JVC 2008 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2008 JVC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The JVC KENWOOD Group considers stable distribution of profits one

of its major managerial issues. It will comply with the basic policy of

determining dividends from surplus and other dispositions from the

overall perspective of its profitability and financial condition.

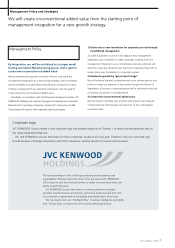

Performance targets of JVC KENWOOD Holdings for

fiscal year ending March 2011 are as follows:

— Net Sales: ¥750 billion

— Operating income: ¥39 billion

— Operating Profit Ratio: 5.2 %

1) Decline in Sales and Improvement in Profit Margin due to

Change in Accounting Policy

Until the second quarter of the year ending March 31, 2009, JVC

calculated its net sales based on gross sales to its business partners,

customer discounts were treated as selling expenses. Following

management integration, JVC will adopt the same method as

Kenwood for calculating net sales, by deducting customer discounts

from gross sales (or netting customer discounts with gross sales).

This will commence from the third quarter of the year ending March

31, 2009. As a result of this change in accounting policy, the sales

projection of JVC for the year ending March 2011 will decrease by

about ¥70 billion compared to the previous method. In addition, profit

margins, including the operating profit ratio, will improve because this

change does not affect operating income figures.

2) Increase in Net Sales due to “Negative Goodwill” and

Application of the Consolidated Taxation System

Management integration is expected to result in approximately ¥10

billion of “negative goodwill” on the consolidated balance sheet of

Synergies

Target for FYE’11/3 — Net sales, Operating profit

Combined net sales and income for Both Companies

*For FYE’07/3 to FYE’08/3, sales amount was converted to under the net method

KENWOOD

JVC

Net sales and income of JVC KENWOOD HD

Net sales

(billion yen)

800 762.2 Net sales

400

Net income

5

Operating profit

12.5

750

39

0.0%

0

5.2%

1.3%

1.2%

-5.8%

-44.3

9.5

-0.7%

FYE’07/3 FYE’08/3 FYE’09/3

Operating

profit ratio

3.1%

Net income

ratio

FYE’11/3 Target

600

400

200

0

40

20

0

-20

-40

Profit

(billion yen)

Net sales and income for

1st half of FYE’09/3 for JVC

will not be consolidated.

シナジー

2011年3月期の売上・利益目標

両社の売上高・損益単純合算

※07/3期と08/3期は売上高をネット方式に換算しています。

ケンウッド

ビクター

JVC・ケンウッド・HDの売上高・損益

売上高

(億円)

8,000 7,622

8,456

845.6

売上高

4,000

当期純利益

50

営業利益

125

7,500

390

0.0%

5.2%

1.3%

1.2%

-5.8%

△443△56

-56

-0.7%

95

0

-0.7%

07/3期 08/3期 09/3期

営業利益率

3.1%

当期

純利益率

11/3期目標

6,000

4,000

2,000

0

利益

(億円)

400

200

0

-200

-400

JVC KENWOOD Holdings. Consequently, on the assumption that it will

be amortized over five years, negative goodwill of approximately ¥2

billion per year is expected to be recorded as non-operating income.

JVC KENWOOD Holdings intends to implement and apply the

consolidated taxation system in association with management

integration; therefore anticipated tax payment by JVC KENWOOD

Holdings for the year ending March 2011 is expected to decrease by

about ¥2.5 billion compared to a situation where both companies did

not integrate management.

As a result, non-consolidated net income of JVC KENWOOD

Holdings for the year ending March 2011 would increase by about

¥4.5 billion compared to a situation where both Companies did not

integrate management.

The amounts of estimated negative goodwill and the anticipated tax

payment are based on tentative estimates at this time and could be

subject to change.

Performance Targets

Basic Policy Regarding Dividends

Outline of Management Integration

JVC KENWOOD Holdings, Inc.

6