are provided when necessary to reduce deferred tax

assets to the amount expected to be realized.

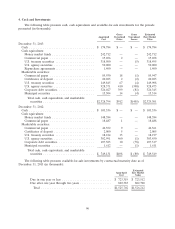

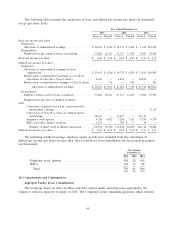

2. Fair Value Measurements

The Company measures its cash equivalents, marketable securities and foreign currency derivative

contracts at fair value based on an expected exit price as defined by the authoritative guidance on fair

value measurements, which represents the amount that would be received on the sale of an asset or paid

to transfer a liability, as the case may be, in an orderly transaction between market participants. As such,

fair value may be based on assumptions that market participants would use in pricing an asset or liability.

The authoritative guidance on fair value measurements establishes a consistent framework for measuring

85