LinkedIn 2013 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2013 LinkedIn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

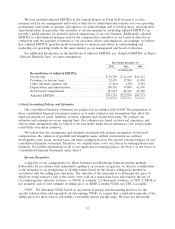

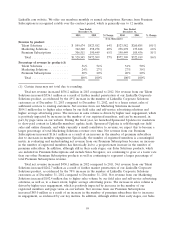

We have included adjusted EBITDA in this Annual Report on Form 10-K because it is a key

measure used by our management and board of directors to understand and evaluate our core operating

performance and trends, to prepare and approve our annual budget and to develop short- and long-term

operational plans. In particular, the exclusion of certain expenses in calculating adjusted EBITDA can

provide a useful measure for period-to-period comparisons of our core business. Additionally, adjusted

EBITDA is a key financial measure used by the compensation committee of our board of directors in

connection with the payment of bonuses to our executive officers and employees. Accordingly, we believe

that adjusted EBITDA provides useful information to investors and others in understanding and

evaluating our operating results in the same manner as our management and board of directors.

For additional information on the limitations of adjusted EBITDA, see ‘‘Adjusted EBITDA’’ in Item 6

‘‘Selected Financial Data’’ for more information.

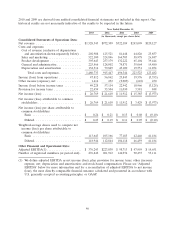

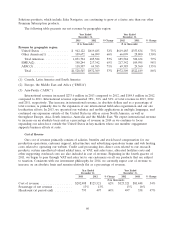

Year Ended December 31,

2013 2012 2011

(in thousands)

Reconciliation of Adjusted EBITDA:

Net income ................................ $ 26,769 $ 21,610 $11,912

Provision for income taxes ..................... 22,459 35,504 11,030

Other (income) expense, net .................... (1,416) (252) 2,903

Depreciation and amortization .................. 134,516 79,849 43,100

Stock-based compensation ..................... 193,915 86,319 29,768

Adjusted EBITDA ........................... $376,243 $223,030 $98,713

Critical Accounting Policies and Estimates

Our consolidated financial statements are prepared in accordance with GAAP. The preparation of

these consolidated financial statements requires us to make estimates and assumptions that affect the

reported amounts of assets, liabilities, revenue, expenses and related disclosures. We evaluate our

estimates and assumptions on an ongoing basis. Our estimates are based on historical experience and

various other assumptions that we believe to be reasonable under the circumstances. Our actual results

could differ from these estimates.

We believe that the assumptions and estimates associated with revenue recognition, stock-based

compensation, the valuation of goodwill and intangible assets, website and internal-use software

development costs, leases, income taxes and legal contingencies have the greatest potential impact on our

consolidated financial statements. Therefore, we consider these to be our critical accounting policies and

estimates. For further information on all of our significant accounting policies, see Note 1 of the Notes to

Consolidated Financial Statements under Item 8.

Revenue Recognition

A majority of our arrangements for Talent Solutions and Marketing Solutions include multiple

deliverables. In accordance with authoritative guidance on revenue recognition, we allocate consideration

at the inception of an arrangement to all deliverables based on the relative selling price method in

accordance with the selling price hierarchy. The objective of the hierarchy is to determine the price at

which we would transact a sale if the service were sold on a stand-alone basis and requires the use of:

(1) vendor-specific objective evidence, or VSOE, if available; (2) third-party evidence, or TPE, if VSOE is

not available; and (3) best estimate of selling price, or BESP, if neither VSOE nor TPE is available.

VSOE. We determine VSOE based on our historical pricing and discounting practices for the

specific solution when sold separately. In determining VSOE, we require that a substantial majority of the

selling prices for these services fall within a reasonably narrow pricing range. We have not historically

53