JVC 2013 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2013 JVC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Car electronics, a business domain in which Japanese corporations

can exercise their strengths, must maintain a high quality and be

reliable enough to cope with the special temperature, vibration,

and dust conditions inside vehicles.

The JVCKENWOOD Group has positioned the Car Electronics

Segment, in which both JVC and Kenwood participated, as its

largest business. We expect this business will display the greatest

effects of integration, and have therefore been pushing forward

with efforts to integrate the technological development,

production, procurement, product planning, and marketing

functions in this business since October 2007. Over many years,

the two companies had independently fostered acoustic, video,

and car mounting technologies as well as product planning

capabilities. We have focused on developing new products by

combining these with cutting-edge data compression and

extension technologies as well as user interface technologies. In

addition, we have developed marketing and sales strategies to

make the most of the Kenwood and JVC brands, each of which

has different features. At the same time, we have further

enhanced our cost competitiveness by integrating production and

procurement.

As a result, we have achieved the largest share in the

European and U.S. after-market with the Consumer Business for

car navigation and car audio systems leading to our large-scale

composition. Unlike the overseas after-market, the main product

in the domestic after-market is car navigation systems. We are

also increasing our share and making a success in of the domestic

market with Saisoku-Navi, a flash memory type of car navigation

system developed by integrating the technologies of the two

companies.

Keeping an eye on the shift from the after-market to the

genuine product market, we are increasing orders received for

dealer option products for automobile dealers and genuine

products for automobile manufacturers. We are achieving this by

strengthening the OEM Business and forming alliances with

partner corporations. We are also winning orders for CD and DVD

drive mechanisms for car-mounted equipment not only from

domestic makers, but also from European and U.S. car accessory

manufacturers. These orders reflect our industry-leading product

quality, merchandising capabilities, and cost performance.

In the Consumer Car Electronics Business, we will aim to

expand sales in the domestic market by emphasizing car

navigation systems with specialized flash memory type products,

equipped with Saisoku-Navi series, including cost reductions. In

the overseas after-market sector, we will increase our variety and

sales of display audio system products with enhanced connection

capabilities to smartphones and tap into emerging markets by

launching models exclusively for emerging countries.

In the OEM Business, we will develop and mass-produce a

specially designed car navigation system and display audio system

to win new orders. We will also make efforts to increase orders

received for car navigation systems to be converted to after-

market models as dealer option products by leveraging our

strengths in the after-market, and cooperating with our partner

corporations. In the segment that includes CD/DVD mechanisms

for car-mounted AV systems, we will boost mass-production of

newly developed optical pickups through cooperation with

Shinwa International Holdings Limited, which became a subsidiary

in June 2013, thereby developing a new customer base. In

addition, we will work to create synergies and step up activities in

the water-based paint plastic panel business in a bid to expand

and strengthen our business in emerging markets, focusing

particularly on China, where continuous rapid growth can be

expected. Furthermore, JVCKENWOOD acquired all shares of

JVCKENWOOD Nagaoka Corporation (formerly TOTOKU Nagaoka

Corporation) through a corporate split (absorption-type split) from

TOTOKU Electric Co., Ltd. in July 2013. We hold high expectations

that in-car electronic devices and parts, which are provided on an

EMS basis by JVCKENWOOD Nagaoka, will become a new

business domain for the Group and contribute to expansion of the

OEM Business.

Looking ahead toward the establishment of a car-mounted

network environment, we set up a joint venture with ZMP INC., a

company which operates the development platform for next

generation mobility, etc., at the end of July, 2013. The aim is to

develop a technology with various services for cars linked to an

open Internet environment and establish those services as a

business. Using the establishment of the joint venture as a

springboard, we will make full-fledged efforts to promote

business development in the telematics※ field, a sector that is

expected to grow in the future. Moreover, we will work toward

the early commercialization of new growth domains such as the

Head-up Display Business, Controller Area Network (CAN)

Business and the Self-driving Car Business under the innovative

Advanced Driver Assistance System (i-ADAS) task force, which was

launched on August 1, 2013.

Telematics

A newly coined word combining telecommunications and

informatics, meaning the provision of information services in

real time by connecting mobile objects such as automobiles to

communications systems like mobile phones.

■Major Products

Car Audio, Car AV Systems, Car Navigation Systems,

CD and DVD Mechanism for Car-mounted Equipment

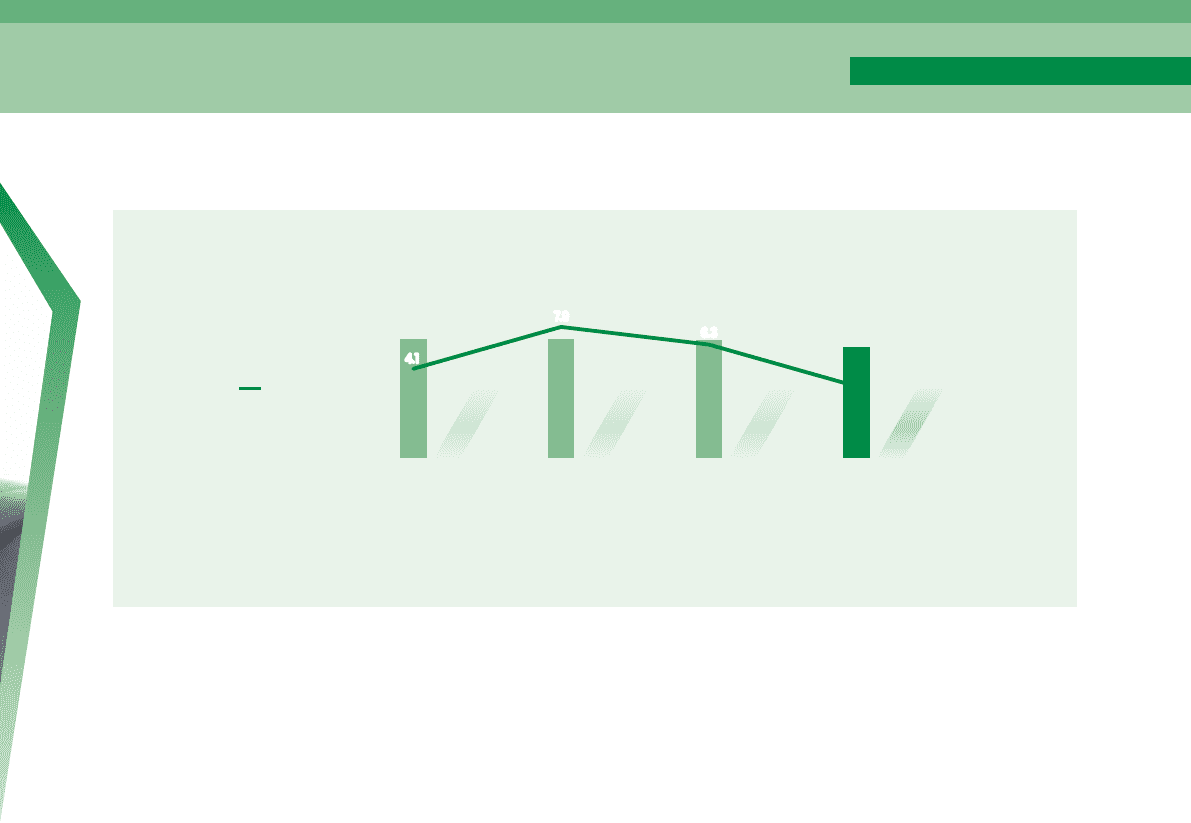

■Net sales and operating income (Billions of yen)

100.5

107.8

108.4 107.3

2.5

4 .1

7.9

6.3

4.0

-1. 3

3.6 3 .1

1.1

-10 . 8

-0.8

1.7

2.0

-1.7

2.2

1. 2

91.8

91.4

92.5 93.5

68.8

141.8

100.1 77. 5

40.9

44.9

42.9

36.7

FYE

3/'10

FYE

3/ '11

FYE

3/ '12

FYE

3/'13

FYE

3/'10

FYE

3/ '11

FYE

3/ '12

FYE

3/'13

FYE

3/'10

FYE

3/ '11

FYE

3/ '12

FYE

3/'13

FYE

3/'10

FYE

3/ '11

FYE

3/ '12

FYE

3/'13

■ Net sales

Operating

income

15

JVC KENWOOD Corporation

Business Overview