JP Morgan Chase 2008 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2008 JP Morgan Chase annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6

Commercial Banking reported net income of $1.4 billion

with an ROE of 20%

Commercial Banking delivered strong results, outper-

forming its peer group and even exceeding our 2008

plan in a tough year. Strong credit quality, risk

management, client service, operational efficiency,

expense control and effective pricing all contributed to

the strong result: a 27% increase to a record $1.4 bil-

lion of net income, on a record $4.8 billion in revenue.

And instead of relying on lending to be the key driver

of revenue, Commercial Banking achieved record

results in gross investment banking revenue of $966

million (up 9%), treasury services revenue of $2.6

billion (up 13%), average liability balances of $103.1

billion (up 18%) and average loan balances of $82.3

billion (up 35%). It also is notable that only 36% of

Commercial Banking’s revenue relates to loans.

In addition to ranking among the top three commer-

cial banks nationally in market penetration and lead

share and being the No. 2 large middle-market lender

in the United States, Commercial Banking maintained

a favorable market position relative to peers in risk

management and deposit growth. We also are encour-

aged by the prospects for the Commercial Term

Lending business we acquired from WaMu and the

expansion of our middle-market model across the

West and Southeast footprints. As ever, client selection

is critical to our success, and Commercial Banking has

not only created more than 1,800 new relationships but

also has expanded nearly 10,000 existing relationships

– a sign of the continued vitality of our business.

That said, due to our clients’ waning loan demand and

higher credit losses, 2009 will be a tough year for the

Commercial Banking business. While we expect prob-

lems in commercial construction and real estate to

worsen for the rest of this year, we are fortunate to

have limited exposure and strong reserves. The turbu-

lence in the economy and its anticipated impact on the

broader Commercial Banking portfolio have led us to

shift into a recession-management mode and dedicate

many of our best resources into critically important

workout units, where expert senior managers are

involved on a daily basis.

Commercial Banking is a business with excellent long-

term value for us. We play a critical role in serving so

many great companies across this nation. And as this

important and vibrant sector of the economy grows,

so will we.

Treasury & Securities Services reported record net income

of $1.8 billion

Treasury & Securities Services (TSS) delivered excep-

tional financial results in 2008. Its net income has more

than doubled since 2005. For 2008, it stands at $1.8 bil-

lion (up 26%), with a 47% return on equity, on record

revenue (up 17%). We value this business tremendously

and appreciate how it has grown consistently over

time, produced good margins, and maintained great

global scale and long-standing client relationships.

The business maintains a leading position in holding,

valuing, clearing and servicing securities and providing

cash management, corporate card and liquidity prod-

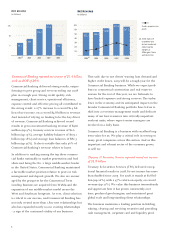

$52.2

30

40

50

60

$70

20

10

2004 2005 2007

(a) 2006

$54.2

$71.4

2008

$67.3

$62.0

$15

5

10

2004 2005 2006 2007

$6.5

$8.5

$14.4

$15.4

2008

$5.6

(a)

Net Income

(in billions)

Net Revenue

(in billions)

Pretax preprovision

profit

(a) 2004 data are

unaudited pro

forma combined,

reflecting the

merger of

JPMorgan Chase

and Bank One