JVC 2013 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2013 JVC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

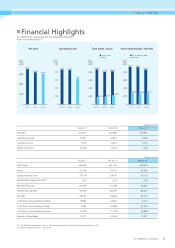

2. Reduction in Foreign Exchange Fluctuation Risks

1)

Reduction in foreign exchange fluctuation risks relating to operating income and loss

Overseas production of the JVCKENWOOD Group accounts for over 90% of the entire Groupʼs production, with

the vast majority of production undertaken in Asia and particularly in China. Production costs are denominated

mainly in U.S. dollars. Hence, imports exceed exports in terms of the U.S. dollar, and the weak yen against the U.S.

dollar becomes a negative factor for profits. Meanwhile, in Europe, where our production is in small lots, exports

exceed imports in terms of the euro, and the weak yen against the euro becomes a positive factor for profits.

With the continuous downturn in the value of the yen, we will focus on balancing the impact of dollar and

euro conversion against low yen base import costs.

Regional Sales Composition (FYE 3/’13)

Europe

(14%) Japan

(45%)

Americas

(29%)

Americas

(29%)

Asia & others

(12%)

Regional Production Composition (FYE 3/’13)

Europe

(1%)

Europe

(1%) Japan

(9%)

Japan

(9%)

Asia (including China)

(90%)

Asia (including China)

(90%)

2)

Reduction in foreign exchange fluctuation risks relating to non-operating income and loss

JVCKENWOOD, as announced in its “Notice on Reduction of Foreign Exchange Revaluation Losses (Gains) as a

result of Eliminating Inter-company Loans between the Parent Company and its Subsidiary” issued on March 8,

2013, posted differences in the conversion of foreign-currency-denominated loans receivable and loans payable

into yen, which arise from foreign exchange fluctuations, as foreign exchange losses (gains).

To cope with such risks of foreign exchange revaluation losses (gains), JVCKENWOOD eliminated 99 million U.S.

dollars out of the U.S. dollar-denominated loan overbalance between JVCKENWOOD and its overseas subsidiaries

by distributing the same amount from overseas subsidiaries to JVCKENWOOD effective March 8, 2013. By doing

this, we achieved a balance between foreign-currency-denominated loans payable and loans receivable between

JVCKENWOOD and its overseas subsidiaries. This led to a substantial reduction of the difference in the conversion

of foreign-currency-denominated loans receivable and loans payable into yen, which accounted for about half of

the foreign exchange losses posted in the fiscal year under review.

As a result, we reduced the risk of foreign exchange revaluation losses (gains) associated with possible foreign-

currency-denominated loan transactions within the JVCKENWOOD Group.

3. Strengthening the Corporate Structure

1) Reinforcement of the financial foundation

The former Victor Company of Japan, Limited, which JVCKENWOOD merged with through absorption in October

2011, issued bonds amounting to 20.0 billion yen in August 2007, of which we redeemed through purchase of

a 2.0 billion yen portion of the No. 8 Unsecured Bonds, worth 8.0 billion yen, on March 30, 2012 and redeemed

the remaining 6.0 billion yen on August 2, 2012. As for the No. 7 Unsecured Bonds totaling 12.0 billion yen, in the

fiscal year ending March 2014, we redeemed the 6.0 billion yen portion, which was due for redemption on August 2,

2013, using unsecured loans payable procured in March 2013.

With regard to interest-bearing debts, we refinanced some of the loans payable from financial institutions in

March 2013. This resulted in the extension of the term of loans payable and improved loan interest rates. In the

fiscal year ending March 2014, we will further improve the terms and conditions of loans by refinancing some of

our loans payable.

10 JVC KENWOOD Corporation