LinkedIn 2013 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2013 LinkedIn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

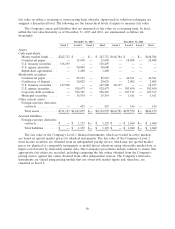

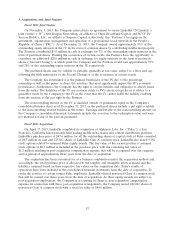

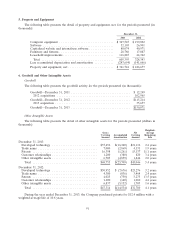

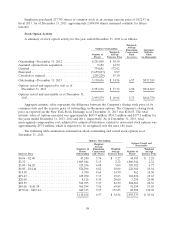

Amortization expense for the years ended December 31, 2013, 2012 and 2011 was $16.4 million,

$9.9 million and $3.6 million, respectively. Estimated future amortization of purchased intangible assets

for future periods is as follows (in thousands):

Years Ending December 31,

2014 ...................................................... $14,938

2015 ...................................................... 12,031

2016 ...................................................... 4,924

2017 ...................................................... 1,601

2018 ...................................................... 1,501

Thereafter ................................................. 7,635

Total .................................................... $42,630

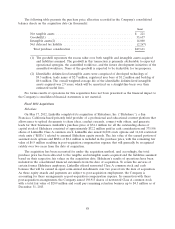

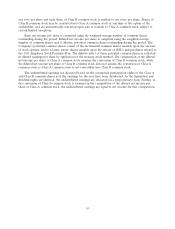

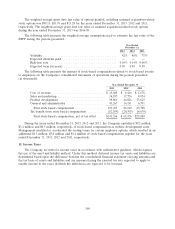

7. Accrued Liabilities

The following table presents the detail of accrued liabilities for the periods presented (in thousands):

December 31,

2013 2012

Accrued vacation and employee-related expenses ............ $ 64,757 $ 35,803

Accrued incentives .................................. 60,081 31,174

Accrued commissions ................................ 32,218 15,380

Accrued sales tax and value-added taxes ................... 10,851 9,103

Other accrued expenses ............................... 15,097 12,617

Total ........................................... $183,004 $104,077

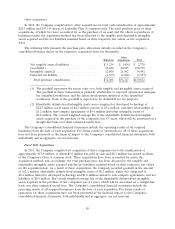

8. Other Income (Expense), Net

The following table presents the detail of other income (expense), net, for the periods presented (in

thousands):

Year Ended December 31,

2013 2012 2011

Interest income ................................ $2,895 $1,025 $ 169

Net loss on foreign exchange and foreign currency

derivative contracts ............................ (1,626) (672) (2,965)

Net realized gain on sales of marketable securities ....... 127 60 6

Other non-operating income (expense), net ............ 20 (161) (113)

Total other income (expense), net ................. $1,416 $ 252 $(2,903)

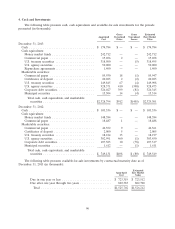

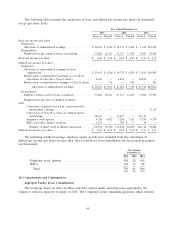

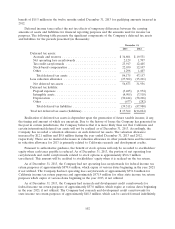

9. Income Per Share

Basic and diluted net income per common share is presented in conformity with the two-class method

required for participating securities.

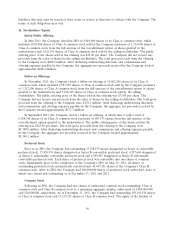

Immediately prior to the consummation of the Company’s initial public offering (‘‘IPO’’) of its

Class A common stock in May 2011, all outstanding shares of preferred stock and common stock were

converted to Class B common stock. As a result, Class A and Class B common stock are the only

outstanding equity in the Company. The rights of the holders of Class A and Class B common stock are

identical, except with respect to voting and conversion. Each share of Class A common stock is entitled to

92