JP Morgan Chase 2008 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2008 JP Morgan Chase annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.3

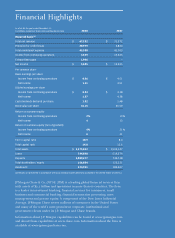

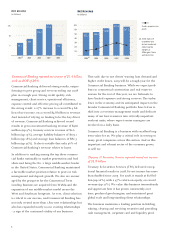

I. REVIEW OF 2008 FINANCIAL

PERFORMANCE AND BUSINESS RESULTS

JPMorgan Chase earned nearly $6 billion in 2008,

down 64% from the $15 billion we earned in the prior

year. During a “normal” credit cycle and environment,

we should earn more than $15 billion. So clearly, this

was not a great year financially. Essentially, the year’s

financial results were marred by two issues, both of

which were highlighted as major risks in last year’s

letter. The first related to increasing credit costs, most-

ly for consumer and mortgage loans. The second

resulted from Investment Bank write-downs of more

than $10 billion, primarily from leveraged lending and

mortgage exposures.

Throughout this financial crisis, we have benefited

from a fortress balance sheet. We started this year

with Tier 1 capital of 8.4% and ended it with 10.9%.

We increased credit loss reserves to $24 billion (up

almost $14 billion, including $4 billion related to

Washington Mutual (WaMu)). Even without the infu-

sion of government capital in the year’s final quarter,

our Tier 1 capital at year-end would have been 8.9%.

Across all other measures of capital, we have remained

relatively conservative. Although we did not anticipate

all of the extraordinary events of the year, our strong

balance sheet, general conservatism and constant focus

on risk management served us well and enabled us to

weather this terrible environment.

While we are disappointed with our 2008 financial

results, we have not lost sight of our important

achievements. We are extremely gratified that we were

able to grow and gain healthy market share in virtually

all of our businesses. And we never stopped investing

in our systems and infrastructure and adding bankers,

branches and products.

Regardless of what 2009 will bring, this emphasis on

serving clients and growing our businesses will drive

our results for years to come.

A. Results by Line of Business

The Investment Bank reported a loss of $1.2 billion

Our Investment Bank (IB) had disappointing financial

results on an absolute basis but performed relatively

well compared with most of our competitors. The

results reflect a tough operating environment and suf-

fered from the aforementioned $10 billion in write-

downs on leveraged lending and mortgage-related

assets, partially related to the acquisition of Bear

Stearns. While those write-downs were painful, they

were among the lowest in our industry. Moreover, our

underlying business performed solidly, and in some

notable areas, it outperformed. Several core businesses

– Rates and Currencies, Commodities, Emerging

Markets and Credit Trading – reported record results.

We also were able to make significant progress across

our IB business. At the end of May, we closed our acqui-

sition of Bear Stearns, which I will discuss in more detail

later in this letter. Throughout the year, we stayed com-

pletely focused on servicing our corporate and investor

clients, and in spite of the credit crisis, we continued to

be there for our clients when they needed our advice and

responsible capital support. J.P. Morgan was engaged in

nearly all of the largest and most complex deals of the

year, and we solidly established ourselves as the first call

for clients on their most important challenges.

We try not to overemphasize market share tables or

awards, but years of focus and discipline did lead to

some extraordinary industry recognition that is worth

noting. We earned our best rankings ever across the

league tables, finishing first in global investment bank-

ing fees; mergers and acquisitions; global syndicated

loans; debt; equity; and debt and equity-related trans-

actions – the only firm ever to finish No. 1 in all of

these categories in a given year. In our Markets busi-

nesses, client revenue increased 40% year-over-year, as

clients shifted more of their business to us in uncertain

times. In addition, J.P. Morgan received top awards

from International Financing Review, Risk and Financial

News and received a leading number of distinctions in

the Greenwich Associates’ 2008 Quality Leader survey

– a record number of industry honors for us.