LinkedIn 2013 Annual Report Download - page 56

Download and view the complete annual report

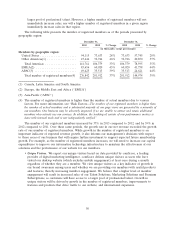

Please find page 56 of the 2013 LinkedIn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.priced our Marketing Solutions within a narrow range to allow us to establish VSOE. We have established

VSOE for a limited number of our Talent Solutions products and for such products, VSOE has been used

to allocate the selling price of deliverables.

TPE. When VSOE cannot be established for deliverables in multiple element arrangements, we

apply judgment with respect to whether we can establish selling price based on TPE. TPE is determined

based on competitor prices for similar deliverables when sold separately. Generally, our go-to-market

strategy differs from that of our peers and our offerings contain a significant level of differentiation such

that the comparable pricing of services with similar functionality cannot be obtained. Furthermore, we are

unable to reliably determine what similar competitor services’ selling prices are on a stand-alone basis. As

a result, we have not been able to establish selling price based on TPE.

BESP. When we are unable to establish selling price using VSOE or TPE, we use BESP in our

allocation of arrangement consideration. The process for determining our BESP for deliverables without

VSOE or TPE involves management’s judgment. Our process considers multiple factors that may vary

depending upon the unique facts and circumstances related to each deliverable. Key factors that we

considered in developing our BESPs include: (1) historical sales prices, (2) prices we charge for similar

offerings, (3) sales volume, and (4) geographies. Generally, we are not able to establish VSOE nor TPE

for our Talent Solutions and Marketing Solutions deliverables. The allocation of revenue has generally

been based on our BESPs.

If the facts and circumstances underlying the factors we considered change or should future facts and

circumstances lead us to consider additional factors, both our determination of our relative selling price

under the hierarchy and our BESPs could change in future periods.

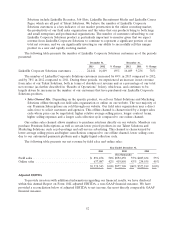

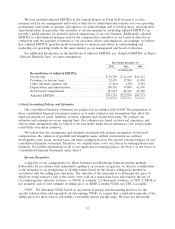

Stock-Based Compensation

We account for stock-based compensation in accordance with the authoritative guidance on stock

compensation. Under the fair value recognition provisions of this guidance, stock-based compensation is

measured at the grant date based on the fair value of the award and is recognized as expense, net of

estimated forfeitures, over the requisite service period, which is generally the vesting period of the

respective award. As a result, we are required to estimate the amount of stock-based compensation we

expect to be forfeited based on our historical experience. If actual forfeitures differ significantly from our

estimates, stock-based compensation expense and our results of operations could be materially impacted.

Determining the fair value of stock-based awards at the grant date requires judgment. We use the

Black-Scholes option-pricing model to determine the fair value of stock options and employee stock

purchase plan options. The determination of the grant date fair value of options using an option-pricing

model is affected by our estimated common stock fair value as well as assumptions regarding a number of

other complex and subjective variables. These variables include the fair value of our common stock, our

expected stock price volatility over the expected term of the options, stock option exercise and

cancellation behaviors, risk-free interest rates, and expected dividends, which are estimated as follows:

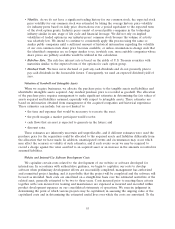

•Fair Value of Our Common Stock. Because our stock was not publicly traded prior to our initial

public offering, the fair value of our common stock underlying our stock options was determined by

our board of directors or compensation committee of our board of directors, which intended all

options granted to be exercisable at a price per share not less than the per share fair value of our

common stock underlying those options on the date of grant. Upon completion of our initial public

offering on May 19, 2011, our Class A common stock was valued by reference to its publicly traded

price.

•Expected Term. The expected term was estimated using the simplified method allowed under SEC

guidance.

54